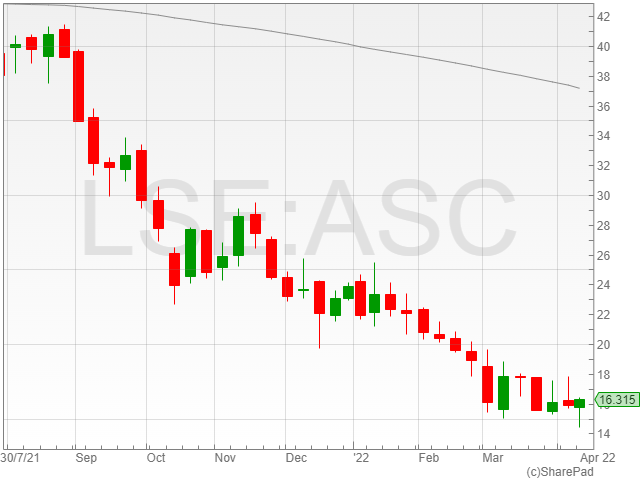

ASOS shares were down 5.3% to 1,620.5p in late morning trading on Tuesday after the fast fashion company reported a pre-tax profit fall from £112.9 million to £14.8 million in its interim results, marking yet another blow for the struggling retail sector.

The online fashion retailer also said it expected a £14 million loss in pre-tax profit due to its suspension of business dealings in Russia.

The group highlighted a 4% revenue growth to £2 billion, with the UK bringing in an 8% sales growth alongside an 11% increase from the US.

ASOS reported a continued triple-digit growth in Topshop brands with a 193% year-on-year rise, highlighting especially strong growth across the UK, US and Germany.

The company also noted an increase in its active customer base to 26.7 million, representing a 300,000 consumer increase over the last six months.

However, the fast fashion firm suffered a slowdown in growth as a result of cycling a term of exceptional customer acquisition in the previous year when the high street was closed.

ASOS forward guidance remained unaltered, however the company cautioned that the impact of inflation has not yet hit its consumer base.

“The broader online retail sector finds itself in somewhat of a sticky spot, with inflation at levels not seen for years the squeeze on finances will slowly start to feed into changing buying habits,” said Hargreaves Lansdown equity analyst Matt Britzman.

“When you add on the resurgence of High Street shopping and higher return rates, the goldilocks conditions seen last year are well and truly over.”

“That’s a pretty sombre backdrop and means the outlook from here is a tricky one to be confident about.”

ASOS reported an adjusted EBITDA of £26.2 million, representing a dramatic 77% fall compared to its £116.2 million result over the same period in 2021.

The company’s adjusted PBT of £14.8 million reflected the unwinding of Covid-19-related benefits from H1 FY21, alongside scheduled investment in marketing and significant cost inflation, particularly across warehouse labour and freight.

“ASOS has delivered an encouraging trading performance, against the continuing backdrop of significant volatility and disruption,” said ASOS COO and CFO Mat Dunn.

“The team has acted with determination and pace and is making good early progress on the strategic plan for the next phase of growth, as set out at our CMD last year.”

“We remain mindful of the potential impact on demand from the growing pressures on consumer spend and will continue to be responsive to any changes in market conditions as we progress the work started in the first half to deliver on our ambitions.”