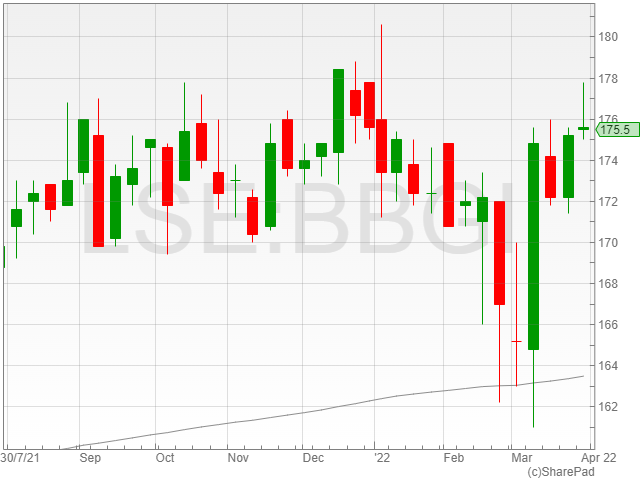

BBGI shares remained flat at 175.1p in early morning trading on Thursday following a moderate 9.4% Investment Basis NAV growth to £1 billion against £916 million in 2020.

BBGI reported a NAV per share increase of 2.1% to 140.7pps compared to 137.8pps in 2020, alongside a 171% total shareholder return since its Initial Public Offering (IPO).

The infrastructure investments company announced a 7.3p dividend per share and added that it was aiming for a 7.4p dividend in 2022.

BBGI attributed its NAV increase to its active management activities, and highlighted its £79.2 million of accretive cash investments in 2021.

The investment group further noted its £51 million acquisition agreement for an interest in a Canadian healthcare asset in 2021 and its £24 million investment in a Canadian green energy investment in February 2022.

BBGI currently holds no assets in Russia or Ukraine, with its portfolio split in 36% Canadian holdings, 33% in the UK, 11% in Australia, 11% in the US and 9% in Continental European investments.

The firm said that its global infrastructure investment remains strong going forward in 2022, and has projected strong potential for expanding its portfolio as a result of growing urbanisation, flexible working models and the desire to reduce emissions.

“The Management Board continues to use its industry relationships to source attractive investment opportunities for the Company’s pipeline, and our internal management structure creates the proper incentives for the Management Board to focus on preserving the value of the Company’s portfolio and growing the Company in a thoughtful and disciplined manner, and not be an asset gatherer focused solely on assets under management,” said BBGI Chair Sarah Whitney.

“This structure has supported much of the Company’s successes in the past ten years, and as a result I have full confidence in our continued ability to create attractive and sustainable long-term value and benefits for all our stakeholders.”