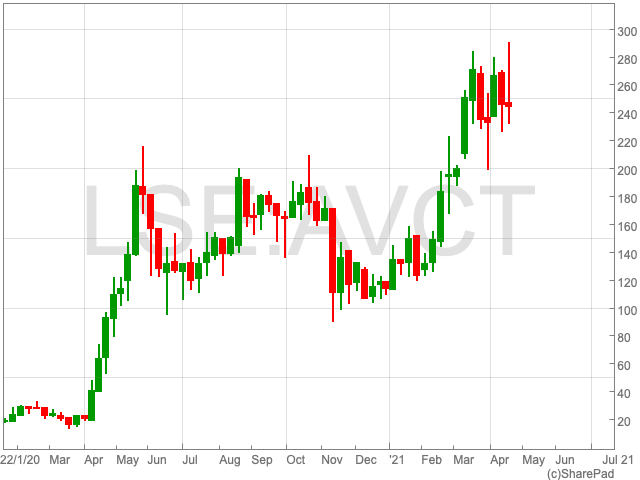

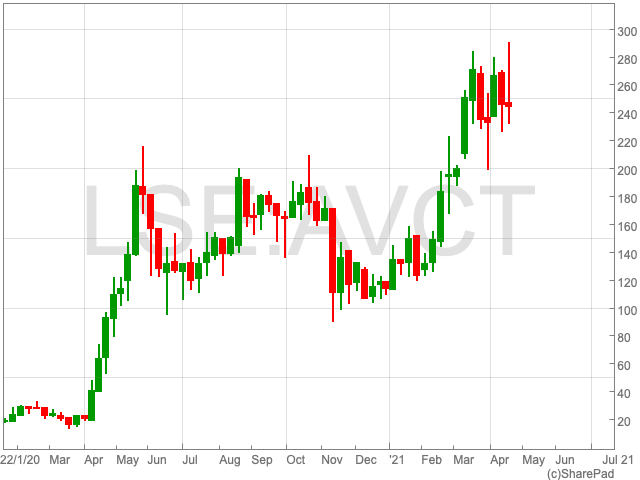

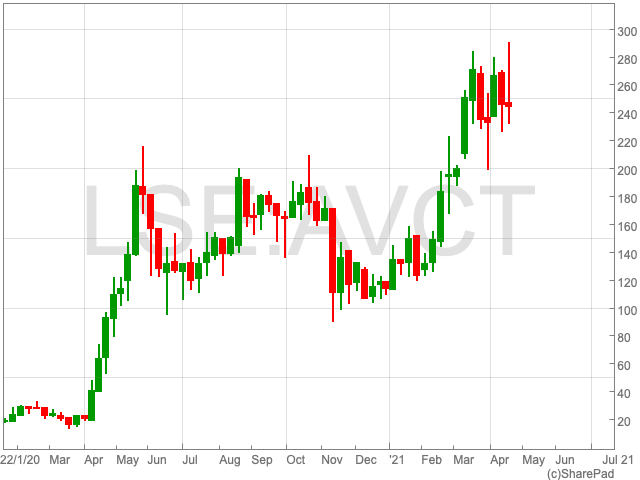

Avacta Group Share Price

Having made outstanding gains since the beginning of April, the Avacta Group share price (LON:AVCT) continued to push on into 2021. Since the turn of the year the company is up by 115%, while in the last 12 months it is up by 360%. Avacta recorded £3.9m during 2020, while its sales for the full year of 2021 are expected to reach £6.25m. The question now is whether, after its impressive resurgence in the face of the pandemic, it is a viable stock for the long-term.

Rapid Antigen Lateral Flow Test

Avacta’s share price shot up in March and the key factor was positive results from its rapid antigen lateral flow test. The therapy and diagnostics developer said that it is now able to detect dominant new variants of the coronavirus, such as the B117 and D614G, in addition the original strain of Covid-19.

The SARS-CoV-2 antigen lateral flow test was clinically evaluated in Europe and identified 96 out of 98 positive patients correctly with a 20 minute read time and 101 out of 102 negative samples.

Chief executive Dr Alastair Smith said: “I am delighted with the clinical data from this larger clinical study, which has robustly evaluated the AffiDX antigen test … The results are very impressive and mark a major step in obtaining a CE mark for professional use.

“We are completing the necessary assessment of the product from our manufacturing partner Global Access Diagnostics, including stability testing that will complete the technical file for CE marking, which we expect will happen in early May.

Avacta said it is looking to provide a commercial update as soon as possible on the commercial roll-out of the AffiDX test in the coming months.

Long-term

Moving forward there is always the possibility that Avacta’s trials will be unsuccessful. This is a risk any investor takes when it comes to biotechnology, which could negatively impact the company’s share price. Alternatively, as seen over the course of the past 12 months, it can be the cause of sharp rises.

Another hazard of the industry is research and development costs, which as well as being substantial, are ongoing. This means Avacta has to pump money in which has at times come from a dilution of the company’s share price. Avacta is also an AIM-listed stock, and so there is less liquidity than in, for example, the FTSE 100. This means there can be a great deal of volatility, which presents a risk for investors who want quick access to their money.