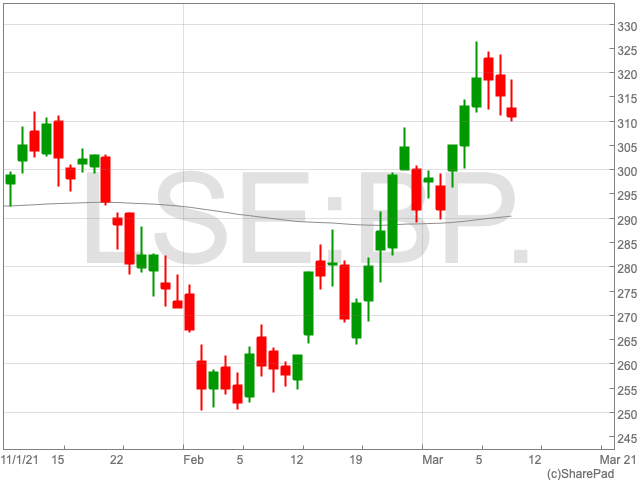

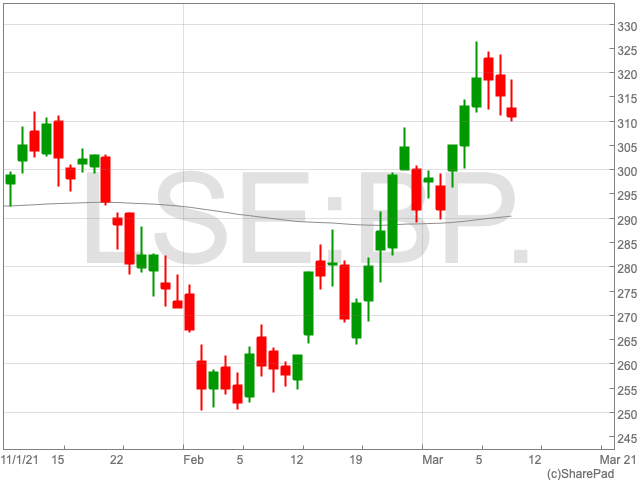

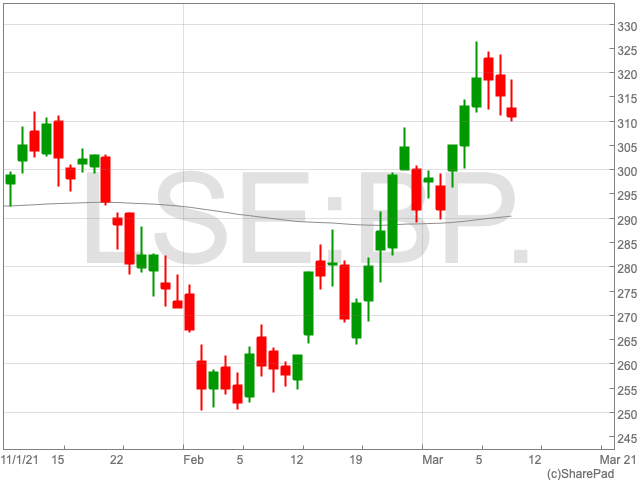

BP Share Price

BP’s share price surged throughout February and into March despite a slight retreat in the last few days. BP shares are now at 313.75p per share, up by 21% over the past 30 days from 259.1p. The oil and gas sector has generally experienced an upturn, helped in part due to a resurgence in the price of oil. In addition to continued optimism around vaccine roll-outs, the decision to restrict oil production by OPEC+ has worked in the British oil giant’s favour.

OPEC+

Earlier this month, OPEC+, the Organisation of the Petroleum Exporting Countries and its allies, decided to restrict its production of oil, opting to stick in the most part with its current quotas.

Prince Abdulaziz bin Salman, Saudi Arabia’s oil minister and son of King Salman, warned against complacency over the commodity’s recovery.

“Let us be certain that the glimmer we see ahead is not the headlight of an oncoming express train,” he said, at a meeting of oil ministers. “The right course of action now is to keep our powder dry, and to have contingencies in reserve to ensure against any unforeseen outcomes.”

So what does this mean for BP? Following the announcement by OPEC+, oil prices climbed to a 14-month high. As seen recently, when the price of oil rises, so does BP’s share price, because the company can make more money. Therefore, a continuation of OPEC+’s supplied control could bode well for BP’s share price.

However, the play does come with risks, according to Michael Hewson of CMC Markets.

“The surge in prices could also speed up the transition towards renewables if the price rises much above $70 a barrel for an extended period. It’s a bit of a gamble on the part of the Saudis, as they could hasten their own demise in a faster move towards renewables, as well as risking the strength of any post pandemic recovery.”