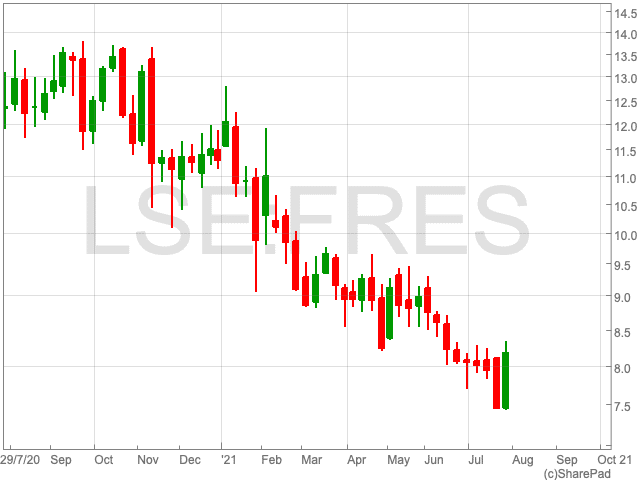

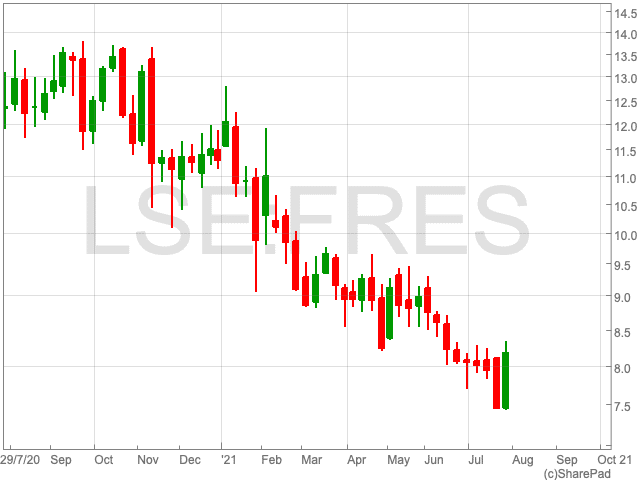

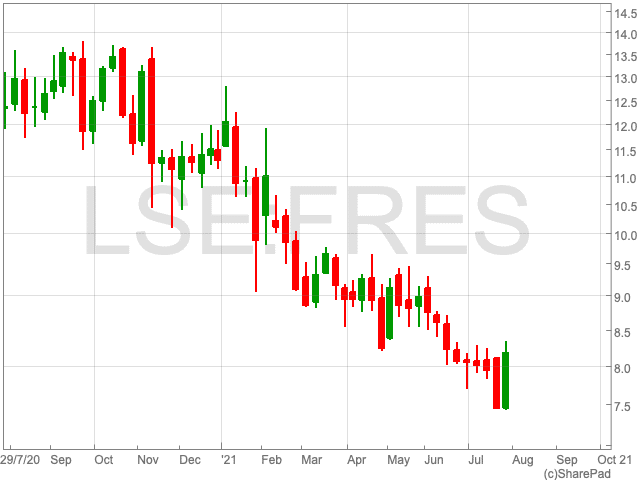

Fresnillo Share Price

The Fresnillo share price (LON:FRES) is up by 6.55% over the past five days as the FTSE 100 company divulged some positive news. The move comes on the back of a sustained downturn in the Fresnillo share price, particularly since November 2020 onwards.

This was in part down to the fact that interest in precious metals cooled following an upturn on the back of the pandemic-induced stock market crash. While the debate will go on about the place precious metals have in the modern world economy, this article will look at some recent news regarding Fresnillo, and what it could mean for its share price going forward.

Guidance

Fresnillo yesterday reaffirmed its annual outlook after the FTSE 100 company saw improvements in its silver output during Q2.

The precious metals miner said it is on course to meet its guidance for the current year of between 675,000 and 725,000 ounces of gold and between 53.5m to 59.5m ounces of silver.

“We remain on track to meet our full year targets and our production guidance for 2021 is unchanged, though we remain vigilant around the continued evolution of the pandemic and its potential future effect on our operations, in particular the implementation of any future new work restrictions,” said chief executive of Fresnillo Octavio Alvidrez.

RBC Capital Forecast

RBC Capital Markets, the global investment bank, upgraded its rating for the Fresnillo share price to ‘outperform’ from ‘sector perform’, it was revealed this month. RBC’s change in outlook came about as it considers the market to have reset following weak Q1 silver production and lower guidance.

RBC is expecting to see a growth phase from Fresnillo, as its Juanicipio project has been accelerated.

“With the shares underperforming peers and trading at the low end of its historical multiple ple range, we upgrade our recommendation,” RBC said.