The average investor lacks information on the nature of market cycles and struggles to understand the nature of bull and bear markets, making prudent investing a difficult task.

According to new research from Fisher Investments UK, most investors have heard the terms bull and bear market, but many struggle to define them and can’t identify important traits.

For example, throughout this eight-year-long US bull market that began March 9, 2009, many investors fear stocks have gone “too far, too fast.”

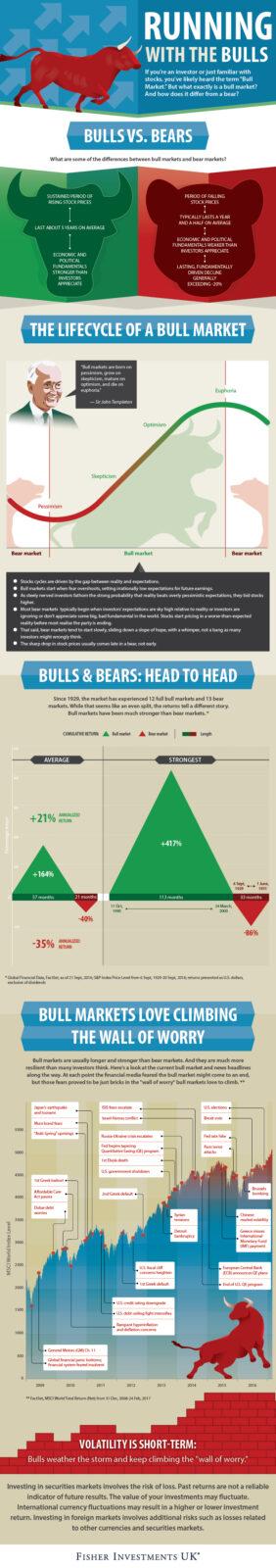

The infographic helps put the current market environment in historical context, shedding light on the evolution of bull markets and their tendency to overcome common fears. By differentiating bull and bear market lifecycles and identifying key points along with way, investors can see the important signs to watch along the way.

The infographic helps put the current market environment in historical context, shedding light on the evolution of bull markets and their tendency to overcome common fears. By differentiating bull and bear market lifecycles and identifying key points along with way, investors can see the important signs to watch along the way.

A core concept is sentiment’s evolution during a bull market. Many investors miss the fact stocks move on the gap between sentiment-based expectations and reality. For example, if the public is deeply pessimistic—as it was in early 2009—then anything less than catastrophically awful data can be the impetus for a nascent bull market. Conversely, if investors’ expectations are euphorically lofty, robust data that misses the mark may be the recipe for stocks to fall. Looking at data or sentiment alone is a common investor error.