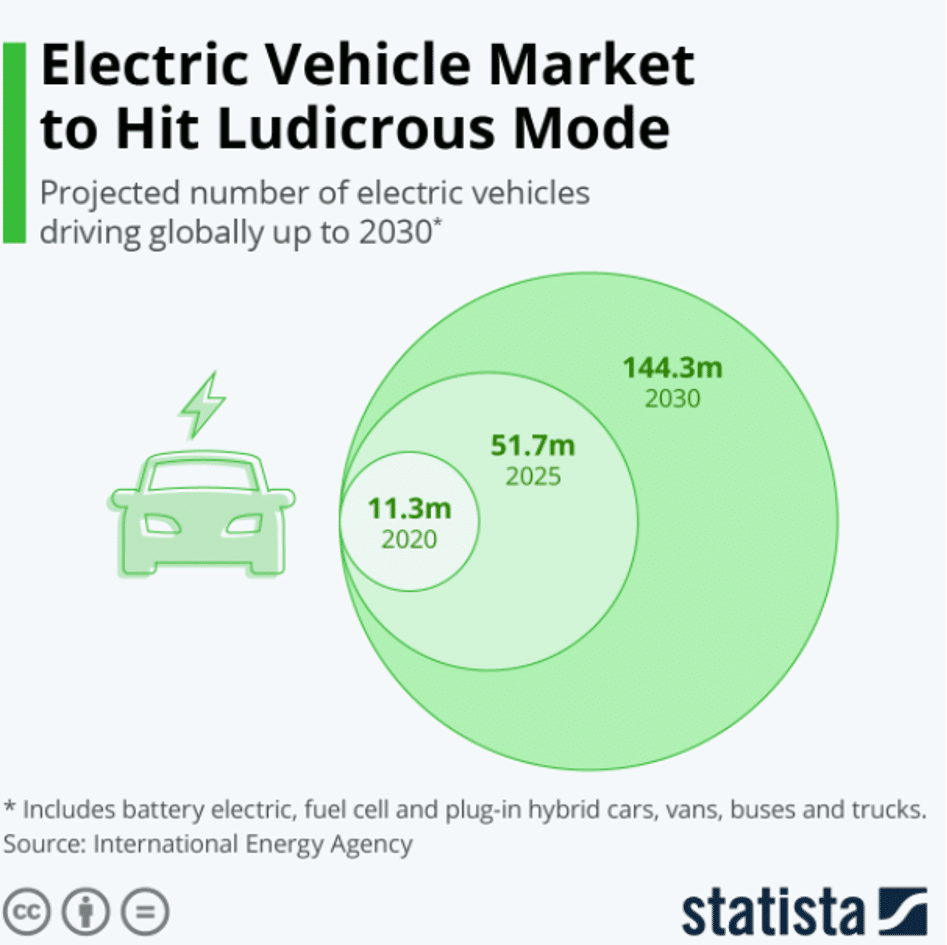

The projected number of electric vehicles on the road is of 51.7 million by 2025 and 144.3 million by 2030. The question is, who will manage to grab a decent portion of the market? What will become of Tesla? And what are real threats to the electric vehicle market?

Short overview of electric cars:

Electric vehicles are automobiles that use energy stored in rechargeable batteries for movement as opposed to traditional gasoline. Electric vehicles can have a battery range of about 350 miles or 550 km. Most electric vehicles use lithium-ion batteries. The benefits of electric cars over combustion engines in addition to being emission free are that they are quieter, have lower recharge costs, faster acceleration and are safer if accidents occur as their lower center of gravity increases driving stability.

The main challenges yet to overcome are the comparatively high price of the vehicles, long recharge time and limited reach, fire concerns around the battery in accidents, and a so far limited variety of electric vehicles.

What Are the Environmental Reasons Against Electric Cars?

- Environmental unfriendly battery production

Battery production for electric cars involves standard practices that aren’t environmentally stable. Electric vehicles are typically heavier and produce more road, brake, and tire dust. But the effects of this can be countered by regenerative braking. Electric vehicles often require rare-earth elements like neodymium, dysprosium, and others. They also use up lithium and cobalt. Like the factory production of other items, factory production of electric vehicles leads to the emission of some greenhouse gases and some air pollution.

Some studies have shown that the factory production of electric vehicles is often more severe on the environment than the factory production of conventional vehicles.

There have been issues about improper disposal or recycling of old batteries.

More than half of the cobalt used in electric vehicles comes from the Democratic Republic of Congo. Most of this cobalt is mined by the hands of children and adults. A lot of unpaid child labor is involved under hazardous conditions.

Minerals like lithium, cobalt, and manganese used in electric vehicles are now being mined from the sea. This is increasingly affecting biodiversity and causing harm to marine life.

Politically, though, there seems to only be one possible scenario for non combustion cars: They will be the only vehicle allowed in Western countries, with London for example expanding their ultra low emission zone this October, making it unaffordable to drive with older combustion style cars, and Britain pledging to be combustion free by 2035. The European Union is aiming to have 30 million electric cars on the road by 2030. This will cut CO2 emissions by 45%.

The rise in the share price of Tesla might have been the most talked about phenomenon in 2020 – yet there has been one sleeping giant that has been posed to take over.

Can hydrogen kill the electricity surge?

Hydrogen has been described as the future for the car industry and SPACS involving Hydrogen projects are in high demand.

The hydrogen fuel cell electric vehicle (FCEV), which simply runs on pressurised hydrogen from a fuelling station, produces zero carbon emissions from its exhaust.

Hydrogen vehicles are automobiles that use hydrogen fuel for power instead of petrol (gasoline) or diesel-like regular vehicles. Hydrogen vehicles convert the chemical energy of hydrogen to mechanical energy. They do this by either combining hydrogen with oxygen in a fuel cell or by burning hydrogen in an internal combustion engine.

The need to find applicable use cases for fuel cells and the possibility of obtaining cheap hydrogen from water are some of the factors driving research into hydrogen cars.

Toyota, BMW, and Daimler are investing about $10 billion into research on hydrogen vehicles and infrastructure. The USA and other countries are sponsoring research grants and investments into hydrogen cars.

Investors are investing in Bloom Energy, FuelCell Energy, and Ballard Power Systems. The stocks of these companies have been increasing as they continue to make exploits on hydrogen fuel technology.

Is hydrogen really a viable threat to electric cars?

The main perceived benefit is the zero carbon emission. However, the steam methane reformation method of producing hydrogen emits as much carbon per mile as regular gasoline cars. About 98% of commercially produced hydrogen uses the steam methane reformation process that emits harmful carbon dioxide.

Studies in 2009 and 2014 revealed that hydrogen cars would emit more carbon than petrol cars over the course of their lifetime.

Over 97% of hydrogen is produced by reforming steam methane or natural gas. This emits harmful carbon dioxide fumes that contribute to global warming and the depletion of the ozone layer.

Research is being conducted to produce hydrogen using renewable energy sources.

The remaining flaw, however, is that converting the energy to and from hydrogen batteries is inefficient. Adding up the conversion processes leads to only 38% of the original energy being used.

A report by BloombergNEF concluded:

Volkswagen ,meanwhile, made a statement comparing the energy efficiency of the technologies. “The conclusion is clear” said the company. “In the case of the passenger car, everything speaks in favour of the battery and practically nothing speaks in favour of hydrogen.”

Hydrogen vehicles will require new hydrogen filling stations, which cost $1-2 millionto establish.

There are currently only 48 public hydrogen filling stations in the US, with most of them located in California. In contrast, the number of available electric charging stations and charging outlets is over 40,000 and 99,000 respectively.

There are additional costs for transporting the hydrogen if the hydrogen is not produced onsite.

Hydrogen has high combustion energy with low ignition energy. Also, hydrogen tends to leak easily from tanks. You can’t store hydrogen at home to fill up your car due to the stringent requirements and the high combustion energy of hydrogen. There are strict codes and technical standards that must be observed in the production and storage of hydrogen. This makes it a tough industry to enter. Hydrogen fuel cells require expensive and rare catalysts like platinum to work.

Which Companies/Organizations/Governments Are Investing in Electric Cars?

In 2020, General Motors announced that it would spend more on the development of electric cars than it spends on diesel and petrol vehicles. The company aims to have 40% of its new cars in the United States as electric vehicles by 2025.

Mercedes has invested $23 billion in battery cells. BMW recently invested €10 billion on battery cells. Hyundai plansto have 23 electric vehicles by 2025.

Audi plans to offer only electric vehicles by 2035. Apple is also reportedly working on an electric vehicle.

What are the opportunities that can outpace Tesla this year?

Tesla’s combined market cap is larger than that of the biggest automakers combined, and while its technology and innovation is superior right now, there are viable options to consider that could outperform Tesla this year.

Formidable Asset Management LLC is betting on Workhouse Group Inc, which is an electric vehicle maker.

Hedge funds are also betting on Nio, the Chinese electric vehicle maker.

The narrative around electric vehicles is clear, questions is, how can we increase our chances of picking the right horse? Technical analysis shows us the following:

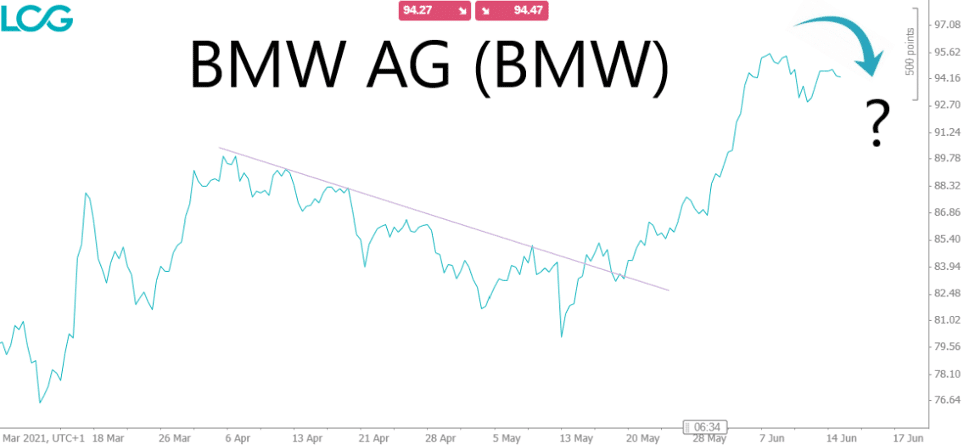

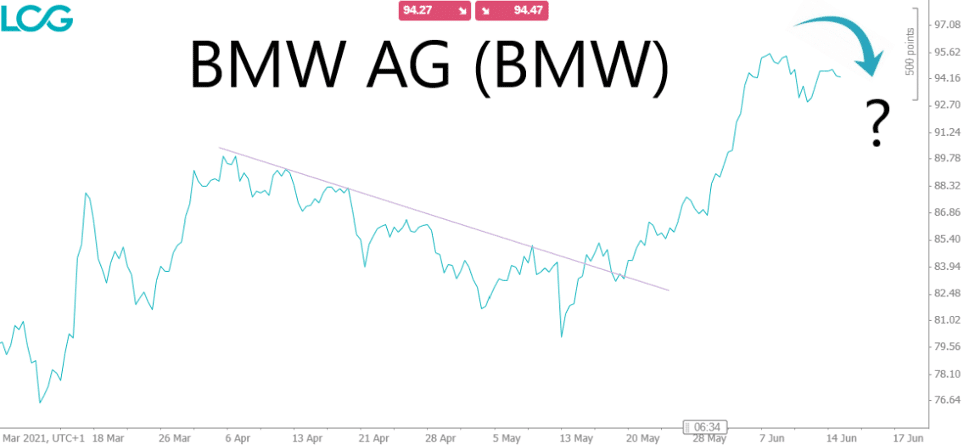

A rotation to traditional car makers has occurred over the past months, yet the rally has slowed and as we can see for German carmaker BMW, the price has dropped below the early June high. Can this be an opportunity for other pure electric vehicle makers to swoop up market share?

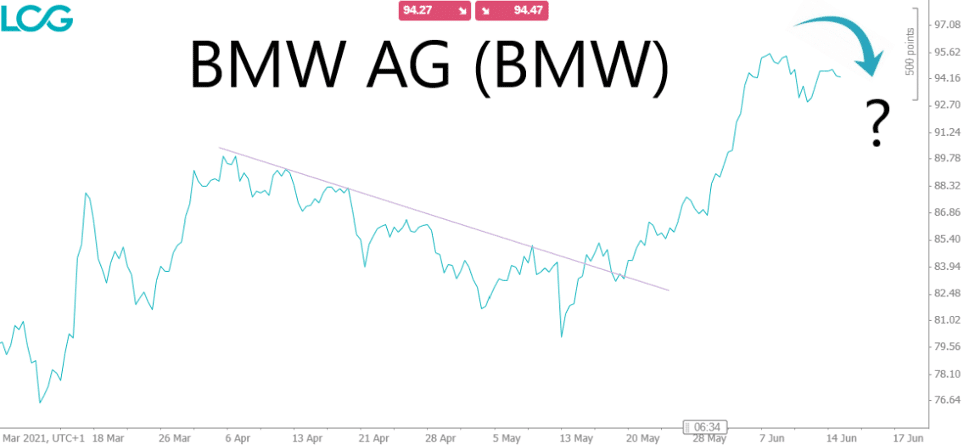

In the six month NIO Inc chart you can see a clear bullish trend emerging as of May and June, possibly breaking the down trend that’s been in place throughout 2021. Closing over 46.9 could mean a progression to 54.3, and failing to meet this level could lead to a correction towards the exponential moving average around 45.21.

Open an LCG Trading account and get access to charting tools, and stay up to date with analysis, including LCG’s guide to the industries around electric vehicles that have even greater potential than EV shares themselves.

Spread betting and CFD trading carry a high level of risk to your capital and can result in loss of your deposits. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Please note that 78% of our retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing money.

The information provided within this communication has been prepared by London Capital Group Limited (LCG) and is intended for informative purposes only. It is not intended for investment, or commercial advice or an offer or solicitation for the purchase or sale of any financial instrument. Any opinions, news, research, analysis, prices, other information or links to third-party contained within this communication is provided as general market commentary and does not constitute investment advice and is not intended for any form of commercial use. LCG shall not accept liability for any loss, damager including, but without limitation, to any loss or profit which may arise directly or indirectly from use of or reliance on such information.

The information in this article is not directed at residents of EU as well as Australia, Belgium, Canada, New Zealand, Singapore or the United States, and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

London Capital Group (LCG) is a company registered in England and Wales under registered number: 3218125. LCG is authorised and regulated by the Financial Conduct Authority (FCA) under the firm reference number of: 182110. The registered address for LCG is: 80 Cheapside, London EC2V 6EE.