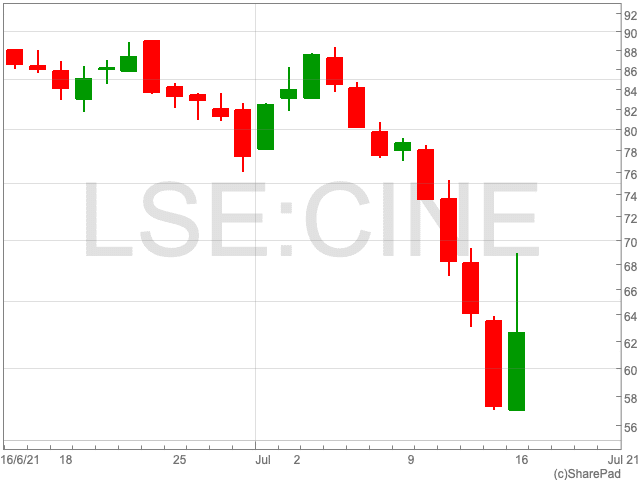

Cineworld Share Price

The Cineworld share price (LON:CINE) soared on Friday in a move that looks to be straight out of the AMC playbook. In the middle of the afternoon session on Friday, as the week draws to a close, the Cineworld share price is up by 9.53% to 62.78p per share. It follows a torrid month for the cinema chain which saw its share price tumble. At the time of writing, the Cineworld share price is down by 28% since the beginning of July. It appears as though the dramatic moves over recent weeks have been a result of short selling from major investors followed by a response from Reddit-type short squeezers.

Short Selling

It has been reported that 7.5% of Cineworld shares are being held in short positions by large investment companies. Short shellers have likely been attracted to Cineworld because of its significant debt of $8.3bn, as concerns remain over the strength of the recovery from the pandemic, and the cinema chain’s ability to cope.

However, the dramatic fall in the stock’s value caught the attention of other investors who have been able to buy Cineworld shares at a cut price. The mass buying also appears to be an effort to squeeze on the major investment managers, in a similar vain to previous Reddit-induced shorts.

Analysts’ View

Earlier this week Peel Hunt, the specialist for UK investment banking, confirmed its is maintaining its ‘hold’ recommendation. However, it did reduce its price target by 10p to 75p per share.

“The Cineworld share price has drifted off since the highs of March, when it reached 120p, more sharply recently,” Peel Hunt said.

While the cinema has performed reasonably well in the US and UK as restrictions have been lifted, the precariosuness of the recovery remains an issue, as does the threat of streaming services to the industry.

Investors will be keeping an eye on the Cineworld share price over the coming days to see which way things go.