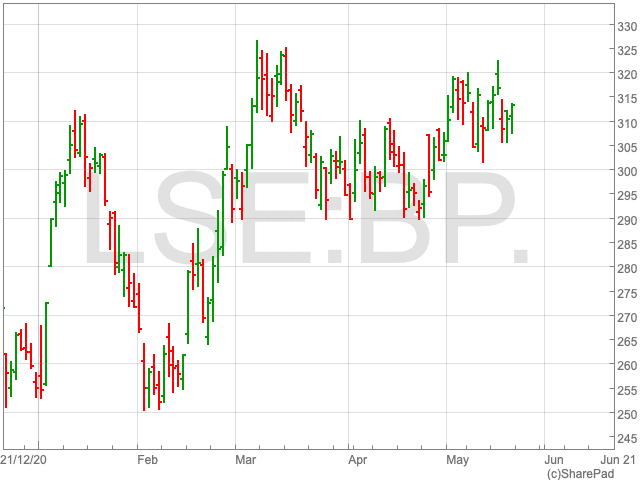

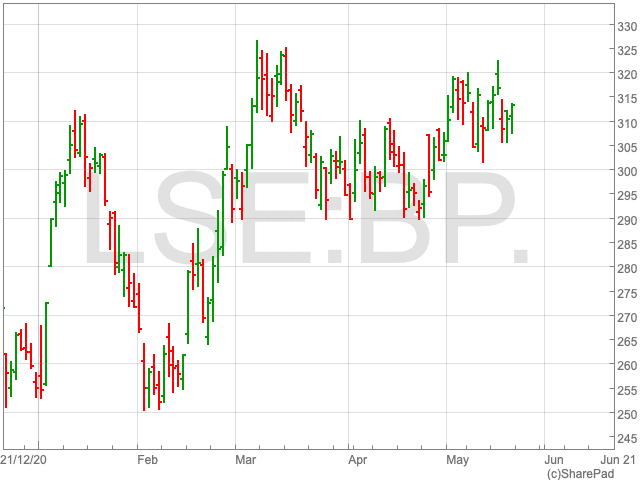

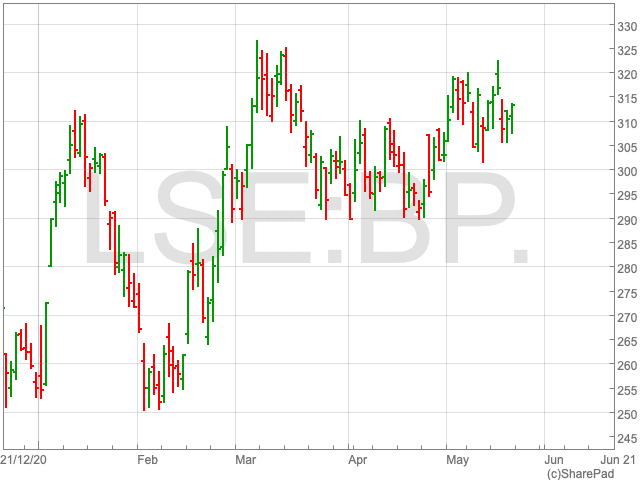

BP Share Price

There is much contention over the direction of the BP share price in the coming months. Analysts at Barclays are tipping it to move upwards, while climate activist groups continue to put pressure on the oil giant. Following steady growth over the last month, the BP share price is now sitting at 312p. Since the turn of the year it is up by 22.6%, as its recovery looks on course. However, it has someway to go before it is close to its pre-pandemic level of above 490p.

Climate Activist Pressure

Earlier this month BP avoided proposals calling for climate action although shareholder support for the demands of Follow This, an activist shareholder group, is growing. At the company’s AGM, just under 21% of votes supported a resolution by Follow This to put in place targets that satisfy the goals of the Paris climate accord.

The vote fell well short of the 75% needed, although it could serve to place further pressure on BP as well as major shareholders that have stood by the company. “We will continue to engage with our stakeholders as our plans evolve over time,” BP said after the vote.

BP’s currency chief Bernard Looney has promised to make the company carbon neutral by 2050. “Going back to the drawing board on strategy, targets and aims would disrupt our business plans and set us back at the very time when shareholders are asking us to focus on execution,” the company added.

It is clear there is a balance to be struck for BP between addressing environmental concerns and the concerns of shareholders in the short-term. Especially while revenues from fossil fuels remain the most reliable stream of income. For now, the vote may give the company more freedom to secure the BP share price, although it could serve to put investors off the company altogether.

Analyst’s View

The BP share price has been tipped by Barclays as one to watch over the coming months. Barclays set the oil giant a price target of 475p. This remains some way of its level of above 490p in early 2020 before coronavirus struck. However, it would also represents a significant increase from its current level. Barclays’ bullish outlook on BP was accompanied with an “overweight” rating.

The reasoning for such a bullish outlook on the FTSE 100 company, according to Barclays, is that it is misunderstood. Analysts at Barclays believe the company’s efforts to switch to low carbon will eventually be rewarded by shareholders.