In an effort to upgrade America’s transport systems, the US Senate has passed a $1trn infrastructure bill.

“After years and years of ‘infrastructure week’, we are on the cusp of an infrastructure decade that I truly believe will transform America,” Biden remarked at the White House following the vote.

Over the next five years the infrastructure bill will allocate $550bn in federal spending, improving roads, tunnels and bridges across America, in addition to the power grid, rail networks and airports.

Investments into access to broadband and clean drinking water have also been included in the bill.

The infrastructure bill will put specific companies, especially those who could receive government contracts, on high alert. This could lead to investment opportunities, although some analysts have suggested markets have priced the infrastructure bill in already.

“The passage of the infrastructure bill is a nice headline but unlikely to be a big market mover at this point,” Brian Price, head of investment management at Commonwealth Financial Network, said.

“The $1.2 trillion piece of legislation has secured the votes it needs in the Senate and that’s giving a lift to companies that stand to be winners like Nucor and Caterpiller. It’s a huge investment and a huge victory for the Biden administration but it’s not the end of the story and the bill now faces a difficult path as it negotiates its way through the House,” said Danni Hewson, AJ Bell financial analyst.

After the bill passed, the Dow Jones Industrial Average is up by 0.34% during the morning session on Wednesday, while the S&P 500 has added 0.27%.

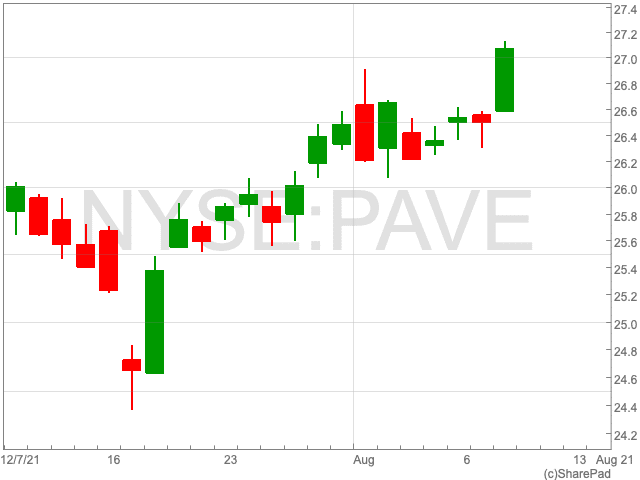

More specifically, the Global X U.S. Infrastructure Development ETF, an exchange-traded fund that offers exposure too shares that will be directly impacted by the infrastructure bill, has added 0.45%.

It has been on an upwards trajectory, as seen below, in the run-up to the passing of the infrastructure bill over the past month.

The Global X U.S. Infrastructure Development ETF has holdings in 100 companies, ranging from small to large-cap, that make at least half of their revenue from infrastructure construction, materials or a related service in America.

The top three stocks in the ETF are Nucor Corp, a steel producer, Eaton Corp, a power management company, and Trane Technologies, an industrial manufacturing firm.

However, it might not be obvious exactly which stocks will stand to benefit.

“There’s going to be a lot of spending in areas that people don’t necessarily associate with infrastructure,” said Scott Helfstein, head of Thematic Investing at ProShares.

In the meantime, investors will continue on their search for stocks that could benefit from a potential splurge in infrastructure spending.