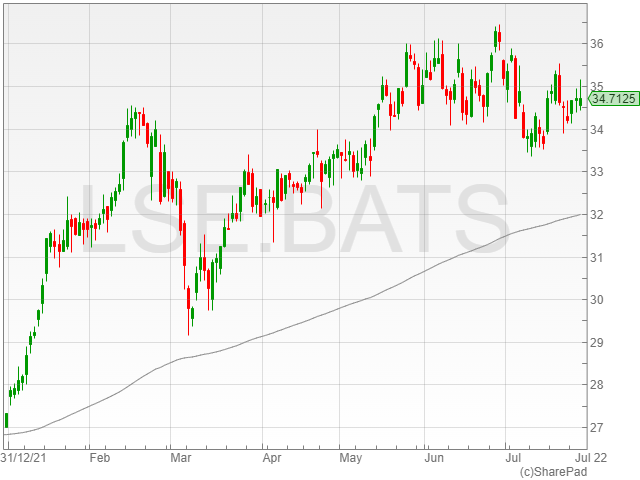

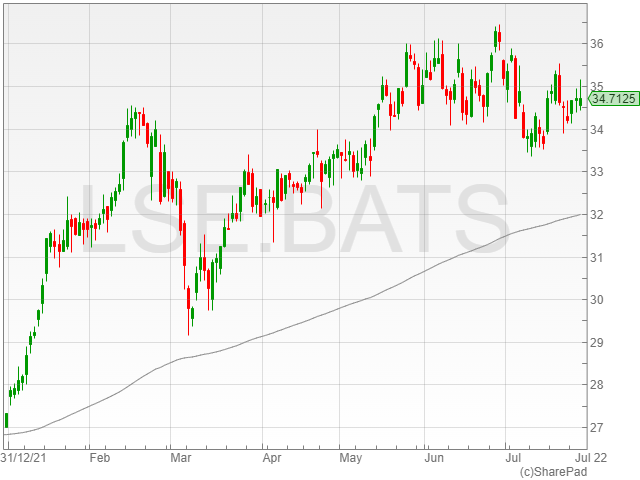

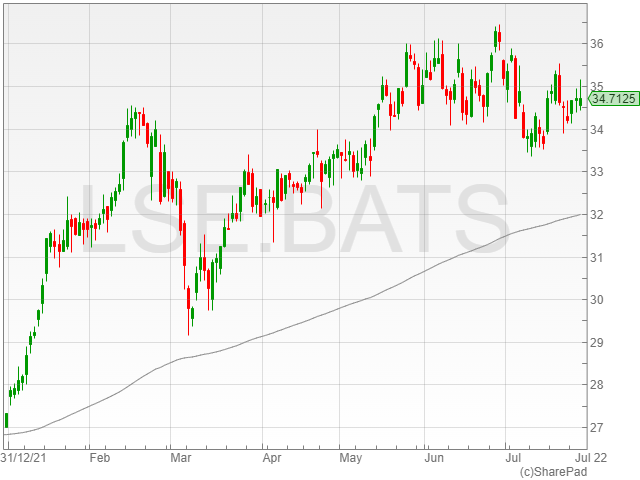

British American Tobacco shares dipped 0.1% to 3,465.5p in early morning trading on Wednesday following a 3.7% revenue climb to £12.8 billion in HY1 2022, led by New Category growth.

British American Tobacco highlighted a 45% expansion in its New Category sector to £1.2 billion in revenue, with a 2.1 million increase in non-combustible product consumers to 20.4 million.

The company reported 14.6% of group revenue was sourced from non-combustible products, representing a 2.2% growth from FY 2021.

“I am very proud that our continued New Categories growth momentum is driving Faster Transformation, with revenue growth of 45% in the first half of 2022, on top of 51% growth in FY2021,” said British American Tobacco CEO Jack Bowles.

“We are delivering both strong operational performance and transforming the business.”

Its vapour revenue climbed 48%, with an extension in Vuse global category share leadership to the number one US product in the sector.

Glo revenue rose 44%, with Glo hyper volume expanding its share gains across Europe, while Modern Oral revenue grew 37% on the back of Velo sales with continued volume share leadership across the continent.

British American Tobacco reported its New Category losses reduced by over 50% to £222 million.

The tobacco group announced a 0.6% rise in combustible revenue and a price/mix increase of 4.8%, along with a 0.1% value share uptick in Cigarettes.

British American Tobacco mentioned £1.5 billion in Quantum savings delivered six months ahead of scheduled, with an expected delivery in excess of £1.5 billion by the end of FY 2022.

However, the group mentioned a £957 million impairment charge linked to its exit from the Russian market following the invasion of Ukraine in late February this year.

The company highlighted an adjusted operating profit increase of 4.9% to £5.6 billion, including an adverse transactional FX impact of 1.5%.

Meanwhile, the firm noted a 0.9% rise in adjusted operating margin and an adjusted diluted EPS growth of 5.7% to 163p.

British American Tobacco confirmed an operating cashflow conversion of 77% on the back of strong continued cash generation.

FY 2022 guidance

The company said it was confident in its FY 2022 outlook, despite macro-economic headwinds.

“From an innovation perspective, the second half promises to be exciting. We are launching our new glo system proposition, hyper X2, and a new consumables range in the THP category, where we are enjoying strong growth,” said Bowles.

“In addition, we continue to build on our international leadership position in Vapour, expanding our portfolio with the launch of Vuse Go, our new disposable Vapour platform. This will be scaled-up and rolled out into a number of new markets following our successful UK pilot launch in the first half of 2022.”

“We are not immune, of course, to the increasing macro-economic pressures, exacerbated by the conflict in Ukraine. However, we are well positioned to navigate the current turbulent environment due to our powerful brands, operational agility and continued strong cash generation.”

British American Tobacco highlighted a dividend of 217.8p per ordinary share of 25p for the end of calendar year 2021.

The dividends were scheduled to be paid out in equal quarterly instalments in May 2022, August 2022, November 2022 and February 2023.

The first payment was issued on 4 May 2022, with the additional three payments scheduled for 17 August, 10 November and 2 February for shareholders on the London Stock Exchange.