Online crowdfunding platform Crowd2Fund have recently launched the “Revenue Loan”, a completely unique type of lending tailored for early stage or seasonal businesses.

Revenue-based funding is a model whereby businesses repay the loan as a percentage of company revenue, meaning that they are not tied to fixed monthly repayments; giving them the agility to grow quicker due to more manageable cash flow. They are ideal for start-up businesses who are not eligible for a bank loan, but do not want to part with company equity; whilst revenue loans are more expensive than bank loans, they are less expensive than equity and are much easier to obtain.

Revenue-based financing isn’t a new idea – it was very popular in the early-to-mid 1900s, especially in the American oil and gas industries – however, Crowd2Fund are the first platform to bring revenue loans to the UK.

From an investor’s point of view, revenue lending is particularly attractive because of their high returns; the normal interest rate is around 10%. With revenue-based financing, investors don’t own shares or sit on the board of the company they invest in; revenue-based financing is similar to equity in that it’s in the investor’s best interest for the business to grow quickly and successfully. Companies usually pledge 2 percent to 8 percent of their revenue until the amount repaid reaches a certain threshold, usually two to three times the amount borrowed. Loan terms are typically structured so that repayment takes two to three years, but the duration really depends on the borrower’s financial performance.

Crowd2Fund completed the UK’s first ever revenue loan for the Glen Rothay Hotel, established in 1624 and based in the Lake District.The Glen Rothay Hotel was unable to get a bank loan due to a technicality, even though they are clearly a credit worthy business. Due to the seasonal nature of the business, the revenue loan was perfect for them as it allowed them to undergo refurbishment works during low season. Six investors funded the £40k loan via Crowd2Fund with Glen Rothay expecting to repay the loan early as revenue has been higher than anticipated following the upgrade.

Beef Digital were the UK’s second ever revenue loan, which recently closed successfully after raising £50k to fund the expansion of their digital agency. Matt, the founder of the agency said: “Traditional bank funding was not able to provide us with the support that we need. As well as allowing us access to finance, Crowd2Fund have provided us with marketing and business development resources which have allowed us to raise more awareness of who Beef Digital are and what we are doing.”

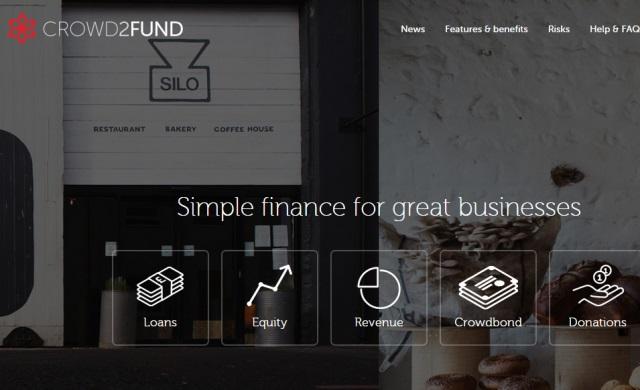

Interest in Crowd2Fund’s revenue loan seems to be high , and they have started to attract more mainstream brands who are applying for this type of flexible finance. Crowd2Fund are a platform that aim to create fast, fair and flexible finance to meet today’s demands. They are the only FCA regulated crowdfunding platform to offer 5 models of finance, across debt and equity investments.