The region could be a major beneficiary of the pickup in global economic growth

Emerging market share prices have lagged behind their developed market counterparts since the pandemic inspired sell-off in March 2020 and could offer a buying opportunity. Some of these countries are currently being held back by the delta variant, but the longer term picture is more favourable with the expansion of the working age labour force and expanding middle class boosting their growth prospects, although China remains a key influence.

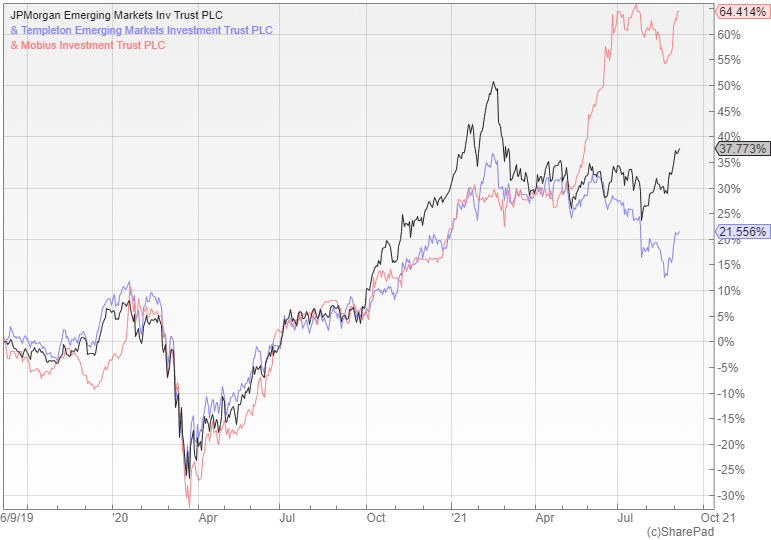

For those who want exposure to the sector the broker Winterflood recommends the £1.6bn JPMorgan Emerging Markets (LON: JMG) and the £2.2bn Templeton Emerging Markets (LON: TEM).

JMG provides a core exposure to global emerging market equities and is managed by the highly experienced Austin Forey who can draw on the extensive resources of JPMorgan in the region. Forey invests in high quality growth companies that Winterflood believe will allow it to outperform over the long run and has built up an excellent track record during his 27 year tenure.

Templeton is seen by many as the flagship trust in the sector due to its history, size and profile that allows it to attract both institutional and retail investors. It has a long-term, value-oriented approach based on bottom up stock picking, which makes it a good complimentary holding to the JPMorgan trust.

Those who are comfortable with a higher level of risk might want to consider the £152m Mobius Investment Trust (LON: MMIT) that holds a concentrated portfolio of 28 small and mid-cap stocks from across the region. It has done exceptionally well over the last 18 months due to strong stock selection and the managers are well motivated to succeed given that they hold around 15% of the shares.