CVS saw its share price fall 0.9% to 106.2p in early morning trading on Thursday despite the company reporting an 11.4% increase in revenue to £273.7 in its half-year results due to rising vet care membership rates and organic growth.

The veterinary firm reported an adjusted EBITDA of £52 million compared to £45.1 million in 2020.

CVS enjoyed a £36.2 million pre-tax profit against £29.7 million in 2020 as a result of 461,000 new subscribers to its ‘Healthy Pet Club’ affordable preventative healthcare scheme.

The company saw a 9.6% rise in like-for-like sales and predicted a growth of 10% in the first eight months.

The firm paid a final dividend for the year of £4.6 million, which represented a 6.5p per share payout.

CVS confirmed its trading outlook is currently positioned for future growth after increased investment in its facilities, equipment and potential acquisitions pipeline.

“I am pleased to report on another strong set of results which reflect the commitment, dedication and professionalism of our colleagues,” said CVS CEO Richard Fairman.

“Our ongoing strategy of investment in our people, in our practice and other facilities, and in our clinical equipment is generating beneficial returns through organic growth.”

“The positive trading momentum in H1 2022 has continued into the first two months of our second half, and with a strongly cash generative model we remain well placed to continue to invest and acquire to deliver future growth.”

Analysts noted CVS’ strong momentum going forward and the company’s strategy for organic growth in 2022.

“While acquisitions are an important part of the story, with huge scope for further consolidation of the UK’s vet market, a focus on organics is very pleasing,” said Sophie Lund-Yates, Equity Analyst, Hargreaves Lansdown.

“The potential for growth in Europe is another window of opportunity, feeding into the long-term attractions of the business.”

“The UK pet boom seen during the pandemic should act as a long-term growth driver too.”

“As the puppies and kittens welcomed in lockdown age, they will require more trips to the vets.”

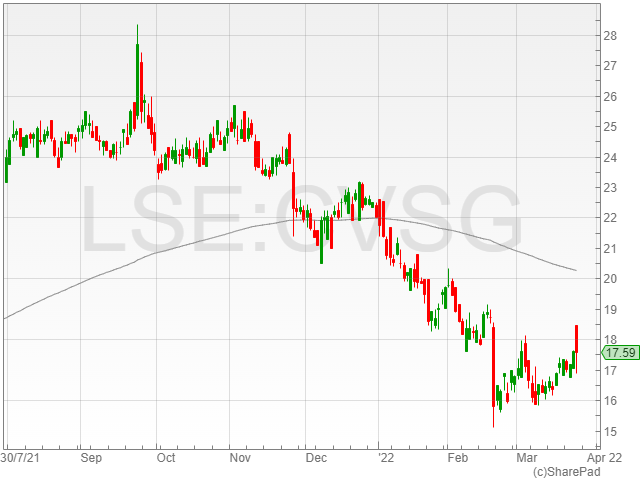

“This bolstered source of income isn’t fully reflected in the group’s valuation, which has come down some way from previous highs.”