The FTSE 100 was down 0.2% to 7,556 shortly after midday on Thursday after oil prices dropped below $110 per barrel.

The price of Brent Crude was down to $106 per barrel after the US announced a potential release of 180 million barrels of oil from its strategic reserve, in a bid to compensate for the loss of exports from Russia.

Yesterday, the FTSE 100 outperformed European indices helped by stronger commodities. However, the impact of stronger commodities diminished today and London’s leading index joined European shares that were broadly weaker.

“It has felt a bit like the FTSE 100 was singlehandedly being kept afloat by the big oil stocks, BP and Shell,” said AJ Bell investment director Russ Mould.

Shell shares were trading down by 1% to 20,897p and BP shares were down 2% to 374.9p following the developments.

China’s Covid-19 lockdown and Russia’s war in Ukraine are yet to upset the market in a major way, with analysts awaiting the results from crumbling peace talks between the embattled countries and the prospect of advanced lockdowns in China.

The OPEC meeting later today will also bring new developments for the oil market moving into the end of the week.

“Really this is tinkering at the margins. What might put more of a brake on prices is action by OPEC at its meeting later but the extent to which it could increase production, even if it wanted to, is open to question,” said Mould.

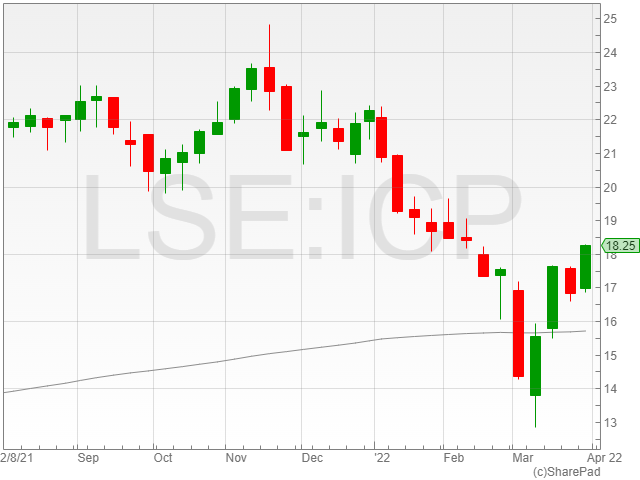

Intermediate Capital Group led the market risers with an increase of 2.9% to 18,232p after the company successfully raised €1.5 billion for its debt Infrastructure Fund, ICG Infrastructure Equity 1.

The group surpassed its initial €1 billion by €500 million as a result of “strong client demand.”

Pearson rose 2.3% to 756.8p as it recovered some ground following Apollo’s withdrawal of interest in the company after the educational services provider rejected its third and final takeover bid.

Halma PLC shares were up 1.8% to 25,340p.

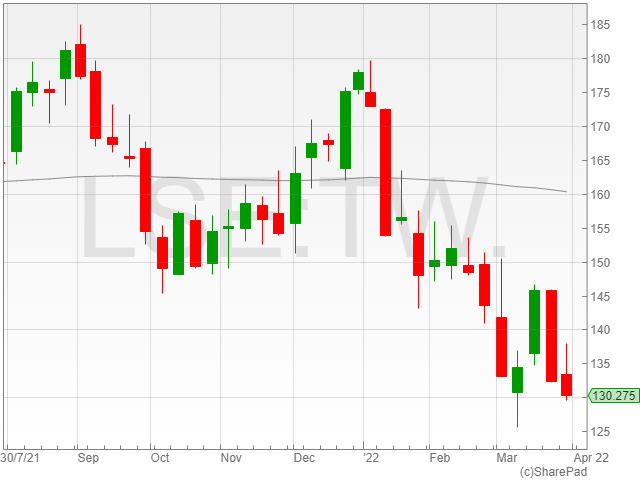

Taylor Wimpey share were trending down 3.5% to 130.1p as Nationwide Building Society said house prices had skyrocketed at their fastest rate of growth in 17 years by £33,000.

Houses are projected to decrease in desirability as inflation spikes and rising energy costs eat into shrinking consumer wallets.

Next fell 3.1% to 60,790p in the retail sector’s decline in sales on the back of rising inflation and falling consumer spending in retail, reported at a 0.3% drop in February by the Office of National Statistics (ONS).

The Royal Mail Group dropped 3% to 335p as it continued its spiral downwards.