The M&G Global Emerging Markets Fund should be explored by investors ready to move back into Emerging Markets and lean towards Chinese equities.

Managers of the fund have made material changes to the portfolio’s composition this year and are preparing for the next chapter in the Emerging Markets story.

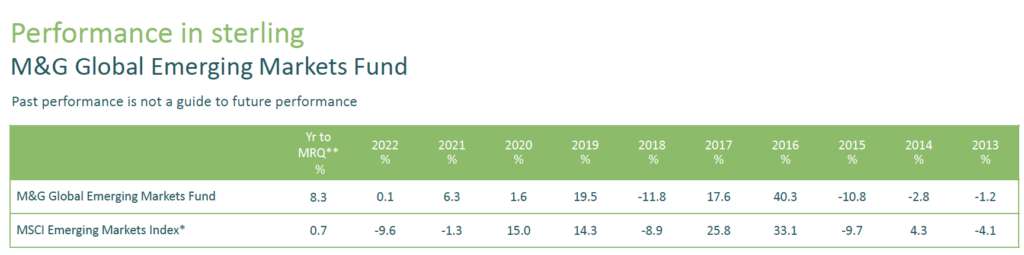

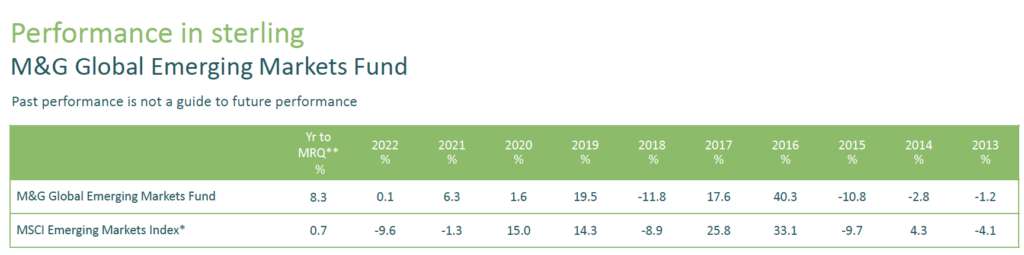

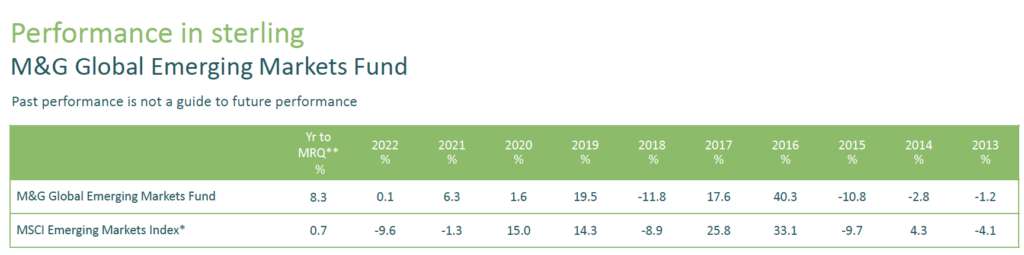

The M&G Global Emerging Markets Fund has consistently outperformed the benchmark, avoiding the drawdown in 2022 and producing an 8.3% return this year to the most recent quarter – a period in which the benchmark is almost flat.

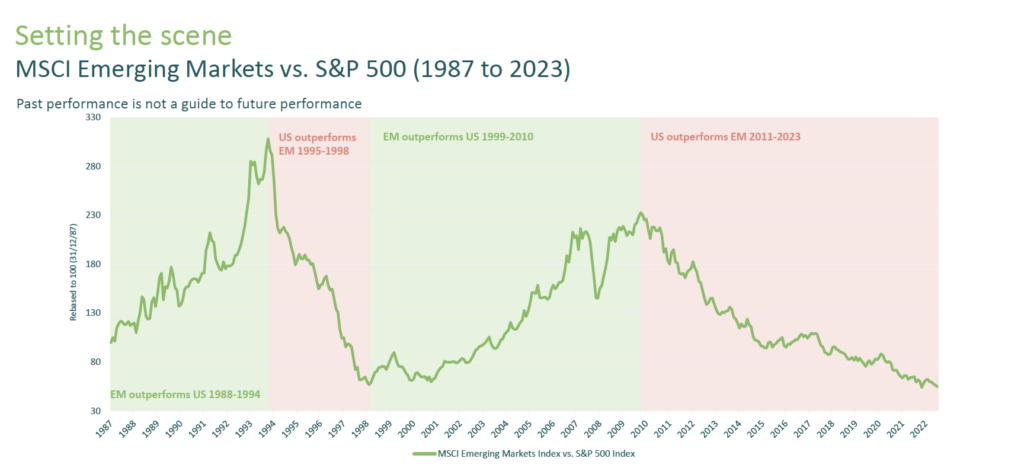

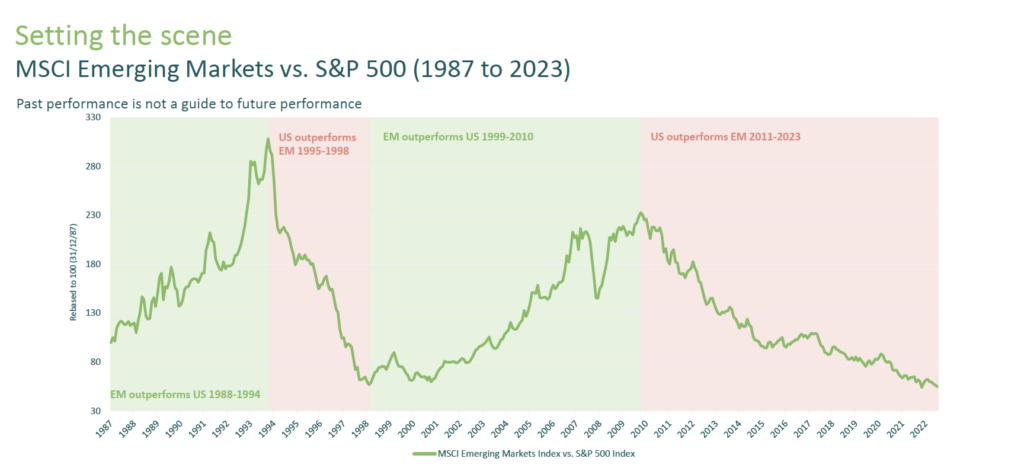

There is an overarching case for Emerging Markets from a performance perspective relative to US equities.

The outperformance of Emerging Markets versus US equities enjoyed in the noughties has completely unravelled since 2010, and Emerging Markets are now at the lowest level compared to the S&P 500 since 2000 after the US and other developed market equities sucked flows away from Emerging Markets.

Emerging Markets have consistent cycles relative to US stocks, lasting 5 – 10 years. Although past performance is not a guide to future performance, should this cycle repeat itself, Emerging Markets could be in for a period of relative outperformance against US equities.

However, relative performance in itself is not enough to drive equity returns.

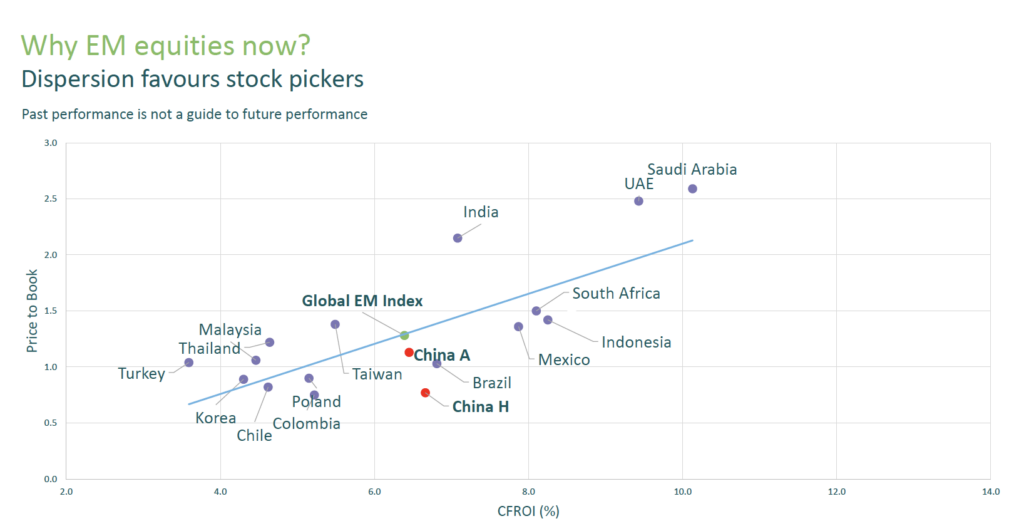

Speaking at an event in London this month, Michael Bourke, Fund Manager of the M&G Global Emerging Markets Fund, outlined compelling valuations and favourable growth stories throughout EM.

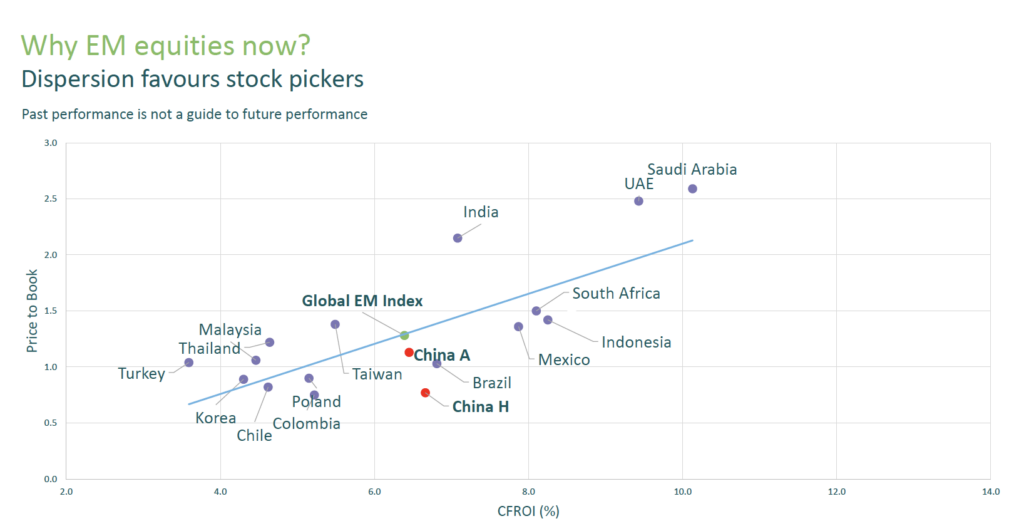

Highlighting the merits of an active approach to harnessing the opportunity, Bourke explained the dispersion of profitability and price-to-book valuations underpinned the attractiveness of stock picking compared to buying the index.

An Active Approach to Emerging Markets

The argument for employing an active manager over choosing passive alternatives is rarely as strong as in Emerging Markets.

Identifying value and allocating cash to companies with the potential to produce outsized returns is lost in passive investment, where investors are forced to take exposure to broad baskets of companies they may otherwise rather avoid.

M&G’s success in Emerging Markets has come from avoiding many of the underperformers in the space and carefully timing allocation to opportunities they see in both individual companies and countries.

Michael and his team have identified one such opportunity in recent months, the Emerging Markets’ largest constituent country, China.

After being underweight China for nearly seven years, the managers have decided now is the time to bolster exposure to the country.

In 2020, the M&G Global Emerging Markets Fund was underweight China compared to the MSCI Emerging Markets Index by 10.2%. In September 2023, the fund was overweight China to the tune of 2.8%.

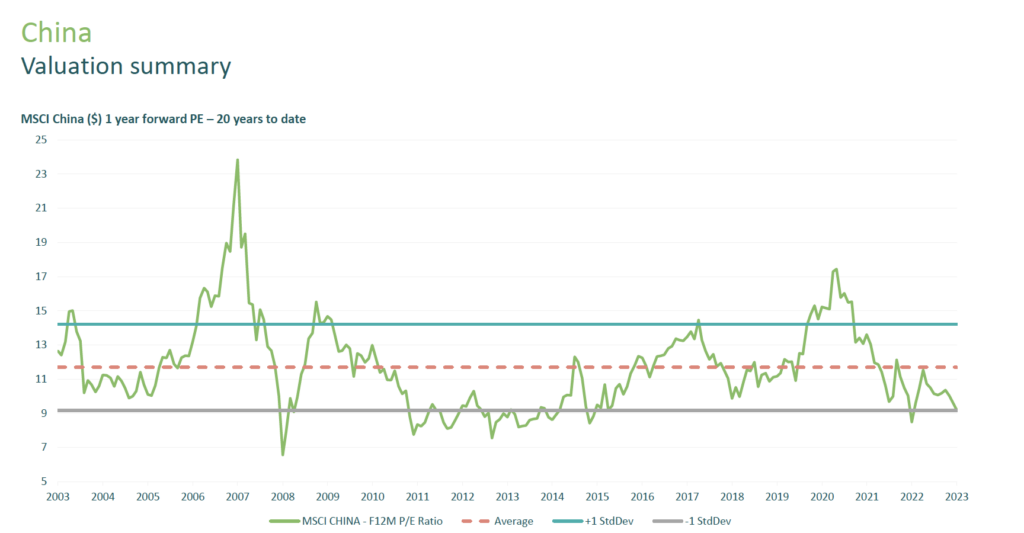

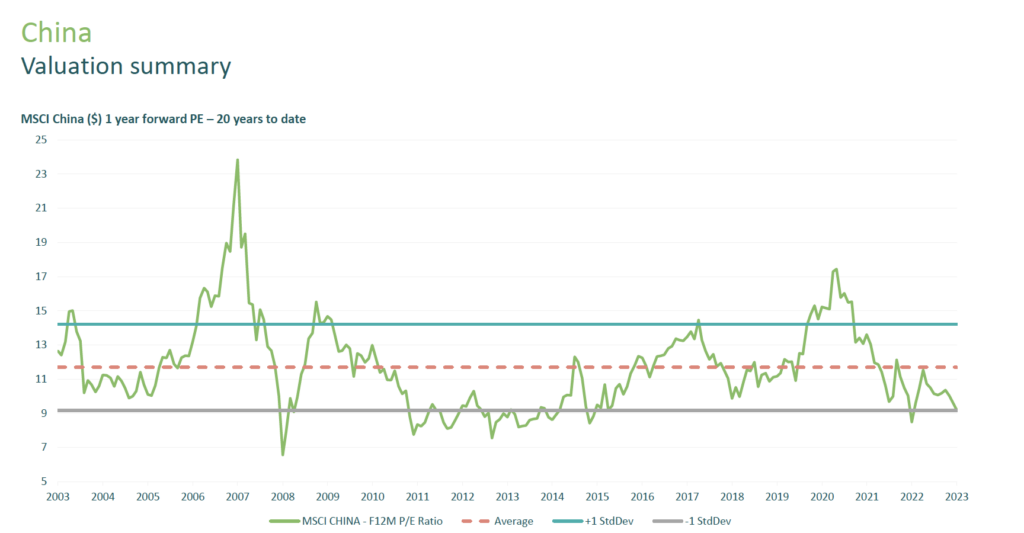

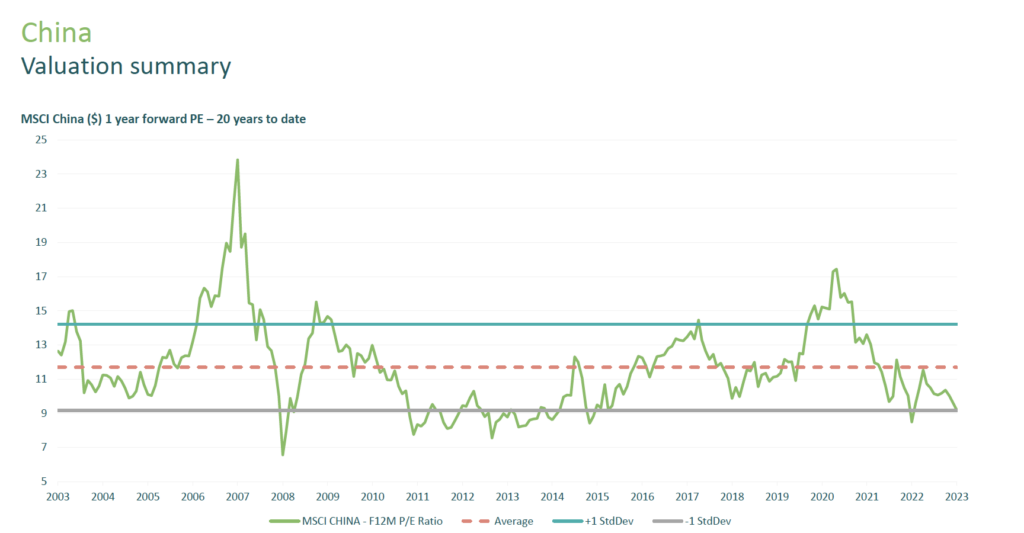

The shift lies almost exclusively in the valuation of Chinese equities and the ability of Chinese companies to return cash to shareholders.

China is entrenched in the communist approach to managing the economy, typified by high levels of investment spending to drive the economy. This approach has supported Chinese corporations and their earnings despite damaging COVID restrictions and a property crisis.

There are, of course, concerns about the Chinese property market and Taiwan, but these are arguably priced in and are a reason Chinese equities trade on the lowest Price/Book multiple since the pandemic.

Adding context to the Chinese property crisis and potential fallout across the wider economy, Michael Bourke pointed out the current issues being experienced in the real estate market can not be compared to the West’s 2008 financial crisis because China’s derivatives market is limited compared to the one that blew up the financial system in 08/09.

Bourke suggested the problems in Chinese property represent a realignment of the economy rather than an existential threat.

“The Chinese real estate sector has halved, and it’s not coming back,” he said.

Considering the risks in China and concluding the attraction of equity valuation outweighs the risk in the long term, the fund has carefully picked out Chinese companies with the ability to return cash to shareholders through dividends and share buybacks.

These include JD.com, Alibaba and KE Holdings.

South Korea, India, and Brazil

With a 31% weighting as of the end of October, our focus has justifiably been on the fund’s approach to China

That said, the fund’s approach to South Korea, India, and Brazil is notable.

The managers are heavily overweight South Korea and see value in their larger holdings, including Samsung and Hana Financial.

The orientation of the Brazilian economy towards commodities has earned the country an overweight allocation of assets.

India is interesting in as far as it is the country the fund is most underweight. M&G doesn’t like the composition of the economy in that it relies too heavily on the consumer and lacks the punch of a booming manufacturing sector and extensive infrastructure projects to drive the next leg higher in India stocks.

There is the recognition Modi’s efforts have boosted the economy and driven equity prices higher. But the next phase in India’s growth story is one M&G’s Emerging Markets equity team are less convinced about.