A trending sector that looks like its here to stay. Despite many people’s reluctance to give up their traditional preferences, European sales of plant-based meat and dairy alternatives have grown by around 10% per year over the course of the last decade.

According to ING (AMS:INGA) Food and Agri Senior Economist, Thijs Geijer, this change is being led by a combination of tastier and more-cost effective plant-based alternatives entering the market, alongside the growth of consumer trends such as health, animal welfare and sustainability.

Despite the rise of these considerations in shoppers’ decision-making, plant-based substitutes still represent a small base, with alternatives making up just 0.7% of the market for meat and 2.5% of the dairy market.

The bulk of the demand for these new products differs greatly from region-to-region, and the UK stands as Europe’s most-developed market, with sales of almost €1 billion, while France and Germany follow close behind. Consumption per head, though, is highest in Scandinavian countries and the Benelux (the Netherlands, Belgium and Luxembourg).

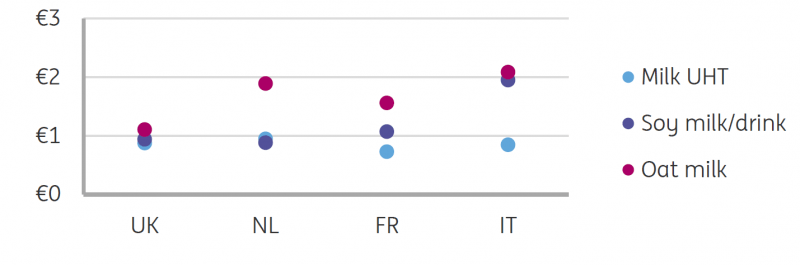

To see the plant-based market grow, Geijer identifies three challenges that its products will have to overcome: cost, user experience and availability. Not only do plant-based alternatives remain comparatively expensive – likely due to their trending status – but they often have less desirable tastes and textures than their meat and dairy counterparts, and few outlets offer an expansive range of different brands and products.

With the plant-based market being more mature in the UK, prices have already begun to lower, and there is a greater scope of choices, creating a ‘highly competitive’ retail environment. This differs greatly from markets such as Italy, where these alternatives are still marketed at consumers willing to pay above the odds to access plant-based goods.

Despite these challenges, the prevalence of sustainable themes, and the level of investment and innovation that these trends are inviting, mean that the barriers to plant-based alternatives are likely to subside ‘substantially’ over the next five years.

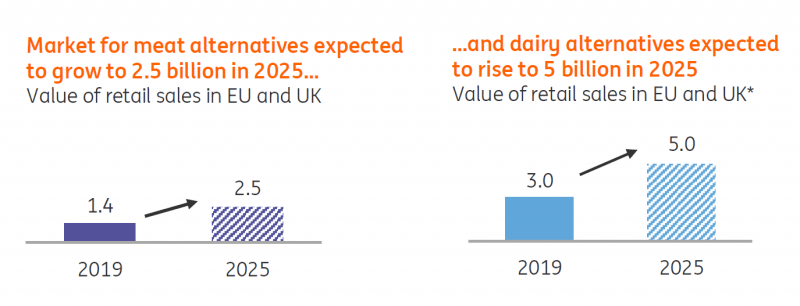

Because of this, ING estimates that the meat and dairy alternatives market will be able to maintain its 10% annual growth rate towards 2025. With this being the case, retail sales of meat alternatives could increase to €2.5 billion, while sales of dairy alternatives grow to €5 billion in 2025. In other words, the market share for meat substitutes will almost double, to 1.3%, while dairy alternatives’ share will rise to 4.1%.

Speaking on the growth of the plant-based alternatives sector, and the work that still needs to be done, Tribe Impact Capital CIO, Amy Clarke, comments:

“Shifting consumer preferences combined with the increasing awareness of the role of a more plant-rich diet in tackling some of the key ecological and health consequences of our current global food system has led to the rise of plant-based alternatives, both as stand-alone businesses as well as existing businesses pivoting into this space. At Tribe, we have found a clear expansion in the number of opportunities to support this transition as an investor over the last couple of years.”

“Plant-based meat and dairy is now disrupting the food production industry in many of the same ways that renewables disrupted the energy market over the last 30 years. The annual growth rate European retail sales of meat and dairy alternatives of 10% between 2010 and 2020 though does compare favourably to the 3.3% growth in renewables in a similar period1, showing the size of the potential opportunity for investors in new food developments.”

“As this shift continues, we also have to commit to managing and reducing the impacts that such a wholesale change in agriculture can create – for example, the issues with soy production leading to deforestation is documented. Investors must be aware of the impact and sustainability issues associated with plant-based food too, if they are to identify those companies who are managing themselves for this transition sustainably. Those companies who have adopted frameworks that help them navigate the complex issues embedded in agriculture, for example the Natural Capital Protocol or the Regenerative Organic certification scheme, are better placed to manage the sustainability issues associated with this transition.”