The FTSE 100 bounced back from last week’s selling in early Monday as a raft of positive corporate stories took attention away from concerns over inflation, the associated potential monetary policy tightening and lockdowns in Europe.

However, the index wasn’t able to hold onto gains and sank into the afternoon session.

The FTSE 100 was 0.4% stronger at 7,255 in mid morning trade on Monday having closed at the lowest since 25th October on Friday.

“The FTSE 100 rose 0.4% to 7,255 thanks to strength among banks, miners and telecoms stocks, the latter sector helped by a private equity takeover approach for Milan-listed Telecom Italia,” said Russ Mould, investment director at AJ Bell.

By lunchtime the FTSE 100 retraced all its gains and traded negatively.

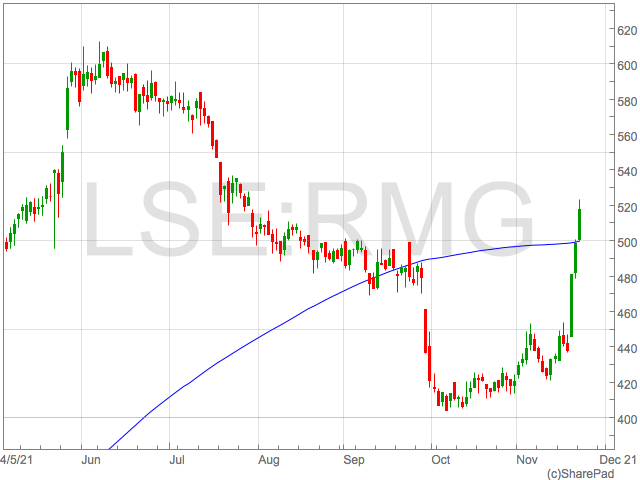

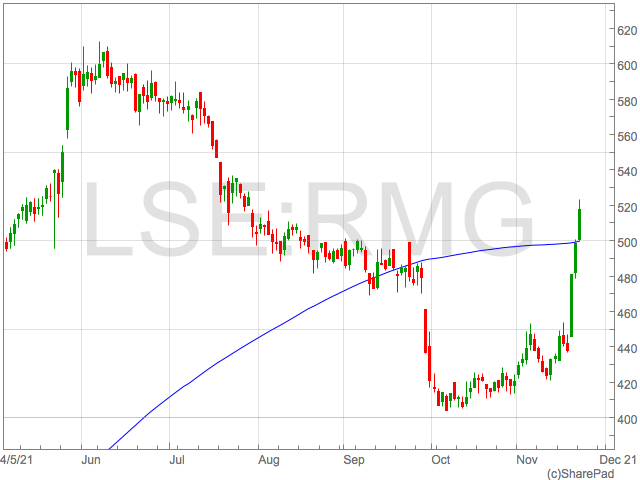

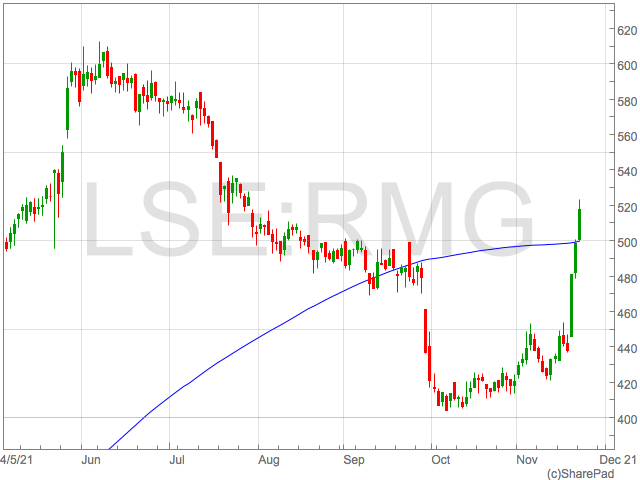

Royal Mail was again the FTSE 100’s top riser as investors continued to pick up shares following a strong set of results last week and the promise of shareholder distributions.

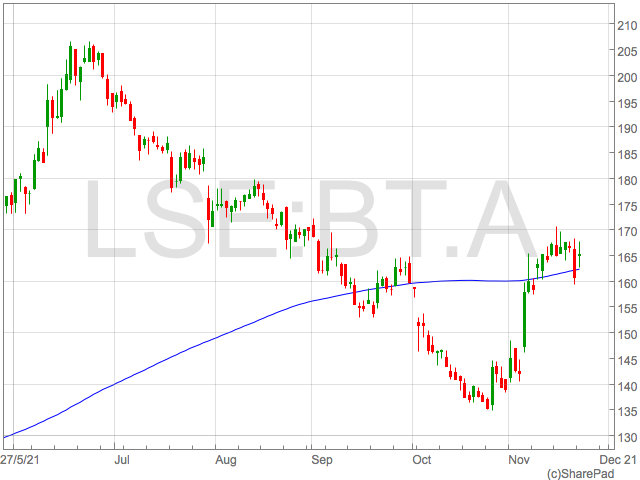

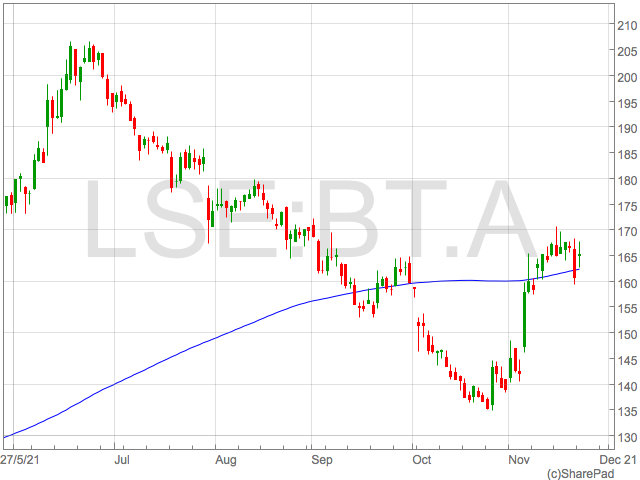

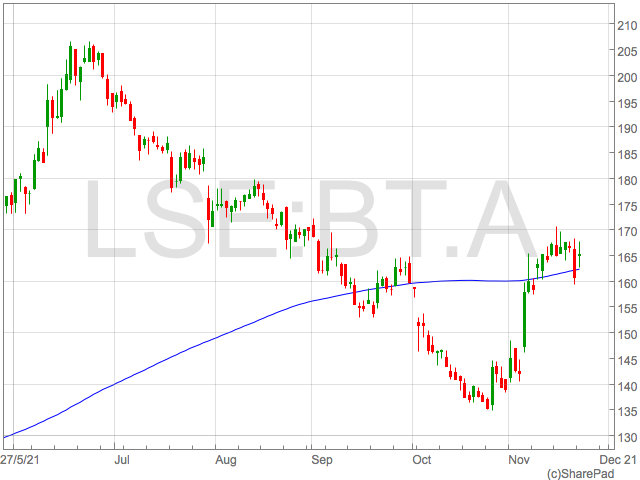

BT also kept hopes of an ongoing recover alive as it benefitted from M&A activity in the sector. Telecom Italia received an approach from US-based private equity group KKR, sending shares in the Italian Telecoms provider soaring.

Travel shares were also among the top risers as they bounced back from heavy selling at the end of last week sparked by fresh lockdowns and restriction in Europe due to a rise in Coronavirus cases.

IAG and Rolls Royce were both up over 2%, albeit off the highest levels of the session.

Precious metals miner Polymetal was the FTSE 100 biggest loser, falling inline with gold as the risk aversion evident last week diminished.