Endeavour Mining announced the upcoming construction of its Sabodala-Massawa expansion based in Senegal for $290 million in upfront capital, following supporting results from a recent Definitive-Feasibility Study (DFS).

Endeavour Mining reported that its DFS recommended the expansion of the mine by supplementing its present 4.2 million tonnes per annum (mtpa) Carbon-in-leach (CIL) plant with a 1.2mtpa BIOX plant in order to process high-grade refractory ores sourced from the company’s Massawa Central Zone and Massawa North Zone deposits.

The group estimated that the first gold production could be expected by early 2024.

The mining firm said that the Expansion Project is projected to yield an incremental production of 1.35 million ounces (Moz) of gold at a low all-in sustaining cost (AISC) of $576/oz throughput the life of mine.

The company also said the extension boasts robust economics, and will provide an after-tax IRR of 72% and a fast 1.4-year payback period based on a gold price of $1,700/oz.

The news follows Endeavour Mining’s sale of its 90% stake in its non-core Karma mine in Burkina Faso to Nere Mining for a $25 million total consideration.

“We are extremely pleased with both the current performance of Sabodala-Massawa and the Definitive Feasibility Study results announced today, as they demonstrate the asset’s potential to be a top tier mine capable of producing in excess of 400,000 ounces per year at an industry-leading AISC,” said Endeavour Mining CEO Sébastien de Montessus.

“Given the robust project economics, which significantly exceed our investment criteria, and the strong exploration upside potential, we are excited to launch this low-capex intensive brownfield expansion project as it will continue to improve the quality of our operating portfolio and contribute to driving the Group’s return on capital employed above our 20% target.”

“In line with our capital allocation framework, we are very pleased to be able to pursue this organic growth opportunity while maintaining a healthy balance sheet and the financial flexibility to continue to deliver strong capital returns to shareholders.”

“We believe we are well positioned to unlock the full value of the Sabodala-Massawa complex as we have significantly de-risked the project by integrating key changes into the DFS, based on experience gained from operating the asset and the results of further technical analysis, and we have highly experienced operating and construction teams already in place.”

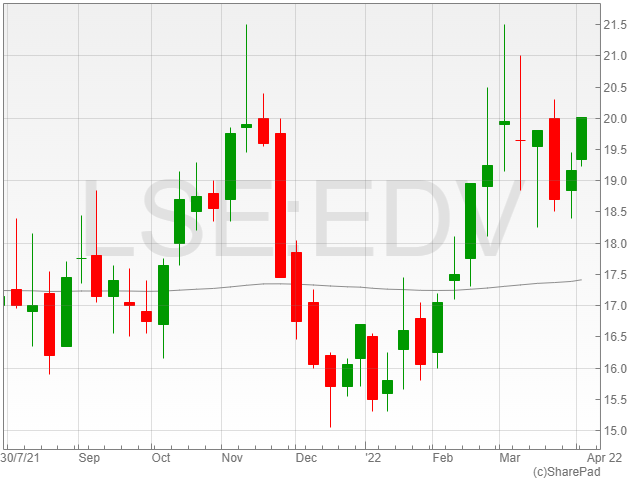

Endeavor Mining shares were up 4.5% to 2,004p in late morning trading on Monday following the news.