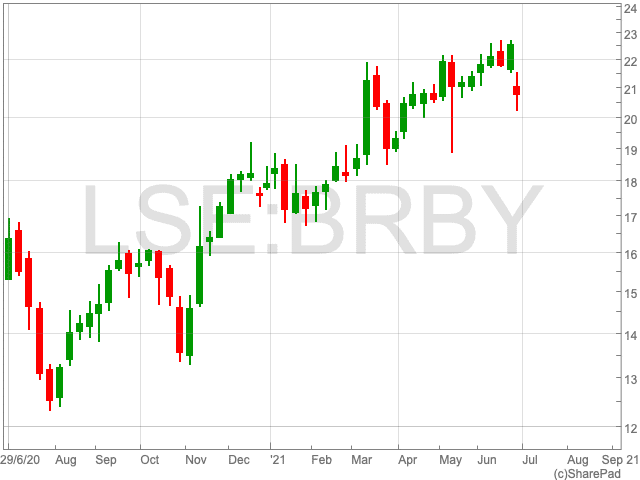

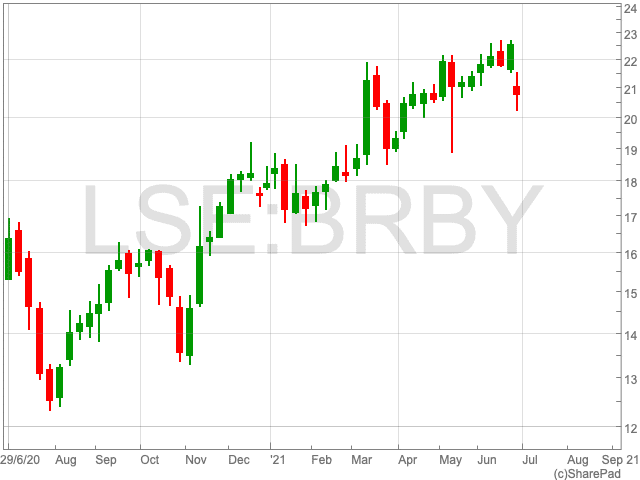

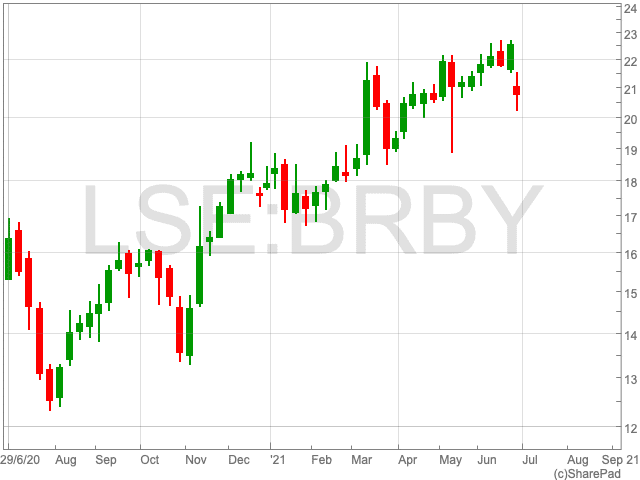

Burberry Share Price

The Burberry share price (LON:BRBY) is down by 8.04% on Monday as news broke that Marco Gobbetti is stepping down as chief executive of the luxury brand. The slide comes on the back of what has been a long bull-run over the past 12 months, with Gobbetti steering the company back towards its pre-pandemic level, albeit with some hiccups along the way. Since the turn of the year the Burberry share price is up by 13.71%, while over the past 12 months it has added 30.7%. It still remains someway short of 2,329p, its level before its stores were forced to close down across the world. However, shareholders will be hoping the new leader can maintain the FTSE 100 company’s recent momentum.

Marco Gobbetti

After nearly five years at the helm of Burberry, Marco Gobbetti stepped down from his role as chief executive of the luxury fashion brand. Gerry Murphy, the Burberry chairman, heaped praised on the departing chief executive:

“The board and I are naturally disappointed by Marco’s decision but we understand and fully respect his desire to return to Italy after nearly 20 years abroad. With the execution of our strategy on track and our outlook unchanged, we are determined to build on Burberry’s strong foundations to accelerate growth and deliver further value for our shareholders,” Murphy said.

The Burberry share price move following Gobbetti’s exit certainly suggest investors agreed with Murphy’s sentiments. This could cause difficulties for the company moving forward, adding pressure to find a high quality replacement.

“Investors must always resist the temptation to fall for the ‘cult of the CEO’ because one person cannot do everything at a firm, no matter how driven or talented, but the share price plunge shows how disappointed by Marco Gobbetti’s decision to step down from the top job at Burberry,” says AJ Bell Investment Director, Russ Mould.

There does not seem to be any negativity behind the decision, simply a desire on Gobbetti’s part to be with his friends and family in his native Italy.

Gobbetti compares favourably to the firm’s other CEOs when judging the performance of the Burberry share price compared to the FTSE 100 under their respective tenures.

| % change in | % change in | ||

| CEO | Tenure | Burberry share price | FTSE 100 |

| Rose Maria Bravo | Jul 2002 to Dec 2005* | 87% | 31% |

| Angela Ahrendts | Jan 2006 to Apr 2014 | 246% | 21% |

| Christopher Bailey | May 2014 to Jun 2017 | 12% | 8% |

| Marco Gobbetti | Jul 2017 to present | 35% | (2%) |

“That might not match the spectacular share price gains forged under Angela Ahrendts or Rose Maria Bravo, but allowances must be made for the different economic and market backdrops, as well as Burberry’s higher valuation. The company was valued at just over £1 billion when it came to market in 2002 and £2 billion when Angela Ahrendts took over, while its price tag now is some £9 billion, so the law of large numbers will have some effect,” said Mould.

“With Burberry re-energised and firmly set on a path to strong growth, I feel that now is the right time for me to step down,” Gobbetti said in a statement.

“I have every confidence that the creativity and strong values that define Burberry will continue to drive the company’s future success.”