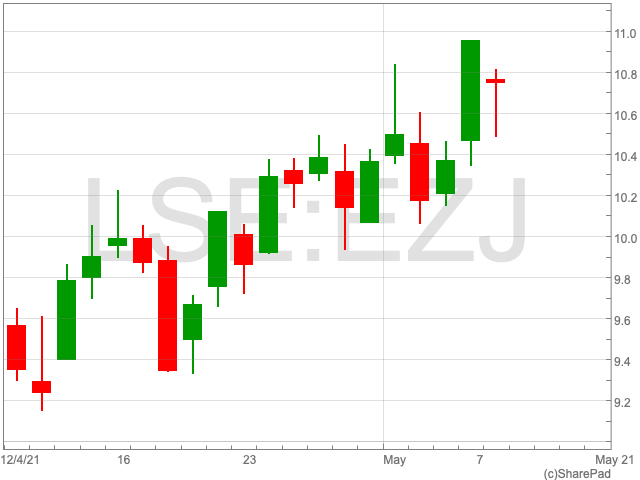

EasyJet Share Price

The EasyJet share price had added 10.7% over the past month, now at 1,068p, as destinations across Europe are set to become accessible on May 17. While it has not recovered to its pre-pandemic high of 1,508p, its current level is the highest it has been since lockdowns first came into affect across the UK. However, today, after news came that 12 countries made the “green list”, the EasyJet share price is down by 2.5%, suggesting that investors would like further good news before they can get behind the airline.

Britain to allow foreign travel

Britain has allowed the resumption of international travel from May 17, after a ban which lasted for months. However, a majority of major destinations were left off the list. Much to the dismay of airlines, France, Italy, Spain and the US, failed to make the much anticipated list of destinations.

“Today marks the first step in our cautious return to international travel, with measures designed above all else to protect public health and ensure we don’t throw away the hard-fought gains we’ve all strived to earn this year,” transport minister Grant Shapps said.

It seems as though Brits will have to wait a while longer before they are able to travel to some of their preferred destinations as the list will be reviewed every few weeks.

“This excess of caution from the government is extremely disappointing for everyone who works in the travel sector,” Brian Strutton of the British Airline Pilots Association told Reuters. With the added uncertainty over when passengers will be able to travel to some of Europe’s major destinations, EasyJet’s recent bull-run could come under threat. However, the UK government’s cautious approach could also suggest the likelihood of positive news coming soon being high.

In April, Credit Suisse gave a price estimate for the EasyJet share price of 1,200p, which looks attainable following the company’s recent upward move.