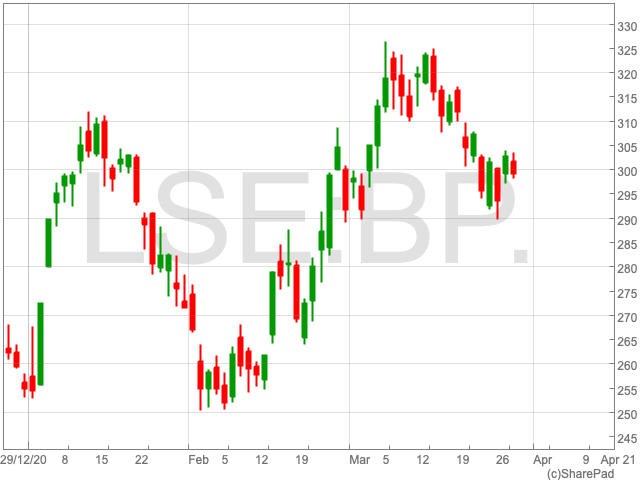

BP Share Price

The BP share price (LON:BP) is up 17.5% year-to-date after a challenging 2020. Over the same period the FTSE 100 index is up by 2%. While the major oil player could be set to capitalise on an economic recovery across the world, and rising oil prices, a number of factors remain at play that make its outlook difficult to evaluate.

Oil Prices

Oil prices dropped on Monday as the Ever Given ship was refloated in positive news for global supply chains. Brent crude oil fell by 2% before pushing back to 0.6% lower on early Monday trading. However, this will only have a short-term impact. Looking further ahead, BP looks set to profit from an oil price which will outperform in 2021 compared to the year before.

Barclays upped its forecast for oil prices for 2021 on account of a weak supply response from US producers to higher prices following the cold storm in Texas in February. The UK bank increased its forecast for Brent crude oil from $55 to $62 per barrel and West Texas Intermediate (WTI) from $52 to $58 per barrel.

Bank of America (BofA) Global Research and Goldman Sachs Equity Research also raised their oil price forecasts for 2021.

Of course, these bullish predictions are on the assumption vaccinations go according to plan, and economies are able to regain a sense of normality.

BP Dividend

While companies across the board, including BP, decided to slash dividends throughout 2020 due to precarious balance sheets, investors will now look to towards stocks that can generate income going forward.

Despite slashing its dividend payment, BP’s yield remains high, which could bode well for shareholders once its earnings return to normal levels.

Clean Energy

The BP share price’s future prospects will come down to a balance between profiting from oil and moving to clean energy. The company will have to judge when oil production peaks, as well as making smart investments in green technology to secure its future.

BP has committed to spending billions of dollars in renewable energy over this decade. If the company is successful, it could become a major player in the supply of renewable energy. If BP is able to successfully make this move, and investors are tuned in, then there could be money to be made. A recent forecast by the company estimated that demand for oil will fall by over 10% before 2030 and 50% by 2040.

BP confirmed in January that it completed the formation of its strategic US offshore wind partnership with Equinor. The oil company intends to develop a “green” hydrogen project at its Lingen refinery in Germany as part of plans to move towards sustainable forms of energy.

The BP board appears to be under no illusions that it must actively readjust to the future world economy. Investors will be keeping a close eye on its ability to capitalise on oil prices in the near-term as well as the effectiveness of its investing in green energy into the future.