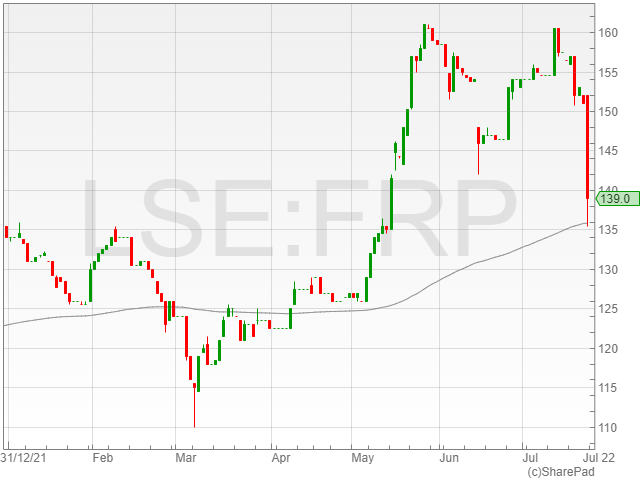

FRP Advisory Group shares dropped 7.6% to 139.4p in late afternoon trading on Friday following a pre-tax profit slide to £15.1 million in FY 2022 against £16.6 million in FY 2021.

However, the company announced a revenue growth to £95.2 million compared to £79 million in the previous year, with 11% driven by organic increases underpinned by the support offered on several larger projects, and 10% stemming from acquisitions.

FRP Advisory Group also reported an adjusted underling EBITDA of £25.7 million from £23 million.

Meanwhile, the business advisory firm mentioned a basic EPS of 5.3p compared to 6p and an adjusted EPS of 7.5p against 7.1p year-on-year.

FRP Advisory Group noted net cash of £18.1 million at the end of FY 2022 from £16.4 million the last year, along with an undrawn revolving credit facility of £10 million.

“I am pleased to report another year of profitable growth. FRP is a resilient business, with a track record of growth regardless of the economic conditions. The UK M&A mid-market remains active, our Corporate Finance team have an excellent pipeline to help clients realise their strategic ambitions,” said FRP Advisory Group CEO Geoff Rowley.

“Uncertainties still remain over how long troubled businesses can continue in their current form or how proactive key creditors like HMRC and institutional lenders will be on addressing over-due debts. Following the removal of government support, inflationary pressures and other disruptive forces, the Group has seen an increase in the level of enquiries for restructuring services in recent months.”

“The Group has a strong balance sheet and the Board believes the medium-term outlook for all the Group’s markets is positive. Trading since 1 May 2022 is in line with the Board’s expectations.”

FRP Advisory Group announced a total dividend of 4.3p per share against 4.1p the year before.