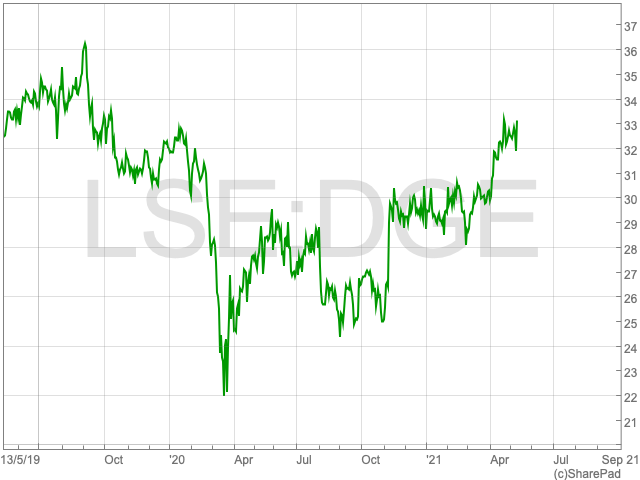

Diageo Share Price

The Diageo share price (LON:DGE) jumped during the morning session on Wednesday, up by 3.8% at the time of writing, as the drinks company made a pledge to buy back shares or provide a special dividend. The company’s share price reached 3,317p per share, now less than 10% below its all-time-high of 3,640p, as it looks to be closing in on the marker last reached in September 2019.

Diageo Pledge to Shareholders

Shareholders in Diageo are set for billions worth of share buybacks or special dividends. The news came on Wednesday as the company said it had made a strong recovery from the coronavirus-induced downturn, allowing the company to return cash to its investors.

Going back to April, Menezes, chief executive of Diageo, paused the return of capital (ROC) scheme last April. The FTSE 100 drinks giant had returned £1.25bn to investors out of the £4.5bn scheduled to be returned over the longer-term.

As the company as seen growth in its profits that has exceeded expectations, it made the announcement, which came as a surprise to many.

AJ Bell investment director, Russ Mould, commented on what the news could mean for shareholders looking ahead:

“Like several businesses, Diageo hoarded cash during the pandemic to help get it through, now profit is expected to bounce back quicker than expected it can afford to be more generous,” Mould said.

“With its on-trade sales in bars, clubs and restaurants virtually disappearing for large parts of 2020 and the beginning of 2021 the company did a good realignment job – focusing its marketing on the off-trade as people enjoyed their Guinness or Johnnie Walker at home instead.”

Now things are reopening Diageo is likely to see hospitality-linked sales recover with the only area still severely impacted being sales in airports and other travel hubs.

“The company’s main focus is on the manufacture of spirits and this industry has some winning attributes for a market leader like Diageo as consumption is increasing in both developed and emerging markets, the relative costs of making it are low and yet brand power allows it to be sold at a premium price,” Mould added.