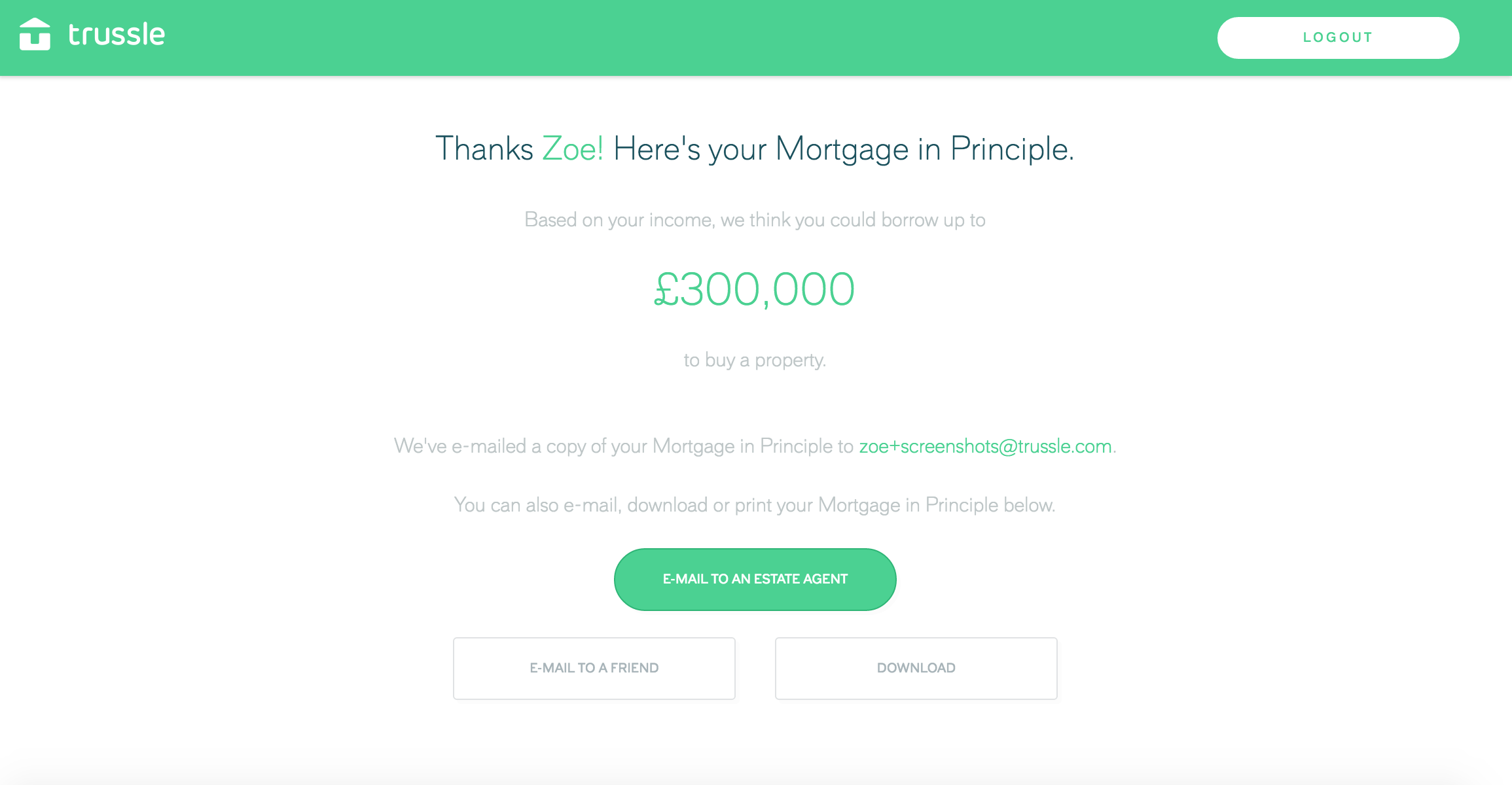

Finding the right mortgage provider can be a time-consuming and often fruitless search; conflicting advice, confusing options and a lack of clear knowledge makes finding a mortgage a difficult task. However Trussle, the new online mortgage service backed by Zoopla, is looking to mix up the market with its easy-to-use, hassle-free site.

Trussle makes it easier for first time buyers trying to secure the right mortgage, as well as helping homeowners looking to save money on their existing mortgage by offering a quick and easy tool to compare over 11,000 deals. After a mortgage has been secured through the site, Trussle then continues to monitor the mortgage and help you switch to a better deal later on – so you’re never paying more than you should.

Trussle was founded in August 2015 by Ishaan Malhi, who had experienced first-hand the difficulties of negotiating the mortgage market. Even with his background in finance – Malhi was previously a mortgages and real estate analyst at Bank Of America Merrill Lynch – the choice and advice was overwhelming and, ultimately, frustrating. With Trussle, the weight is lifted. Malhi said, “through technology, design and our expertise, we’re making a traditionally cumbersome process smarter, faster and more transparent than anything else, without charging you a penny.”

Despite launching only 8 months ago, Trussle has really gained some traction. It raised £1.1 million in a funding round in January 2016, led by Robin and Saul Klein’s LocalGlobe, with others taking part including notable UK-based investors Ed Wray (co-founder of Betfair) and Ian Hogarth (co-founder and chairman of Songkick). Just one month later, in February 2016, high-profile housing site Zoopla announced a strategic long-term partnership and investment in Trussle.

Despite launching only 8 months ago, Trussle has really gained some traction. It raised £1.1 million in a funding round in January 2016, led by Robin and Saul Klein’s LocalGlobe, with others taking part including notable UK-based investors Ed Wray (co-founder of Betfair) and Ian Hogarth (co-founder and chairman of Songkick). Just one month later, in February 2016, high-profile housing site Zoopla announced a strategic long-term partnership and investment in Trussle.

For more information on Trussle and the services it offers, visit trussle.com

Miranda Wadham on 08/08/2016