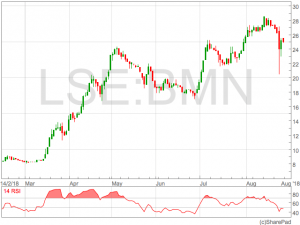

Bushveld Minerals (LON:BMN) is set to benefit from a higher average Vanadium price when it reports half year results in the coming months.

Ferro-Vanadium price are up over 150% in the past year as recorded by the Metal Bulletin which is set to boost revenue achieved from Bushveld’s Vametco mine in South Africa.

Vanadium is used in alloys with engineering applications due to its durability. More recently has been applied to power storage as a possible alternative to Lithium, presenting the potential for significant demand in the coming years.

In a recent Operational Update the mining company said total production guidance for the year had been lowered to 2,850 and 3,000 mtV. Despite the lowering of guided production, the higher end of this range would represent a 13% jump on 2017 production.

In addition to the forecast 13% jump on last year’s output, the firm has said it see’s production increasing to an annualised production rate of 3,750 mtV in the coming months.

The potential for higher production rates given this year’s exponential rally in Vanadium prices sets Bushveld up for a sharp increase in revenue in the next market update.

CEO Fortune Mojapelo said of the recent progress:

CEO Fortune Mojapelo said of the recent progress:

“Bushveld Vametco’s operating performance during the first six months under Bushveld Minerals control and a new management team has benefitted from a rising vanadium price resulting in significantly higher profit margins relative to the first half of 2017.”

“I am pleased to see the completion of Phase Two of the Vametco multi-phased expansion project, which was successfully completed on time and within budget, bringing Vametco’s annual production run rate to 3,750 mtV. The slower than expected ramp up to this production capacity has been disappointing contributing to the revised production guidance. Notwithstanding the 2018 production guidance revision, we remain confident that the Company’s expansion efforts remain on track to grow Vametco’s production capacity to 5,000 mtV per annum to further strengthen our competitive position in a favourable market environment.

“Meanwhile, we are very pleased with the recent positive drilling results at the Brits Vanadium Project, which has shown similar mineralisation to Vametco with vanadium grades in magnetite of 1.54-2.09% V2O5.”

Broker targets

Broker SP Angel have a 30.5p price target on Bushveld Minerals having recently lowered it from 33.6p following the latest operational update in which production guidance was lowered.

SP Angel’s price target represents a potential 22.4% upside from the closing price 24th August 2018.