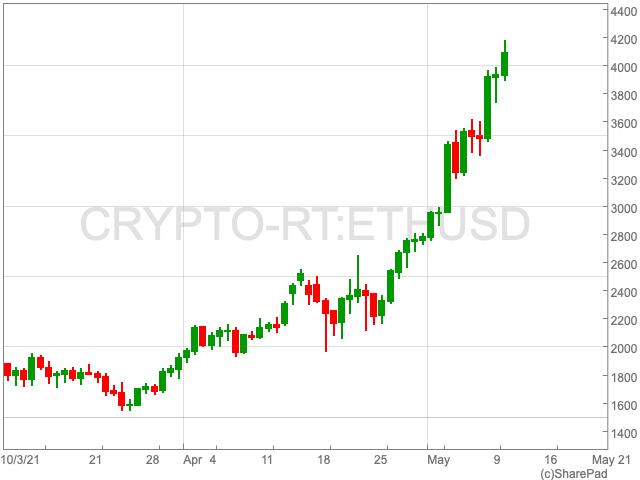

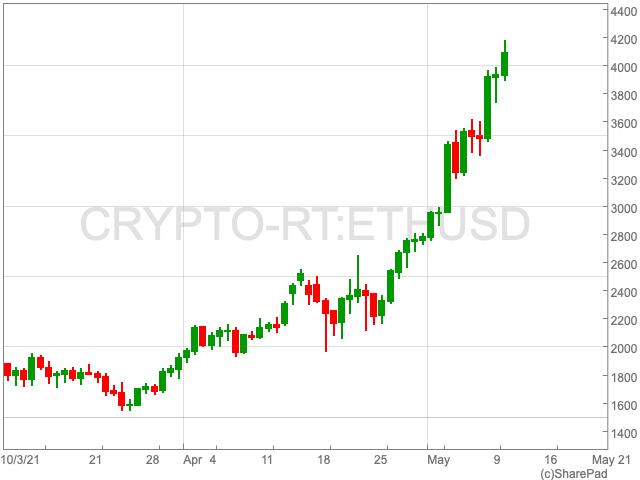

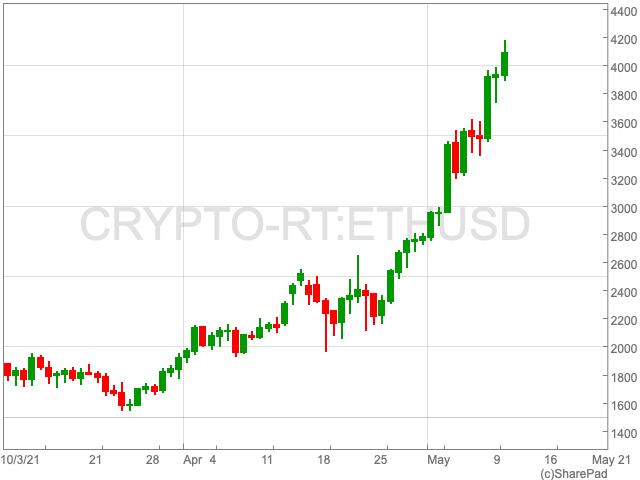

Ethereum market cap nears 50% of bitcoin’s

Ethereum soared past the $4,000 mark on Monday, reaching an all-time-high in a continuation of a massive recent bull-run.

Over the past month, Ether, the digital token of the Ethereum blockchain, is up by over 90%, bringing its market cap to $476.3bn, while bitcoin’s stands at $1.1trn.

“(Crypto has) got a lot more institutional involvement than people who haven’t followed the market believe,” Chris Weston, head of research at brokerage Pepperston, told Reuters.

“And everyone’s been in ethereum. It’s not a meme joke coin, it actually has some application use,” he added.

The recent surge in Ethereum, comes as bitcoin has move sideways, and is raising questions over its ability to usurp bitcoin as the most popular cryptocurrency.

According to a recent survey, 68% of people would be most likely to invest in the second largest cryptocurrency, behind bitcoin.

The survey also said that 18% of people would opt to invest in bitcoin, while 14% remain undecided. In addition, there are other indicators that Ethereum is becoming the most popular cryptocurrency in the eyes of investors.

Dogecoin

In other crypto news, the value of Dogecoin bounced back after Elon Musk suggested that SpaceX will accept payments in the cryptocurrency.

Laith Khalaf, financial analyst at AJ Bell, called into question Dogecoin’s underlying value after it plummeted during Musk’s appearance on Saturday Night Live.

“The SpaceX Dogecoin moon mission isn’t a giant leap for cryptocurrencies, because back here on planet Earth, crypto’s long term adoption by consumers, businesses and investors remains highly uncertain, to say the least. If an asset can drop 30% on the back of one individual’s appearance on Saturday Night Live, this tells you there’s not a huge amount of fundamental value holding up its price,” said Khalaf.

“While SpaceX might accept Dogecoin as payment, those Dogecoins will have been bought by people earning money in dollars, euros and pounds, and then converting it. Until cryptocurrencies are used for things as mundane as paying your mortgage or your phone bill, or indeed receiving your wages, as a medium of exchange they simply add an extra layer to transactions, and most don’t actually perform a useful function in the real economy.”