The FTSE 100 was up convincingly on Thursday after a range of top companies boosted the index with a raft of glowing results.

However, rising inflation cast a pall over a slate of boosted profits and rising revenues, and Sainsbury’s warned of a tough year ahead as customers cut down on grocery spending and name brand supermarket products.

Meanwhile, tech stocks in America surged on the back of good news from Meta, which saw an uptick in Facebook users and sent shares upwards in morning trading.

“If you were looking for candidate to come to the tech sector’s rescue it might not have been Meta Platforms given its reputation has taken a real battering of late,” said AJ Bell investment director Russ Mould.

“Apparently though, expectations for the company behind Facebook, Instagram and Whatsapp were pitched at such a level that merely doing OK was enough to send the shares surging higher.”

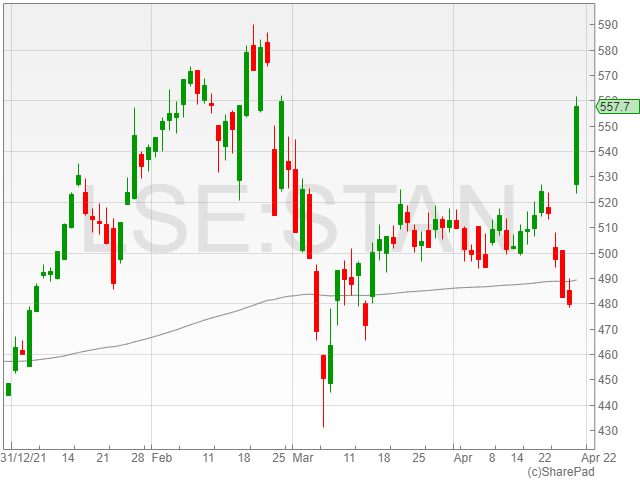

Standard Chartered shares were up 16.5% to 558.9p following a 6% year-on-year increase in Q1 2022 pre-tax profits to $1.5 billion against $1.4 billion, alongside an increased guidance slightly ahead of its previous estimate of 5-7% for the year.

“Our first quarter performance was strong despite the volatile macro environment,” said Standard Chartered CEO Bill Winters.

“Our profit before tax grew 4% year on year, with strong underlying business momentum.”

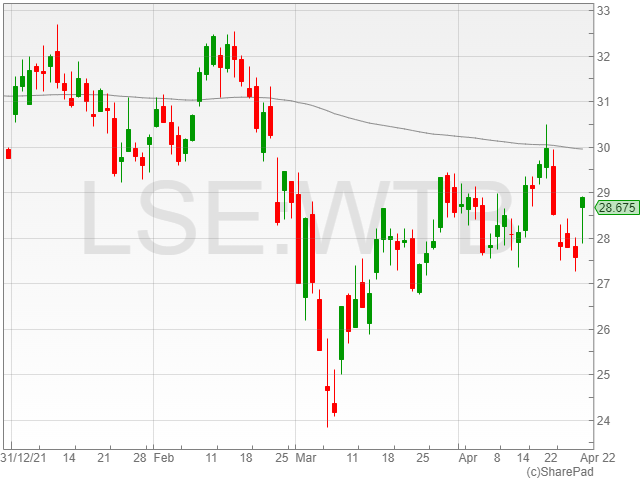

Whitbread shares gained 3.9% to 28,645p after the company announced its swing back to a £472.6 million profit compared to a £194.9 million loss in 2020 and the reinstatement of dividends payouts to shareholders.

“With [dividends] back on the table, it sends a clear message to markets that sentiment is vastly improved and the return to profitability plus beat on top and bottom-line estimates adds weight,” said Hargreaves Lansdown equity analyst Matt Britzman.

However, the company warned of rising cost inflation in the range of 8-9%, and said it would be raising prices, growing its estate and slashing group costs to mitigate inflation hurdles.

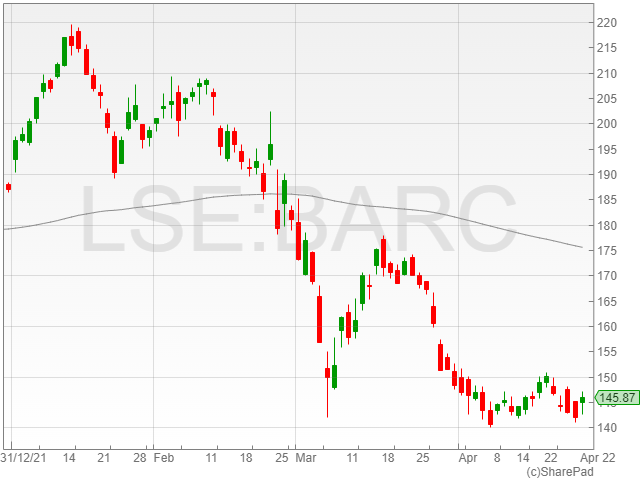

Barclays shares enjoyed a rise of 2.5% to 145.5p after the financial institution reported a 10% rise to £6.5 billion in group income for Q1 2022, however the firm suffered a £540 million conduct charge following the over-issuance of securities in the US in March, resulting in the second suspension of its $1 billion share buyback programme.

“If it hadn’t been for a monumental mess of its own making Barclays could have been really riding high off the back of its first quarter showing,” said Russ Mould.

“Underlying performance was way better than expected … However, when you take a more than half a billion-pound hit over a clerical error relating to structured products it rather detracts from this positive picture.”

“Particularly when it means a previously planned programme of buying back shares must be shelved.”

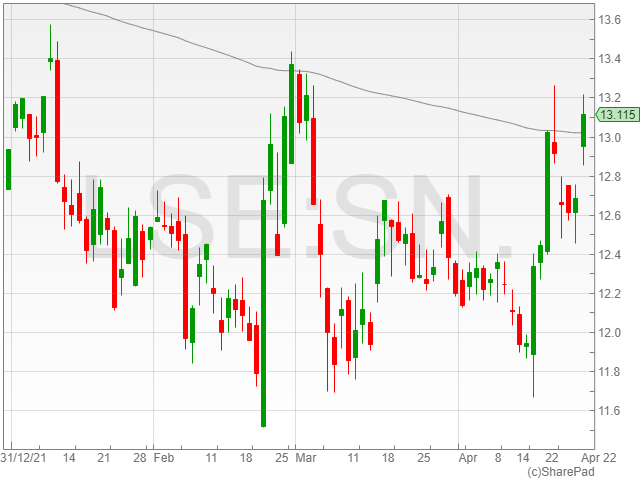

Smith and Nephew shares were up 2.9% to 13,055p after the medical devices group reported a 3.3% boost in revenue to $1.31 billion compared to $1.26 billion the previous year.

“Sports Medicine & ENT and Advanced Wound Management continued to deliver strong growth and Orthopaedics produced an improved performance as elective procedure volumes rebounded across our segments,” said Smith and Nephew CEO Depak Nath.

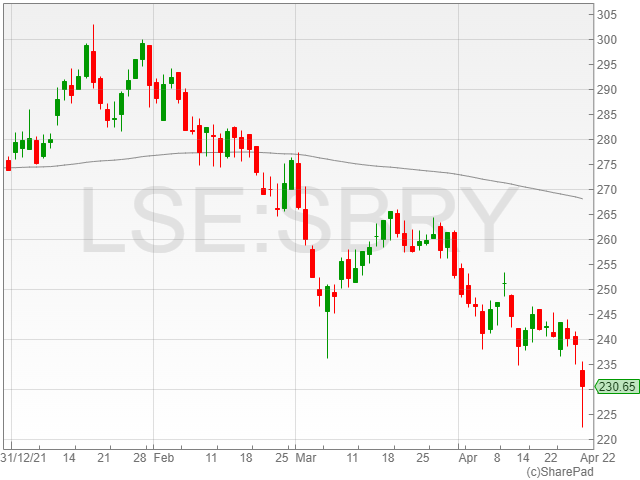

Sainsbury’s shares suffered a fall of 3% to 231.7p despite the company’s swing to a pre-tax profit of £854 million in 2021 from a pre-tax loss of £164 million in 2020.

The supermarket’s stock declined in light of the Big 4 grocer’s stark warnings of lower profits as accelerating inflation and cost of living pressures impacted disposable income, projecting a pre-tax profit fall up to 14% to £630-£690 million in the next financial year.

“The year ahead will be impacted by significant external pressures and uncertainties, including higher operating cost inflation and cost of living pressures impacting customers’ disposable incomes,” said the company in a statement.