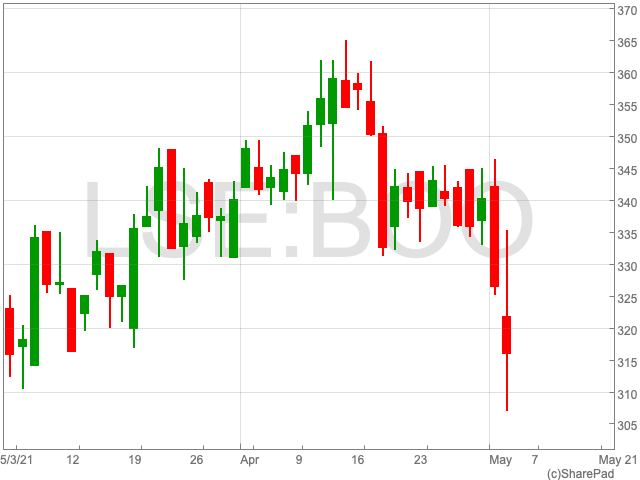

Boohoo Share Price

The Boohoo share price (LON:BOO) has seen impressive growth over the past five years, rising from 47.5p per share in May 2016, to 320p, its value at the time of writing. However, more recently, the online fashion retailer has come into some difficulty. Year-to-date Boohoo shares are down by 6.24%, as the FTSE All-Share Index has added 7.24%. While the company saw its sales and profits jump up last year during the pandemic, questions will now arise over Boohoo’s investment credentials as the dust settles post-lockdown.

Financials

The FTSE 250 company revealed on Wednesday morning that its revenue rose by 41% during the year ending on 28 February, as sales rose by just over £0.5bn to £1.75bn. Pre-tax profit soared too, up 35% to £124.7m over the same time period, while earnings per share increased 36% from 5.35p to 7.25p.

The company made an EBITDA of more than £173.6m, which was better than the expected £171.3m. It also boosted its forward guidance, saying that it expects its revenue to jump by 25% in the new year.

“Boohoo has strutted ahead of flailing high street rivals showing that its bang on trend when it comes to the way fashion followers want to shop and the styles they want to buy,” said Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown.

Superstar sales have meant Boohoo has piled up the cash, with its operating cash flow hitting more than £200 million, compared to £127 million in 2020. With plenty of cash in the bank, Boohoo is in a position to continue acquiring rival businesses, as it did with Dorothy Perkins, Wallis and Burton.

“This plan is on track with revenue growth for international up 44% over the year, now accounting for a bigger slice of the overall sales pie,” said Streeter.

“Boohoo is now a fashion powerhouse, and investment in scaling the platform is expected to keep paying off, with even higher margins expected in the second half of the year. But the catwalk isn’t completely clear, with hurdles of uncertainty ahead.”

ESG Concerns

It is well documented that Boohoo has received backlash over its practices during the pandemic. In particular as ESG principles are firmly etched into the minds of would-be investors now. The company will now have to make firm steps to distance itself from past practices, including accusations of modern slavery.

In response, the company has announced an initiative with the purpose of linking the pay of its senior executives to the improvements they make in ESG principles. On Monday, Boohoo Group chairman Mahmud Kamani told the Environmental Audit Committee (EAC) about the firm’s plan to link bonuses to sustainability practices.

“Boohoo’s response to our committee’s letter sends promising signals that we are reaching a turning point in fast fashion’s awareness of its environmental and social responsibilities,” EAC chairman Philip Dunne said.