The announcement comes after the ECB raised its inflation target to 2%

The European Central Bank (ECB) committed to maintaining its low interest rates on Thursday, in addition to buying bonds, in an effort to move the eurozone economy away from slow-moving inflation.

Lagarde said in here press conference that the ECB will persist with negative interest rates until inflation reaches 2% well ahead of the end of its projection horizon and for the rest of the projection horizon.

“We did so to underline our commitment to maintain a persistently accommodative monetary policy stance to meet our inflation target,” ECB President Christine Lagarde added.

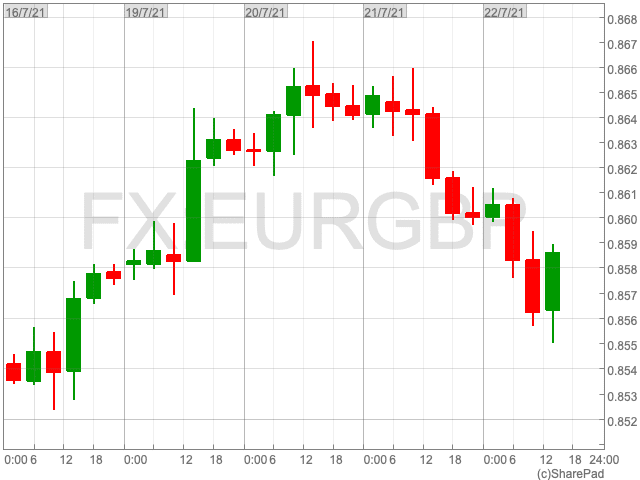

The Euro is down by 0.2% against the pound on the back of the announcement to £0.858525. While, after initially weakening, the Euro strengthened against the dollar by 0.19% to $1.18177.

The announcement comes shortly after the ECB set forward its updated strategy to raise its inflation target to 2%, where the central bank said it would be comfortable with inflation exceeding the target on a temporary basis.

Over the past ten years, inflation has fallen short of the ECB’s target, and this has been excacerbated by the

Commenting on the EUR/USD reaction to the latest ECB policy decision statement, Ben Carter, Analyst, Global Capital Markets at Validus Risk Management, said: “Much like the Fed, the ECB will be letting inflation run hot and are looking for prints of 2% “durably” for the rest of the projection horizon before considering any change in rates. Meanwhile, as expected, there were no changes in the PEPP program and this is looking like it will be a decision for later in the year, possibly the start of 2022, shifting the attention to the September meeting. With lots of talk around the Fed beginning to taper their purchases before year end, the EUR may struggle to gain any ground against the USD over the next few months as Lagarde comments that inflation has picked up but remains subdued.”

“Leading up to the decision, volatility in the EUR was subdued and EUR/USD traded below 1.18. Looking ahead, Lagarde’s dovish comments around inflation decreasing next year, due to significant slack in the economy, does not bode well for the EUR, while any rate hike certainly seems a long way off.”