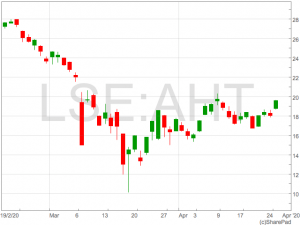

Shares in plant-hire company Ashtead (LON:AHT) rose on Monday after the company said operations were relatively stable during the coronavirus crisis.

Although the US-focused business highlighted disruption due to coronavirus, the business has been classed as an essential business due to the work it does with emergency services. This means most of Ashtead’s locations have remained opened and providing Ashtead with a steady stream of business through the crisis.

The company also provided guidance on profit for 2020FY ending 30th April. Ashtead said it expects profit before tax to be in the region on £1.050m, this would be almost identical to 2019FY profit before tax of 1,059.5m.

Shares in Ashtead (LON:AHT) rose over 7% on Monday morning in reaction to the news.

US lockdown

The propensity of some states in America to begin reopening their businesses means the lockdown will become generally more liberal in the United States supporting construction work in the short-term.

The Sunbelt brand is Ashtead’s most significant contributor to revenue with Sunbelt US accounting for 84% of group revenue in 2019FY.

The gradual reopening of the US economy and Sunbelt’s status as an essential service is likely to provide support for Ashtead’s business for the remanding of 2020.

Brendan Horgan, Group Chief Executive, commented on the update:

“We are grateful for and extraordinarily proud of our team members who continue to respond as essential service providers during a time when our communities are in need. All levels of the organisation have quickly adapted our operations to continue servicing our customers while keeping our leading value of safety at the forefront of all we do.”

:Looking forward, I am certain the swift actions we took during these unprecedented times and the strength of our balance sheet will serve the Group well. These factors, when combined with the diversity of our products and end markets, contribute to the strength of our long-term business model and put the Board in a position of confidence to look to the coming financial year as one of strong cash generation and strengthening our market position.”