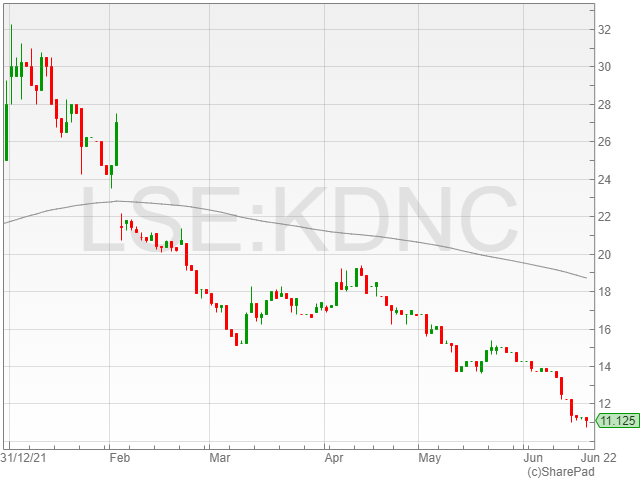

Cadence Minerals shares were down 0.4% to 11.2p in early afternoon trading after the mining company announced an operating loss of £631,000 from an operating profit of £8.9 million in its financial results for FY 2021.

Cadence Minerals also reported a pre-tax loss of £144,000 compared to a pre-tax profit of £7.8 million, attributing its drop in profits to the reduced amount of realised and unrealised profits and losses for the year of approximately £1.2 million against £10.4 million in FY 2020, relating to its share investment portfolio held over the financial period.

The company highlighted a rise in administrative costs by £300,000 from £1.4 million to £1.8 million, however foreign exchange gains climbed by £1.2 million to £460,000 from a loss of £820,000 in the previous year.

Cadence Minerals noted the formalising and successful settlement of its investment into its flagship Amapa iron ore project in Brazil as its main high point of FY 2021, with the operation successfully commencing the shipments of iron ore from its stockpile at the port of Santana.

The board commented that it had “every confidence” that its investment in the region would be a strong success in the coming year.

Cadence Minerals confirmed its priorities for the next term included the publication of a maiden ore reserve estimate for Amapa, followed by the release of a PFS on the operation.

The company is also set to increase its stake in the Amapa asset, and estimated that its investment in Lithium Technologies and Lithium Supplies would have listed in FY 2022.

Cadence Minerals added that it hoped to crystallise some additional value from its other privately held portfolio assets.

The mining firm acknowledged the difficulties linked to the volatile macroeconomic environment at the current moment, and said it believed its lithium and iron ore assets, alongside its Amapa project, would position it to meet the ongoing geopolitical challenges.

“As the impact of the pandemic begins to recede, we face new challenges of higher interest rates and inflation,” said Cadence Minerals non-executive chairman Andrew Suckling.

“For Cadence, sustained higher commodity prices especially those of Lithium and Iron Ore has remained one of the great positives across our portfolio, and together with the successful settlement and initial investment into the Amapa project, your Board believes we continue to be well placed to meet these challenges, both present and future.”

“In closing, I would like to personally thank my fellow Board members, staff and partners in the wider Cadence Community and of course all Shareholders for their continued encouragement and confidence in the Company.”

Cadence Minerals highlighted a basic loss per share of 0.1p from an EPS of 6.8p year-on-year.