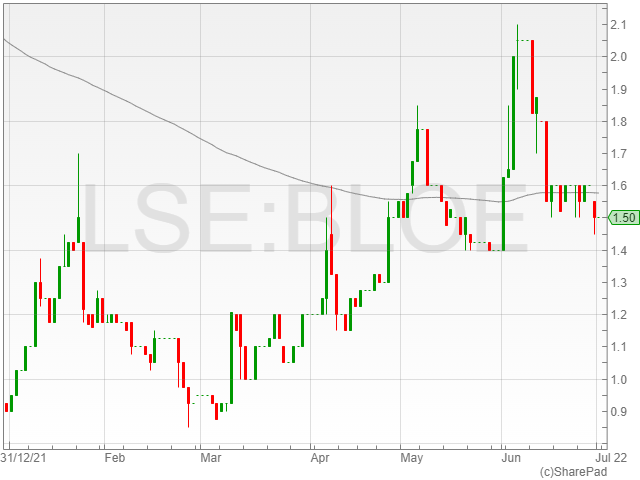

Block Energy shares were up 0.6% to 1.5p in early morning trading on Friday after the firm announced a revenue growth to $6.1 million from $1.2 million in FY 2021.

The group reported a swing back to gross profit of $231,000 compared to a loss of $3.2 million in the previous financial year, alongside an operating loss of $4.7 million against $5.6 million.

Block Energy highlighted a pre-tax loss for the year of $4.7 million from $5.5 million year-on-year, and a narrowed diluted loss per share of 0.7c from 1.3c the year before.

The company mentioned its successful integration of its SRCL assets acquired from Schlumberger and its definition of an asset wide field development and production enhancement plan in its highlights for the financial period.

The firm confirmed it completed several objectives on its FY 2021 roster, including fully integrating its technical database, following its completed acquisition of SRCL, and the completion of a risking and ranking process focused on short-term drilling and production enhancement opportunities across its enlarged portfolio.

It further defined a two-well drilling programme consisting of a new horizontal well, which was designed to appraise areas of low fracture density in the XIF license and a side track of an existing well in the newly acquired XIB license.

Block Energy also noted its simultaneous execution of a workover programme to reverse the natural decline of its baseline production.

“The Company swiftly integrated and advanced the appraisal and development opportunities throughout its enlarged portfolio in 2021. It also delivered on a key milestones, including commencing gas sales and execution of a multi well drilling campaign,” said Block Energy CEO Paul Haywood.

“This relentless drive to advance the Company and maintain consistent momentum has placed it in a stronger position to continue to create value for all shareholders in the current year. The planned three project strategy is designed to efficiently deploy existing cash reserves into further development drilling, throughout the XIF and XIB licenses.”

“This, combined with our enhanced understanding of the subsurface and the Company being profitable, sets the stage for what we forecast to be a rewarding year and we look forward to updating shareholders on short and medium term milestones as we advance.”