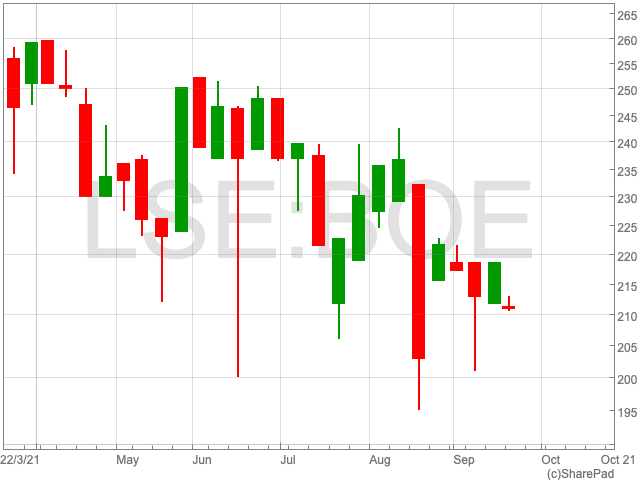

Boeing Share Price

The Boeing share price has been struggled over the past six months as the airplane manufacturer has struggled due to its own issues and the uncertainty surrounding the airline industry. Over the past six months, the company’s share price is down by 19.57%.

Boeing has previously stated that the pandemic cost the airline industry two years of growth. However, as the outlook has brightened somewhat, Boring has won a series of new orders. Only yesterday, news broke that the US is set to lift travel restrictions for vaccinated passengers from the UK and Europe.

Outlook

Boeing has some ideas about how the industry may recoup some of the losses made due to the pandemic. It has suggested that European airlines will cater to wealthier passengers by creating premium-priced cabins.

The airplane manufacturer also believes European airlines will need to replace around 750 of their plans as they are too inefficient and polluting, which of course bodes well for the company.

Boeing, along with rival Airbus, supply most of the world’s aircraft.

The company released a positive forecast yesterday as is assessed the market until 2040. It said that European airlines will order 8,7000 new aircraft as traffic levels return to pre-pandemic levels at an average rate of 3.1% a year.

“We believe air travel will return to pre-pandemic levels by late 2023, early 2024,” said Darren Hulst, Boeing’s commercial marketing chief.

“Within that, however, we believe domestic travel will recover to pre-pandemic levels by mid-2022. For long-haul which has currently only recovered to 42 per cent of where it was, we believe that will be mid-decade. The travel restrictions that are in place is the key issue. We believe the fundamentals of the market — economic activity and connectivity — do not change. It is just that the market will recover at different rates.”

“The airlines need to be versatile and we have to be adaptable,” Hulst added.