After a tough year for Aviva, the insurance firm is taking measures to protect the value of the its share price. Amanda Blanc, chief executive of Aviva, will set about negotiating sales for non-core assets in the first half of the year as the insurance company looks to consolidate its steady yet tepid recovery, following a dramatic fall in its share price in March 2020.

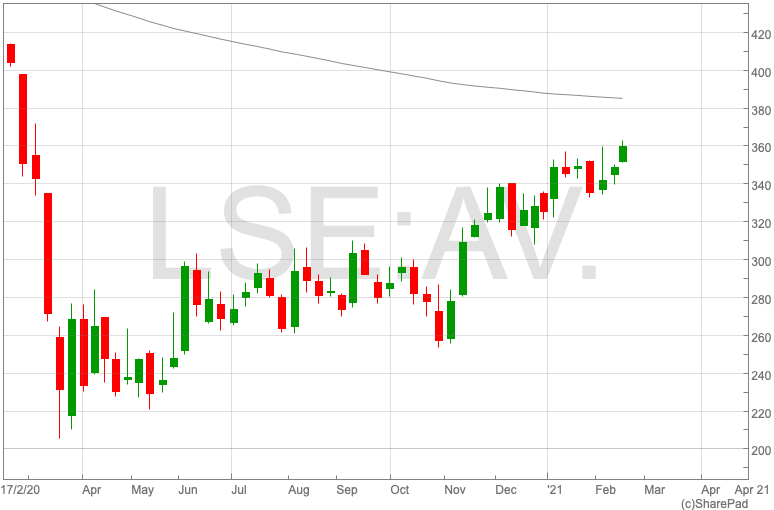

Aviva share price

Aviva’s share price has been hit hard throughout the coronavirus pandemic. From a high of 423p in January 2020, its value had halved by March. The trendline has been moving steadily upwards since then, with a few troughs along the way. Year-to-date, the company’s share price is up by over 10% to 360p per share.

Aviva to sell-off non-core assets

Aviva is in the later stages of discussions to sell a number of its business operations. Reports have suggested the insurance company is looking to sell its Italian life insurance business to Paris-based CNP Assurances, as well as selling the company’s general insurance unit in the country. This follows similar sell-offs at the end of last year.

The sales are reported to be a part of chief executive Amanda Blanc’s strategy of streamlining the business in order to secure the company’s share price.

In January the insurance firm sent a warning out to fossil fuel companies that they will reallocate their investments if they fail do more to address climate change concerns. Aviva has said it will divest across its equity and credit portfolio if companies fail to meet its expectations over the next one to three years.