This morning’s publication of China’s continued drop in both exports and imports in June has sparked worry over the country’s industrial demand, which may weigh heavy on raw commodity suppliers. Lower figures on copper purchases of the world’s biggest consumer of the metal ring especially worrying for mining companies and lower pricing of the metal has largely affected the FTSE100 in the past.

Chinese exchange of goods and services continues to slide

The country this morning reported a 4.4% decrease in exports in July compared to the same month last year. The figure missed estimates by 1.4%.

Imports fell a total of 12.5% compared to a year ago, representing its largest decline in 6 months and the 21st consecutive slide in monthly import figures.

Lower than expected measures fuelled speculation that the country’s economic slowdown is worse than expected and will affect the country’s industrial demand of commodities. This may depress earnings of raw commodity suppliers and weigh heavily on stock prices.

Drop in China’s copper purchases weighs on the metal’s price

Most notably, copper purchases were down a total of 14.3%; worrying new for mining companies and the FTSE100. China is the world’s largest consumer of the metal and news of lower demand therefore has grave impact on its pricing.

Copper traded at its lowest since the 12th July hitting $4,783 a tonne on the London Metal Exchange on Friday. Monday saw a slight increase in price as Friday’s strong US job data helped spur positive economic sentiment. The metal was up 0.8% to $4,829 a tonne in morning trading. However, news of lower Chinese demand still managed to keep prices at a four week low.

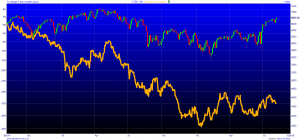

In the past sliding copper prices have not only depressed share prices of all major mining companies but it can also be observed that the FTSE100 moves greatly in response to changes in the metals pricing.

Earlier this year, China’s lower-than-expected figures on exports and imports and especially lower demand for the red metal send mining shares downwards and caused a considerable drop in the FTSE100.

China’s export data weighed heavily in FTSE100 in March

On the 8th March Beijing reported a reduction of 13.8% in imports and a whopping 25.4% drop in exports.

Copper prices were in between the worst hit by the news, dropping as much as 2.4%.

In the aftermath, shares in global mining companies dropped greatly on the London Stock Exchange. Glencore (LSE:GLEN) fell 18 percent to 139.75p, also affected by news of a mining accident in the DRC. Anglo American (LSE:AAL) was down 15 percent. Antofagasta (LSE:ANTO), as well as Rio Tinto (NYSE, LSE:RIO), both lost more than 9 percent. The FTSE100 closed 1% down.

FTSE100 still unaffected by latest data release

In the aftermath of today’s data release the FTSE100 and mining companies’ shares have remained largely unaffected. This could be the result of low expectations of the figures.

However, if decreases in copper prices persist, they may come to show their effect on the FTSE100 and in particular the shares of mining companies.

08/08/2016