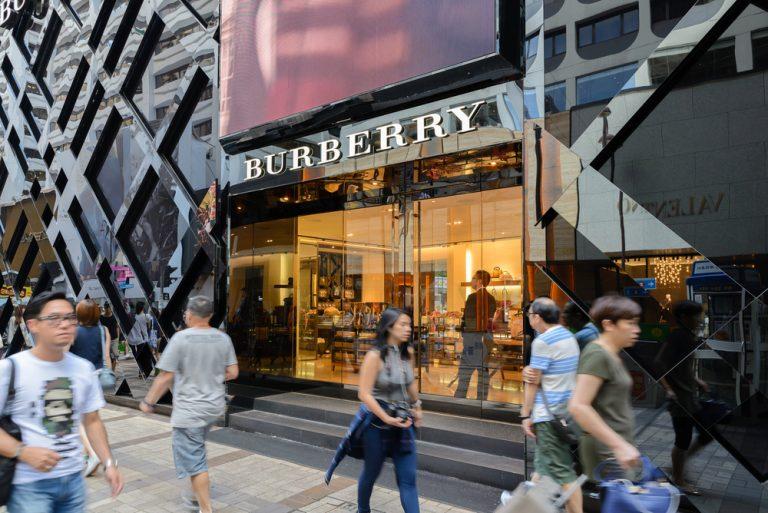

Shares in luxury retailer Burberry (LON:BRBY) fell 6.5 percent on Wednesday, as the company fails to keep up with competition in foreign markets.

Retail revenue fell 2 percent during the three months to December compared to the same period last year, from £735 million to £719 million.

Comparable store sales for the group overall rose by 2 percent, with the best performance seen in the Asia Pacific region, where it “grew by a mid-single digit percentage”. In EMEIA performance was less favourable, falling by declined by a low single digit percentage and impacted by strong UK comparatives, with US revenue remaining broadly flat.

Competitors such Hugo Boss performed better during the period, with Burberry continuing to struggle in the American market.

However, the group confirmed its guidance for the full year 2018 in Wednesday, with operating profit remaining unchanged. The group added that it was on track to deliver cumulative cost savings of £60 million in FY 2018.

Marco Gobbetti, Chief Executive Officer, said: “We are making good progress embedding our strategic vision into the organisation and remain on track to meet our full year profit target. We are building on strong foundations and are fully focussed on the successful delivery of our multi-year plan to position Burberry firmly in luxury and deliver long-term sustainable value.”

Burberry shares are currently trading down 6.47 percent at 1669.50 (0847GMT).