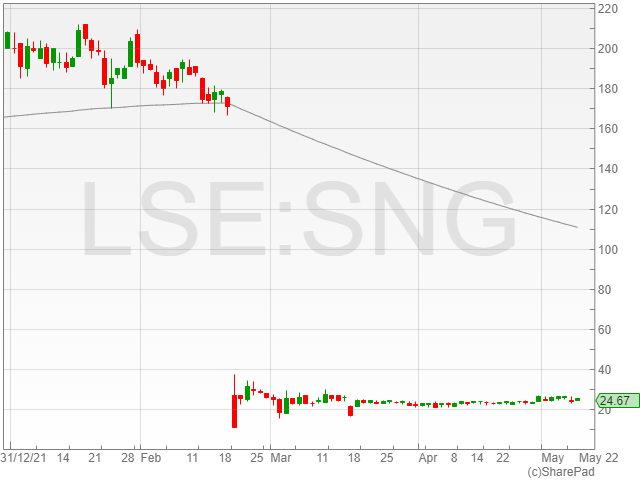

Synairgen shares have suffered a devastating year after the stock plummeted from 177p to 28p in just a few days in late February this year.

The nasty disappointment followed the results of Synairgen’s SNG001 Covid-19 treatment, which failed to meet its primary and secondary efficacy endpoints in its Phase three SPRINTER late stage trial.

The SNG001 trial revealed that patients taking the treatment were not more likely to be discharged from hospital than patients on a placebo in a study of 623 participants.

Synairgen shares have languished below the 30p line since its initial tumble, with the shares currently trading at 24p.

Financial Results

Synairgen pinned its potential and its future ambitions on the success of its lead programme, SNG001.

The biotechnology firm emphasised the value of the treatment for Covid-19 patients, government stockpiles for pandemics in the future, and treatment for basic respiratory viruses such as the cold and flu.

Synairgen invested its financial assets into the development of SNG001, reporting a pre-tax loss of £38.8 million in its interim results on 30 June 2021, against a loss of £5 million year-on-year.

The company said its research and development expenditure was scaled up to £36.9 million from £4.4 million as a result of investment in its Phase three clinical trial for SNG001.

The group’s outlook in its 2020 results pinned Synairgen’s future on the successful outcome of the SNG001 results, with the second half of 2021 focused on the commercialisation and manufacturing of the treatment in order to make the drug readily available across the international market.

Synairgen intended for all cylinders to fire on the approval of SNG001, and when it failed, the stock tumbled dramatically, leaving little else behind for investors to get excited about.

Where are Synairgen shares going?

Synairgen shares saw an uptick of 43% to 26p on 3 March 2022, after studies conducted in the Netherlands suggested that SNG001 had potential antiviral effects against the Delta and Omicron variants at readily achievable concentrations.

However, the Synairgen share price took an 18% hit to 21p on 17 March, following a report that the US National Institute of Allergy and Infectious Diseases suspended patient recruitment in its phase 2/3 trial for SNG001, due to the requirement of an altered format of study in light of the pandemic’s changing nature.

The stop-and-start nature of Synairgen’s development for SNG001 has substantially beaten up the stock, with the failure of its late stage trial breaking all the eggs in its basket.

The company does not have any other significant projects in its pipeline, with its ambitions pinned on SNG001 since 2020, which has so far collapsed in on itself in 2022. All hopes will be on the results of ACTIV-2 Phase 2 data in H2 2022 and the full data from the SPRINTER trial.

The Synairgen share price is definitely cheap compared to its 52-week high, however it appears it might be staying that way for quite a long time.