Cadence Minerals have announced the completion of the pre-feasibility study (PFS) at their flagship Amapa Iron ore project in Brazil. The completion of the PFS marks a major milestone in the journey towards the production of high-grade iron ore at the project which now has a $949m NPV.

The PFS included the Maiden Ore Reserve of 195.8mt at 39.34% Fe and an IRR of 35%. The Amapa project is now expected to produce 5.28 million dry metric tonnes of iron ore per annum.

The PFS forecasted Free on Board (FOB) cash cost of $35.53/dmt at the port of Santana and Cost and Freight (CFR) cash costs $64.23/dmt in China. Iron Ore at 62% Fe is currently trading above $111 in China having touched highs in excess of $230 in 2021.

Cadence Minerals have a 30% stake in the Amapa project.

Having achieved a favourable PFS, DEV Mineração S/A – the owner and operator of the Amapa iron ore project – will now push on with advancing operations at Amapa and pursue mine life expansion at adjacent exploration targets. This will open the door to a Feasibility study and production at the project.

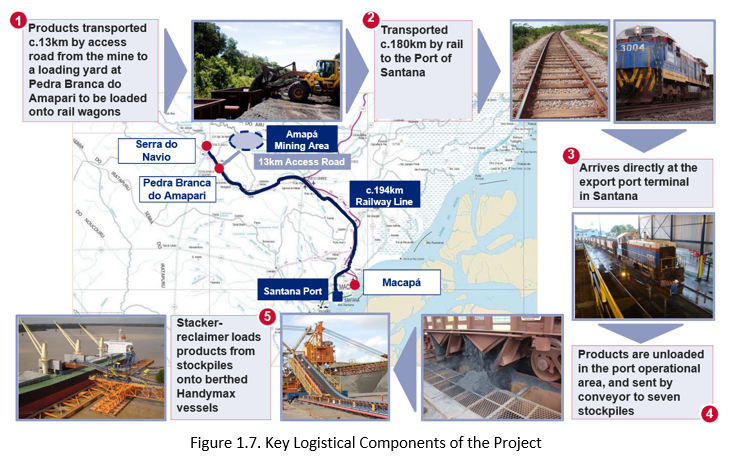

Amapa benefits from excellent infrastructure which will help manage initial capital expenditure currently forecast to be $399m. There are existing facilities including a processing plant, railway and port access set for rehabilitation ready for production at the project.

“The Project benefits from integrated infrastructure under the owner’s control, a well-established processing route, low capital intensity and a quality product with an international reputation,” said Cadence Minerals CEO, Kiran Morzaria.

“Along with a skilled workforce, proximity to operational infrastructure and the potential to increase the mineral resource means that Amapá remains an incredibly attractive investment opportunity.”

Cadence Minerals is a mining and minerals investment company with a diverse portfolio of assets that spans critical minerals and base metals.

Cadence has a number of lithium projects heading towards liquidity events in 2023.