A new report by UK merchant payment provider Dojo has revealed how industries in the UK and beyond have been impacted by the Covid-19 pandemic.

The report, which used Yahoo Finance and public Purchase Intent data, analysed and ranked which industries benefited most and least from the “unforeseen changes” in their customers’ lifestyles during the pandemic, and highlighted which sectors are most ripe for post-Covid investment.

Despite widespread heartache across a slew of industries – hospitality and retail among others – there have been some lockdown success stories.

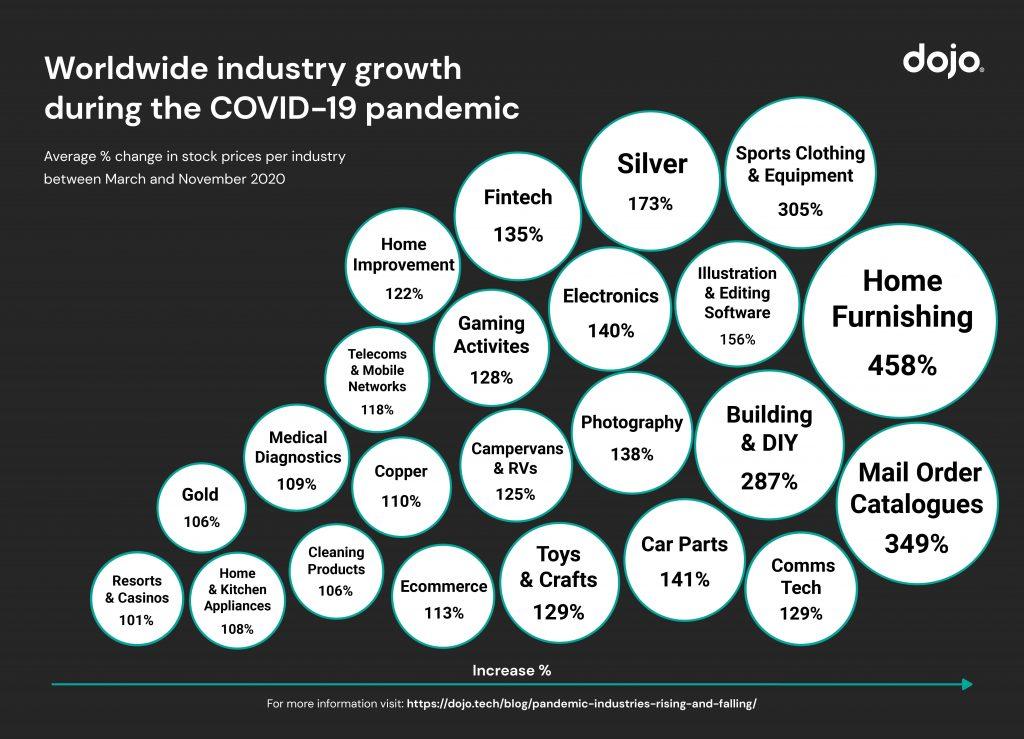

Many are fairly expected, with home furnishing and DIY industry growth soaring as isolated households looked to renovate their ‘work from home’ offices and make the most of their new base during lockdown. B&Q owners Kingfisher reported earlier this week that its full-year profits are set for the top end of expectations, after strong online trading boosted sales throughout 2020. The company performed so well that in December it announced its commitment to return £130m in business rates relief, and has seen its shares increase 35.27% over the past 12 months.

Cleaning products enjoyed a boom during the peak of the pandemic, as people increasingly sought to disinfect household surfaces for fear of contracting Covid-19. Unilever – the company behind Domestos and Cif – reported “better than expected” results in H1 2020, and while its Q4 results are yet to be released, the company logged a 4.4% underlying sales growth in the third quarter. Its share price may have been on the erratic side this year – swinging between an annual low of 3,583.50p and a high of 4,943.00p – but has seen overall growth up 0.38% in the past 12 months and, having tipped downwards in the past few weeks, looks ripe for investment before it ticks up again. The brand has been chasing an upward trajectory since 2016, with shares rising 52.82% in the last 5 years, and is likely to continue performing well in the cleaner post-pandemic environment.

Illustration & editing software (+156%) and photography (+138%) both saw huge growth over the course of 2020, as people around the world turned to new hobbies to pass the time locked indoors. Gaming activities – A.K.A. online gaming – also enjoyed a 129% boost in sales, and household favourites such as Electronic Arts – the company behind the Sims – and Take-Two Interactive Software – responsible for the wildly popular Grand Theft Auto and Red Dead Redemption series – have seen their shares gain throughout the year thanks to a surge in gaming during lockdown. Both have performed well in recent months and move into the New Year with plenty of potential as new consoles such as the Sony PlayStation 5 and Xbox Series X continue to drive sales up.

Capitalising on the surge in sports clothing and equipment sales was Nike, which reported a 9% increase in revenue in Q2 2020 and saw its diluted earnings per share up 11% in the same period. The company benefitted from a surge in online sales – with high street stores around the world closed intermittently throughout the year – with digital sales overall up 84%, triple-digit growth in North America and strong double-digit increases in EMEA, Greater China and APLA markets. With sporting events cancelled during the pandemic, Nike was able to cut expenses which would have otherwise been spent on promotions to lower product prices, which proved especially popular during online seasonal sales such as Black Friday. Nike’s shares have continued to rise over the past 12 months, breaching the New Year at more than double what they had been worth in March 2020 when the first lockdown took hold.

The top industries that saw upwards of 100% growth since March

| Rank | Industry | Ave. % change from March to Nov |

| 1 | Home Furnishing | 458.3% |

| 2 | Mail Order Catalogues | 349.2% |

| 3 | Sports Clothing & Equipment | 305.8% |

| 4 | Building & DIY | 287% |

| 5 | Silver | 174% |

| 6 | Illustration & Editing Software | 156% |

| 7 | Car Parts | 141% |

| 8 | Electronics | 141% |

| 9 | Photography | 138% |

| 10 | Fintech | 135% |

| 11 | Toy & Crafts | 130% |

| 12 | Comms Tech | 129% |

| 13 | Gaming Activities | 129% |

| 14 | Campervans & RVs | 126% |

| 15 | Home Improvement | 123% |

| 16 | Telecoms & Mobile Networks | 118% |

| 17 | Ecommerce | 113% |

| 18 | Copper | 110% |

| 19 | Medical Diagnostics | 109% |

| 20 | Home & Kitchen Appliances | 109% |

| 21 | Cleaning Products | 107% |

| 22 | Gold | 107% |

| 23 | Resorts & Casinos | 101% |

Jon Knott, Head of Customer Insights at Dojo, commented on the report’s findings and how the consumer landscape has changed as a result of the pandemic:

“Last year saw changing fortunes in the economy, which have forced retailers to face some of the toughest challenges in generations. Circumstances beyond control have led to rapid consumer shifts, that were previously unheard of. A lot of retailers have pivoted in order to survive, with some understandably being unable to do so.

“But we’ve also seen other businesses thrive during this time. Our findings confirm that whilst it may have been a tough year for everyone, many industries will come out of the otherside, with some maybe even stronger than ever in 2021”.