As value investors, one of the questions we have been asked a lot recently is, “why doesn’t value investing work anymore?”. The perception behind this question, however, depends hugely on the frame of reference because, from where we sit, it seems that value investing is working once more.

The long period of low interest rates and quantitative easing that followed the Global Financial Crisis clearly favoured growth investing but this is increasingly looking like an anomalous decade, as the long history of financial market evidence suggested it would. It seems that the Covid vaccination breakthroughs in November 2020 (which also roughly coincided with our appointment as managers of Temple Bar) marked an important turning point in equity markets. Below, we demonstrate that value stocks have tended to outperform growth stocks almost everywhere since then.

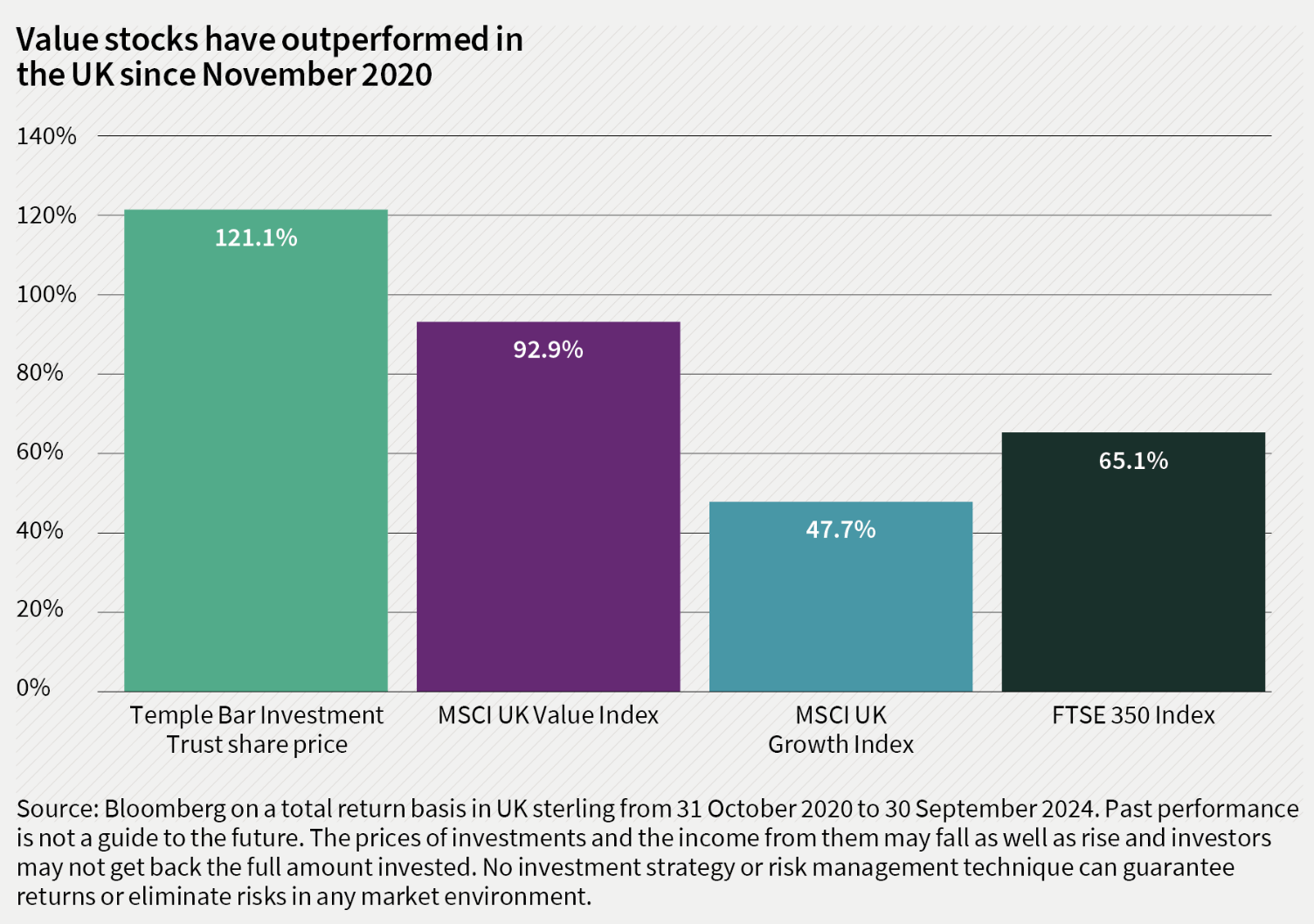

UK

In our domestic market, the value index has beaten the growth index and the wider market since November 2020. By focusing on the better performing parts of the UK value universe, Temple Bar shareholders have done even better.

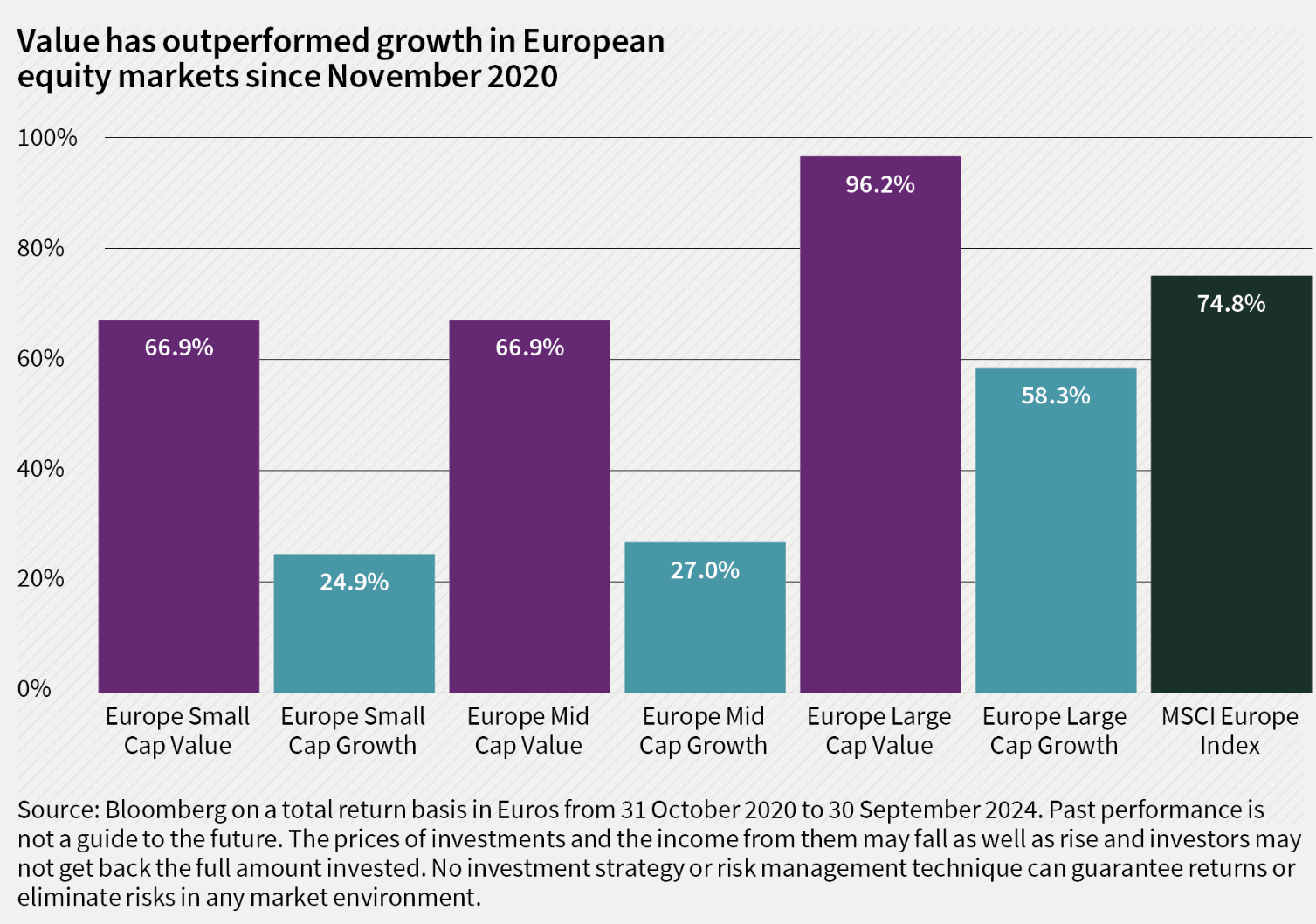

Europe

Meanwhile, in Europe, the same phenomenon can be observed, with value beating growth across all elements of the market cap spectrum.

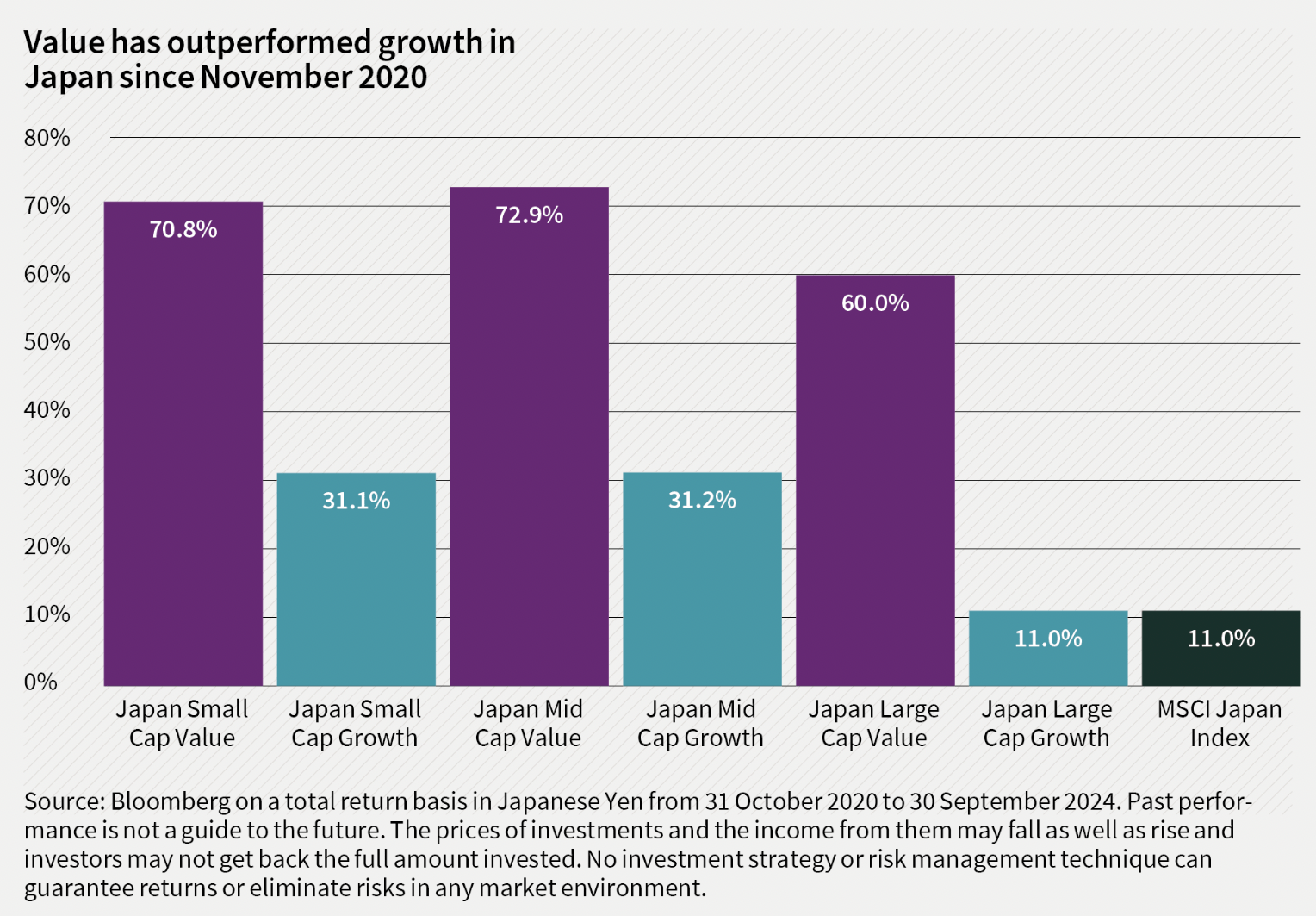

Japan

The same is evidently true in Japan, with value delivering significant outperformance of growth and of the wider market, since November 2020.

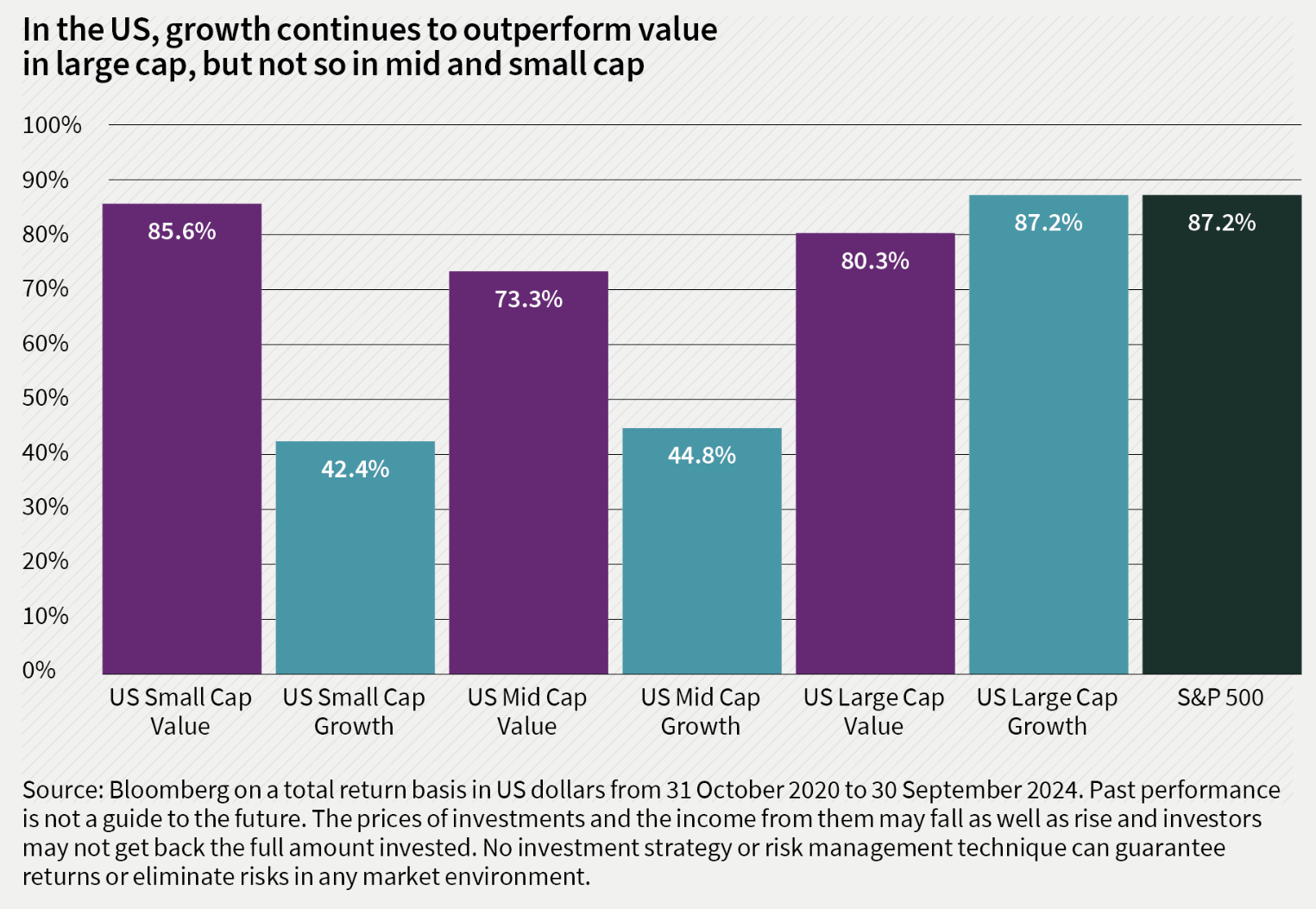

US

In fact, the only place that value isn’t yet working appears to be the US. Peering beneath the surface though, we find that, even in this market, it is only within large caps that growth is still beating value.

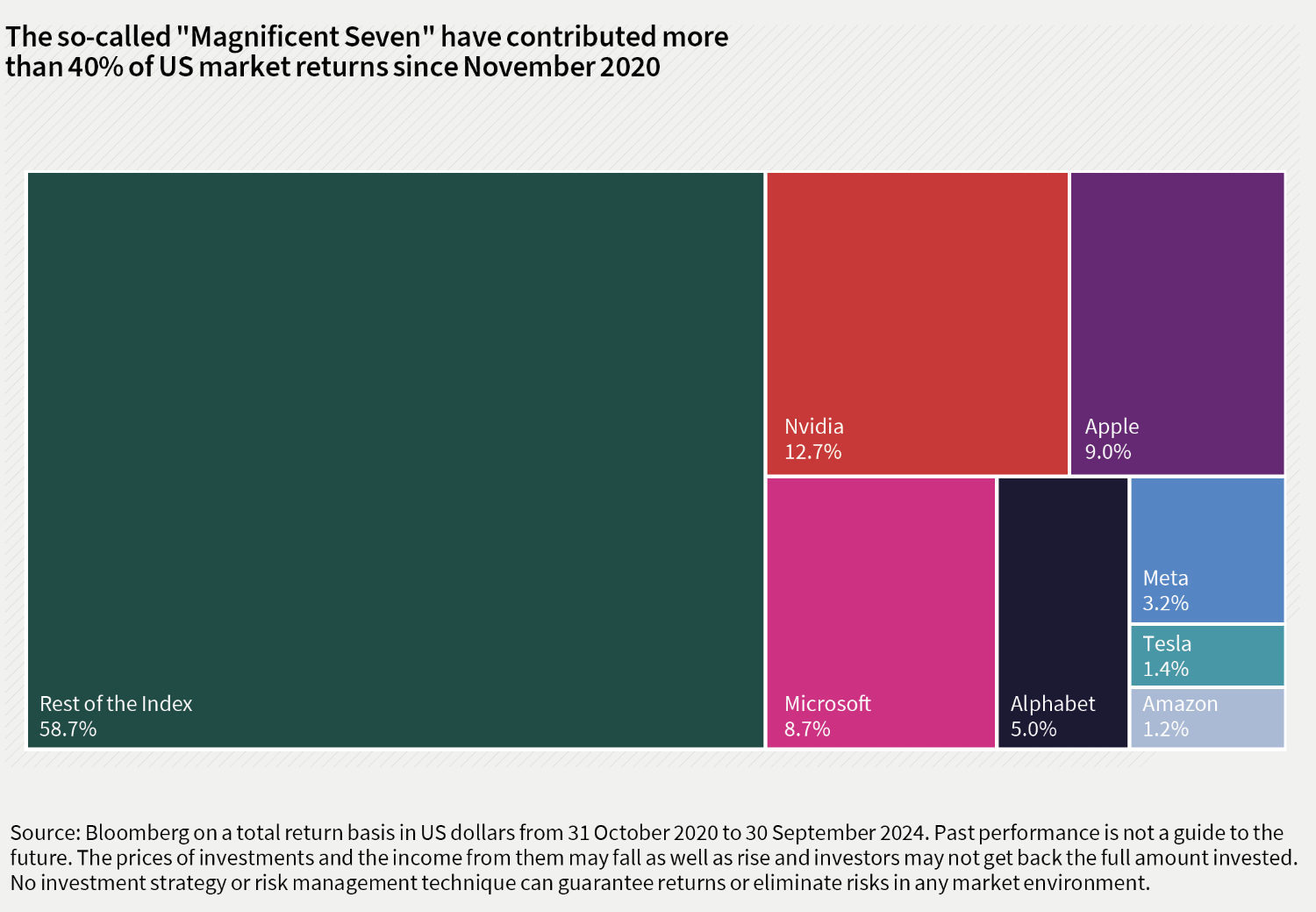

This continued outperformance of growth in the US is almost exclusively a function of that small group of stocks that have become known as “The Magnificent Seven”. Between them, these stocks have contributed more than 40% to the US stock market’s return since November 2020.

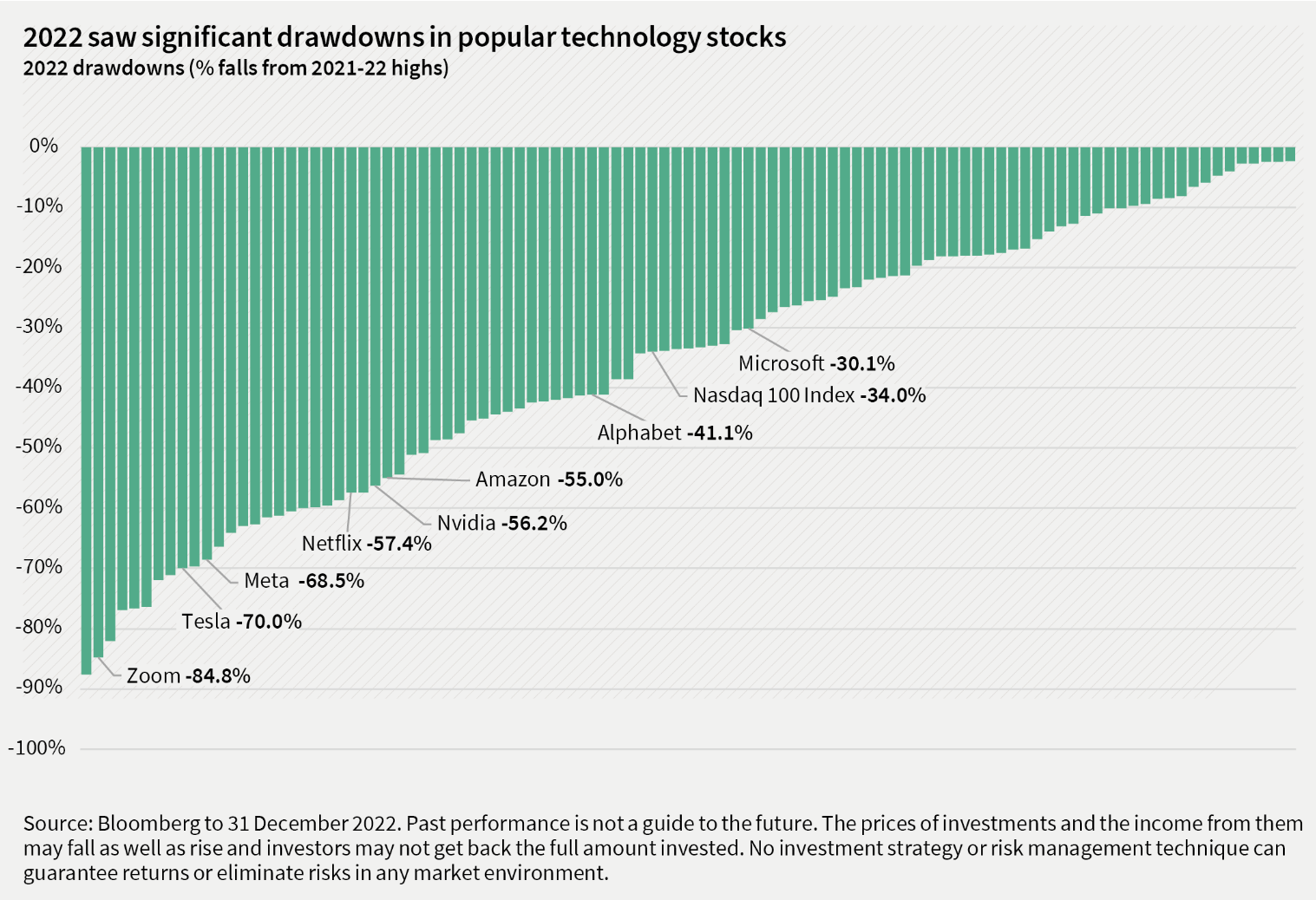

Memories can be perilously short. Many investors seem to have already forgotten the large drawdowns that some of these stocks saw in 2022, and even though it was only two years ago, they can’t seem to imagine these share prices ever going down again.

It ain’t over until it’s over

The long-term empirical evidence behind the concept of value investing is robust. Lowly valued stocks have outperformed in every complete decade of the last 100 years, with one exception – the 2010s. From this perspective, it is not surprising to see value reasserting itself, almost everywhere, over the last few years1.

Indeed, the market’s continued infatuation with a handful of US technology stocks may be described as “the last shoe to drop” as far as the growth obsession of the 2010s is concerned. Everywhere else, value has resumed its former dominance.

The value renaissance has been good news for Temple Bar shareholders, and we are confident that this will continue. We are, and always will be, disciplined value investors, and the excesses that accumulated in the era of low interest rates and quantitative easing will take a very long time to unwind. We believe this should represent a tailwind for value investors that lasts many years into the future.

In other words, there remains plenty for value investors to look forward to.

Hat-tip to Lightman Investment Management for the inspiration.

1 Source: Kenneth R. French library, Morgan Stanley Research. Performance of Value factor (Book Yield) since 1926, Morgan Stanley, 27 May 2022.

Past performance is not a guide to the future. The prices of investments and the income from them may fall as well as rise and investors may not get back the full amount invested. Forecasts and estimates are based upon subjective assumptions about circumstances and events that may not yet have taken place and may never do so.

No investment strategy or risk management technique can guarantee returns or eliminate risks in any market environment. Nothing in this document should be construed as advice and is therefore not a recommendation to buy or sell shares. Information contained in this document should not be viewed as indicative of future results. The value of investments can go down as well as up.

This article is issued by RWC Asset Management LLP (Redwheel), in its capacity as the appointed portfolio manager to the Temple Bar Investment Trust Plc. Redwheel, is authorised and regulated by the UK Financial Conduct Authority and the US Securities and Exchange Commission.

Redwheel may act as investment manager or adviser, or otherwise provide services, to more than one product pursuing a similar investment strategy or focus to the product detailed in this document. Redwheel seeks to minimise any conflicts of interest, and endeavours to act at all times in accordance with its legal and regulatory obligations as well as its own policies and codes of conduct.

This document is directed only at professional, institutional, wholesale or qualified investors. The services provided by Redwheel are available only to such persons. It is not intended for distribution to and should not be relied on by any person who would qualify as a retail or individual investor in any jurisdiction or for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to local law or regulation.

The information contained herein does not constitute: (i) a binding legal agreement; (ii) legal, regulatory, tax, accounting or other advice; (iii) an offer, recommendation or solicitation to buy or sell shares in any fund, security, commodity, financial instrument or derivative linked to, or otherwise included in a portfolio managed or advised by Redwheel; or (iv) an offer to enter into any other transaction whatsoever (each a Transaction). No representations and/or warranties are made that the information contained herein is either up to date and/or accurate and is not intended to be used or relied upon by any counterparty, investor or any other third party. Redwheel bears no responsibility for your investment research and/or investment decisions and you should consult your own lawyer, accountant, tax adviser or other professional adviser before entering into any Transaction.