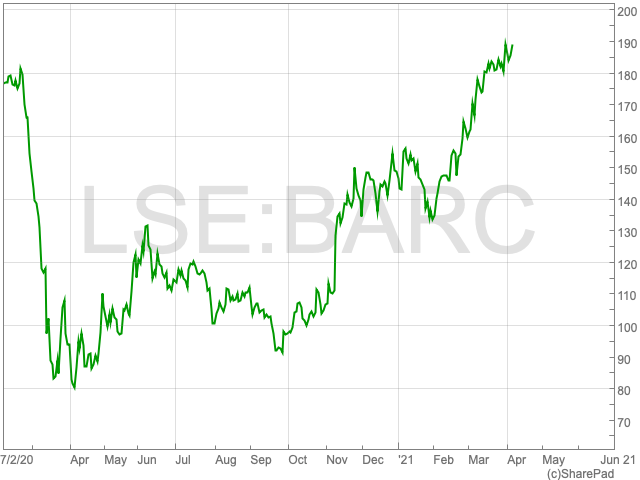

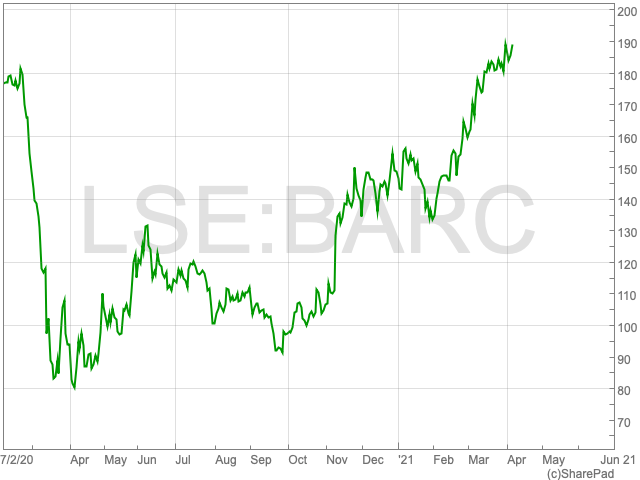

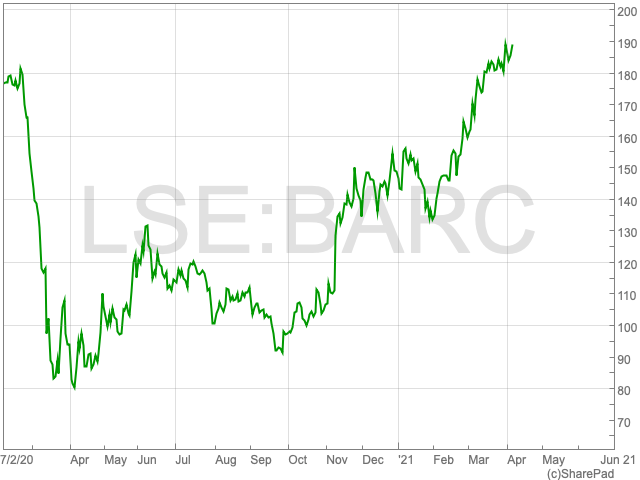

Barclays Share Price

Having surged since the beginning of February, the Barclays share price (LON:BARC) has now fully recovered to its pre-pandemic level. Since the turn of the year, Barclays stock is up by 30% to 187.76p per share. The question now is how much further the share price can go after an impressive recovery.

Good Value?

Going by the price-to-earnings ratio, Barclays, at 19.5, is cheaper than its main competitors, HSBC and Lloyds, at 30.9 and 26.8 respectively. With a relatively low price-to-earnings ratio compared to their peers, investors could consider Barclays if they are looking for the lowest valued bank based on earnings.

UK Recovery

Barclays announced a 68% loss in Q4 in February in net profit following the company’s decision to set aside funds as an insurance for bad loans which came about as a result of the pandemic. Barclays also announced a 30% dip in pre-tax profits to £3.1bn for the year, down from £4.3bn in 2019.

However, like the bank took a beating from the pandemic, it will stand to benefit from a recovery in the UK economy. Only yesterday the IMF upgraded its forecast for the UK economy, predicting a return to a pre-pandemic level of activity in 2022. The new UK forecast is for growth of 5.3% this year and 5.1% in 2022.

Dividend

Despite the fall in profits in 2020, Barclays confirmed it would be resuming dividend payments. The bank’s previous dividend payments were 3p, 2.5p and 1p in December of 2019, 2018 and 2017 respectively. With the recent growth of its share price, as well as its historically generous dividend, Barclays could prove to be a shrewd buy for income investors in 2021.

Risks

While the bank’s recovery has been so far so good, and the UK looks set to continue its roadmap out of lockdowns, there are risks to buying Barclays shares.

The damage of the pandemic on the bank was somewhat offset by strong results from its investment banking arm. However, there is no guarantees that the tables will not not turn in the coming year. If its investment banking arm is unable to maintain its performance then other major banks which are not diversified in the same way could prove a better option.

The Bank of England (BoE) urged banks to be ready in the event of negative interest rates later in the year. While it is not certain that the BoE will implement such a policy, it does however pose an ongoing threat to the Barclays share price going forward.