Elon Musk has secured $46.5bn in financing for a potential hostile takeover of Twitter, with Musk contributing $21bn of his funds as part of the deal.

Elon Musk has managed to obtain $46.5bn to fund the potential hostile takeover of Twitter.

Elon Musk is also obtaining an additional $12.5bn for the offer through a margin loan secured against his shares in Tesla, the electric carmaker he leads as CEO.

Morgan Stanley, a major investment bank in the United States, is spearheading a group of financial institutions that will provide $13bn in debt financing.

The agreements were detailed in a filing with the US SEC on Thursday. The agreement stated that the world’s wealthiest man was “exploring whether to commence a tender offer” for the Twitter shares he did not own.

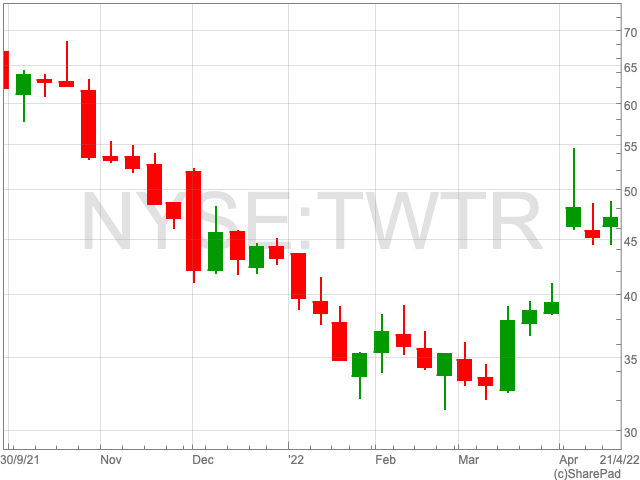

Elon Musk already owns 9.2 % of Twitter and just announced a $54.20-per-share offer last week.

A tender offer is considered a hostile bid since it avoids the company’s board of directors, which would normally suggest an offer to shareholders in a traditional takeover situation.

Instead, Twitter’s board members have taken steps to prevent Elon Musk from expanding his stake in the company without its approval.

Last week, Twitter filed a so-called poison pill defence against Elon Musk’s bid, aiming at preventing him from owning more than 15% of the company.

If anyone tries to buy more than 15% of Twitter without the board’s approval, the method, which is often used by company boards as a barrier against unwanted approaches, will allow existing investors to buy shares at a steep discount. This would diminish an undesired bidder’s equity and would be a severe roadblock to any non-board-approved bid.

Shareholders who support Elon Musk’s strategy, on the other hand, may force the board to abandon the poison pill strategy.

Elon Musk, who has over 82m Twitter followers and is a frequent user of the network, where he hinted during the weekend that a compassionate approach was being considered.

🎶 Love Me Tender 🎶

— Elon Musk (@elonmusk) April 16, 2022

Apart from publicising the poison pill action, Twitter has yet to respond formally to Musk’s $43bn deal.

Twitter said on Thursday, “We are in receipt of the updated, non-binding proposal from Elon Musk, which provides additional information regarding the original proposal and new information on potential financing.”

“As previously announced and communicated to Mr Musk directly, the board is committed to conducting a careful, comprehensive and deliberate review to determine the course of action that it believes is in the best interest of the company and all Twitter stockholders.”

Elon Musk has stated that the microblogging service does not give users complete freedom. In a letter to the board last week, he said Twitter was “the platform for free speech around the world,” but that it couldn’t meet this “societal imperative” in its current form and “needs to be transformed as a private company.”

Elon Musk had hinted at some changes he would make to the firm before announcing his takeover offer, including the addition of an edit button for tweets.

And authenticate all real humans

— Elon Musk (@elonmusk) April 21, 2022

As Tesla met share price and financial growth milestones in its earnings on Wednesday night, Musk, who is already worth an estimated $249 billion, is in line for the bonus share payout.

Musk has set aside less money for a potential Twitter takeover than the $23bn bonus he is expecting to get from Tesla after it reported its growing quarterly profits.

Twitter shares have gained 0.7% to $47.04 on Friday morning and Tesla shares rose 3.2% to $1008.78.