The FTSE 100 was up 0.4% to 7,634 in late morning trading on Wednesday, despite the gathering storm of rising inflation and the spiking cost of living.

The markets also seem to have grown accustomed to Russia’s invasion of Ukraine after the chaotic upheavals of late February and March, with investors adjusting to the new reality of Putin’s knock-on effect on supply chains and international oil and food cost surges.

“The markets seem to be stuck in a bit of a holding pattern. They’ve absorbed the shock of Ukrainian conflict and seemingly shrugged it off, while also reacting calmly to an escalating cost of living crisis and new Covid disruption in China,” said AJ Bell investment director Russ Mould.

“It feels like something will have to give at some stage but when that might be and what the catalyst could be remains to be seen.”

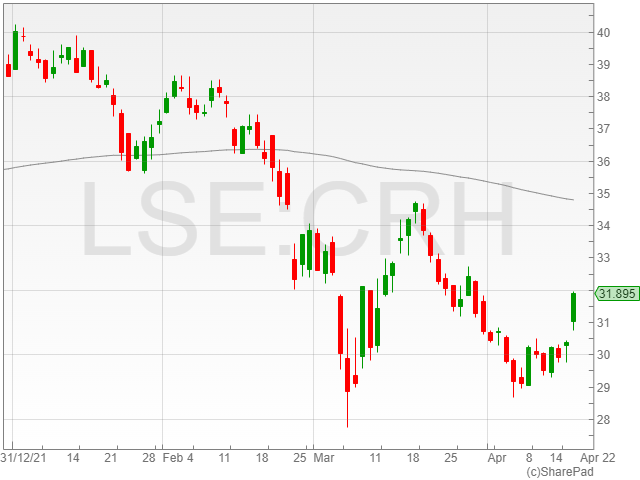

CRH hit the top risers with a 4.4% increase to 31,727p in light of sparkling Q1 results with growth in earnings and sales expected for the first half of the year.

“The continued delivery of our solutions strategy resulted in a good start to the year,” said CRH CEO Albert Manifold.

“Although a number of challenges and uncertainties continue, our demand backdrop remains favourable.”

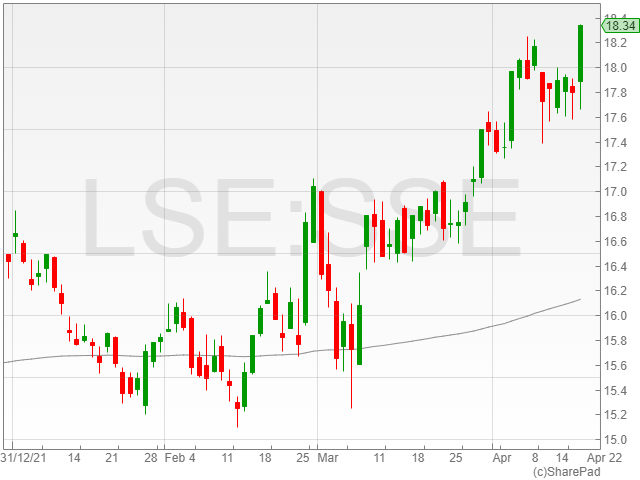

The SSE share price was riding high with an increase of 2.5% to 18,302p after it acquired Siemen Gamesa Renewable Energy’s (SGRE) onshore wind portfolio for €580 million.

The acquisition marks the company’s breakthrough into Southern Europe, with assets across France and Spain.

“The project portfolio brings some excellent assets and will provide a real springboard for our expansion plans in Europe across wind, solar, batteries and hydrogen,” said SSE Renewables managing director Stephen Wheeler.

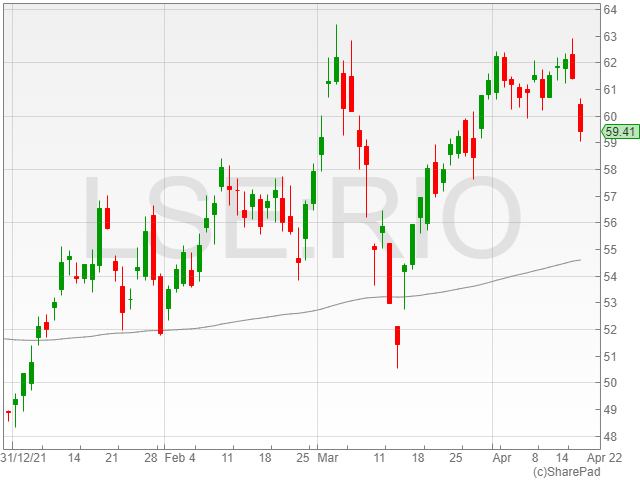

Rio Tinto shares took a blow of 3.5% to 59,220p after the mining giant reported a “challenging” first quarter, with a 15% quarter-on-quarter fall in iron ore shipments.

Covid-19 cases and strikes at its Kitimat smelter also served to exacerbate the company’s difficulties in a tricky quarterly update.

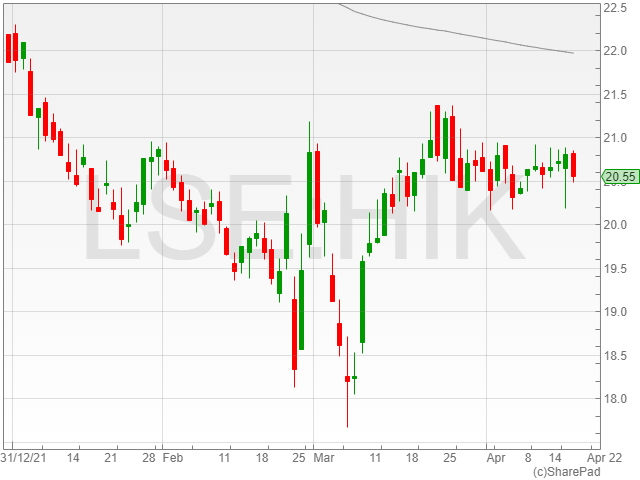

Hikma Pharmaceutical shares were down 1.1% to 20,570p after the group’s recent success in gaining approval from the US Federal Trade Commission for its scheduled acquisition of US generic injectables company Custopharm Inc for $425 million.

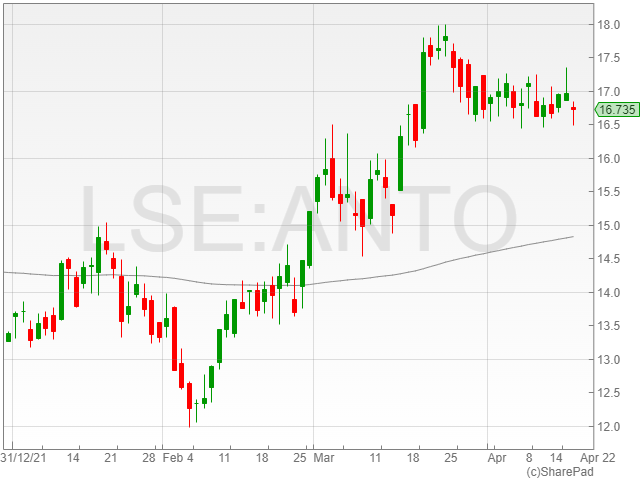

Antofagasta shares dropped 1% to 16,702p after RBC hit the company with an ‘underperform’ recommendation and cut its price target to 1,300p from 1,350p.