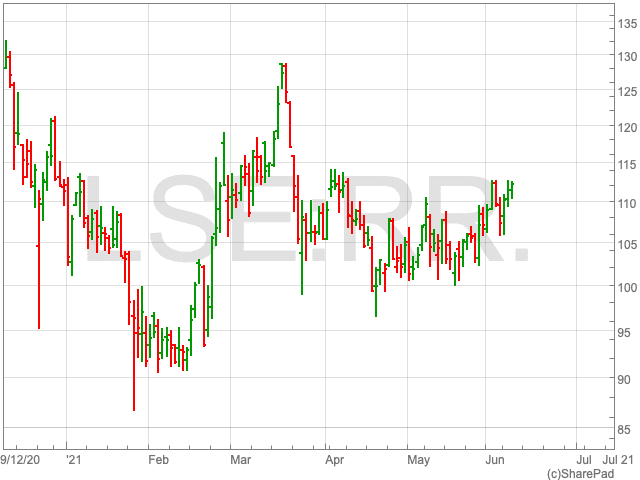

Rolls-Royce Share Price

Following a crash in the middle of March, the Rolls-Royce share price looks to have steadied and appears set for a resurgence. Despite coming down from 127.2p in March to to its current level of 112.21p, it is still up by 8.74% since the beginning of the year.

In June the Rolls-Royce share price crept above 110p, having been range bound for much of the preceding months due to uncertainty over the aviation industry. The UK public, as well as the FTSE 100 aviation company, remains hopeful that airports will be opening across the world sooner rather than later.

Aviation Industry and the G7

The ongoing suspension of flights continues to hurt Rolls-Royce, as it earns a significant portion of its revenue from servicing contracts it agrees with airlines that use its engines.

Therefore, any sign that the airline industry is picking up would be good news for the Rolls-Royce share price.

While the government appears to be working on a day-by-day basis, airline executives are continuing to apply pressure on governments to allow them to continue flying. Representatives from major airlines in the UK and US have come together to call on their respective leaders to reopen transatlantic air travel.

While both parties have been fruitlessly arguing for the air corridor for around a year, they will now argue it is more realistic as both countries have high vaccination rates.

“We are going to open up the world,” said Ed Bastian, Delta Air Lines chief executive. “It is going to happen, and this is the corridor to get started.”

Grant Shapps, UK transport secretary, contacted the BritishAmerican Business lobby group in May and stated that restarting travel between the UK and the US was “a priority”.

The G7 meeting later this week could be a turning point for the air travel industry and subsequently the Rolls-Royce share price. However, we have been here before, and investors will know better than anyone that nothing is certain.