As reported by the BBC and many other major outlets, UK retail sales increased for the fifth consecutive month in September, with sales volumes rising by 1.5% mon-on-month, according to the ONS.

While fuel sales remained down, the growth was led by higher-than-average consumer spend on groceries, DIY goods and garden supplies.

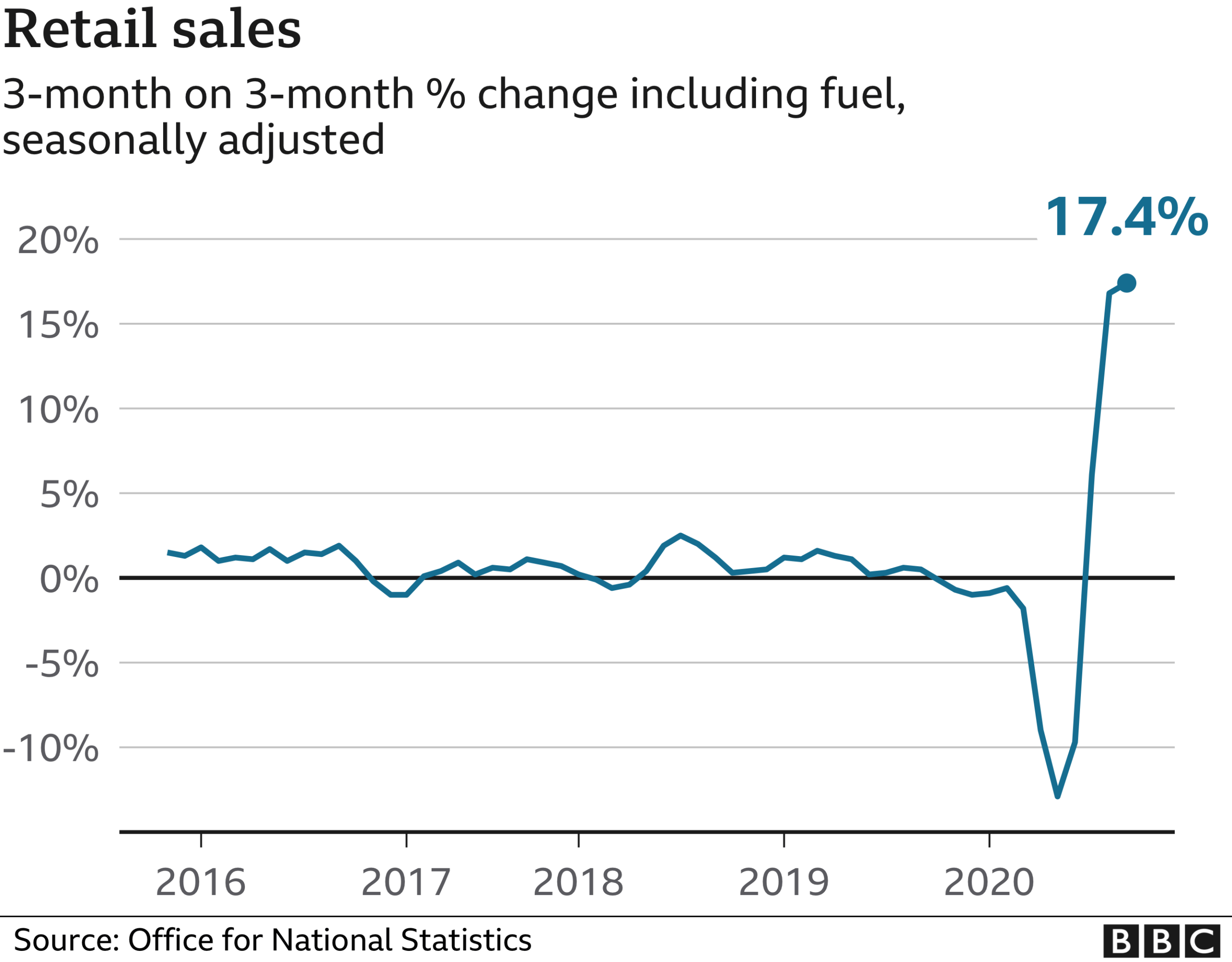

According to the latest statistics, retail sales are now 5.5% higher than pre-pandemic levels in February, with the three months to September illustrating the biggest jump, up 17.4% versus the previous quarter.

The problem with this positive way of thinking is that retail sales aren’t actually experiencing exponential growth, Instead, September’s growth was lower than the previous month, there appear to be challenges ahead, and the growth is not being experienced by retailers across the board.

Indeed, new lockdown restrictions will have the double-edged-sword effect. The first half of this will be a reduction in customers and potential closure of some shops. As stated by Kingswood CIO, Rupert Thompson:

“Retail sales posted an unexpectedly strong gain in September, rising 1.5% m/m to be up 4.7% from a year earlier. However, this is only encouraging up to a point as this strength was prior to the introduction of the new lockdown/social distancing measures. Business confidence fell back in October with the decline led by the services sector, the area the most vulnerable to the latest restrictions. This fall highlights the need for the new package of support measures announced by the Chancellor yesterday.”

The second consideration will be a change in consumer behaviour, with customers focusing on outlets perceived to be selling essential and cut-price goods, as will as outlets offering online retail opportunities. As said by Mark Lynch, Partner at Oghma Partners:

“While these figures highlight British stoicism in supporting a fragile economy, it is important to note that these retail sales figures might be slightly misleading in terms of giving an impression of the strength of the consumer economy as a whole. UK shoppers have been buying more food and drink at supermarkets because they have been spending less on eating out. The Government’s lockdown restrictions have re-emphasised earlier trends that we saw around Spring which showed positive sales growth for direct to consumer and supermarket companies. We have already seen a significant shift in consumer behaviour which has boosted growth for those companies in Q2 and to a lesser extent in Q3 but which now look to boost growth again in Q4.”

“We are sadly seeing more and more long term problems for Food to Go and food service providers that are unable to service clients as per normal. The fact is that more end user businesses will go bust, including pubs, restaurants and the more food service manufacturing capacity and, to a lesser extent, Food to Go capacity we will see taken out of the market.”