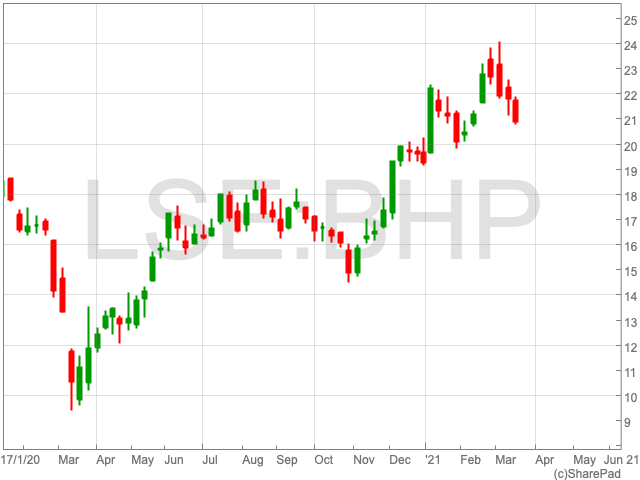

BHP Share price

BHP (LON:BHP) performed well during the pandemic on account of the soaring price of iron ore. Additionally, BHP Group saw record output at its Western Australia Iron Ore (WAIO) operations, the company reported in its results. Over the past 12 months BHP is up over 100%, while year-to-date the share price is up by 8.16% despite a recent retreat.

Results

BHP posted strong results in February with robust margins and a record interim dividend payment.

The company revealed in February underlying EBITDA at $14.7 billion at a margin of 59%. While the mining giant’s underlying profit increased to $6.04bn from $5.19bn in the first half of 2020.

BHP’s operating cash flow is $9.4bn, while its free cash flow was confirmed at $5.2bn. The mining firm also recently announced its dividend at $1.01 per share for H1 2021, up from $0.65 the year before.

Production

BHP could be a preferable option for investors based on its advantages with its own mining sites. Goldman Sachs research suggests BHP’s mine sites and mining hubs could bring its capital intensity in Pilbara to average U$7 per tonne over the next five years, compared to Rio Tinto at around U$11 per tonne. The investment bank feels that Rio Tinto will have more mines to replace, requiring more capital expenditure, in addition to the ongoing fall-out from the Juukan George incident.

Iron Ore

Iron ore’s price thrived throughout 2020 as the company produced 280m tonnes of the commodity. BHP’s outlook will depend on whether or not the iron ore can continue its rise into 2021.

However, a recent pollution crackdown by China began to suppress the price of iron ore. There are now question marks over the future prospects of the commodity, which could in turn lead to concerns over the FTSE 100 company’s future prospects.

Having risen from $80 per tonne in March 2020 to nearly $180 per tonne a year later, the commodity has retreated following China’s new policies.

Nicholas Snowdon, analyst at Goldman Sachs, predicts the Chinese government will increasingly look to limit emissions which will cap the production of iron ore, causing downward pressure on the price of the commodity.

“We now see iron ore prices turning lower in the coming months,” said Snowdon, who has set a 12-month price target of $100 a tonne. “This reflects mounting evidence that supply is shifting toward a sustained recovery and also that China’s environmental policies will reinforce a peak in iron ore imports.”