The FTSE 100 was down over 1.5% in early afternoon trading on Wednesday in light of the Office of National Statistics’ (ONS) latest inflation figures for May, which saw UK CPI hit another 40-year record of 9.1%.

The reading was in line with economists expectations and markets are bracing for a further squeeze on consumers this summer.

“There may have been a bit of relief this morning that UK consumer price inflation, while still at decades-long highs, was nonetheless bang in line with expectations,” said AJ Bell investment director Russ Mould.

“However, this relief will have rapidly dissipated as it dawned that retail prices are now experiencing double-digit increases and factory gate prices are above forecasts and the highest since the 1970s.”

“The FTSE 100, which has held up better than many of its global peers, is now flirting with a drop below the 7,000 mark for the first time since the March sell-off.”

All eyes are primed to turn to the US Federal Reserve and chairman Jerome Powell for hints of the institution’s next move on monetary policy.

“Inflation will also be on the agenda when US Federal Reserve chair Jerome Powell testifies before lawmakers in Washington,” said Mould.

“His comments will be closely followed for clues on what the Fed might do next with monetary policy and whether the risks of a recession in the world’s largest economy are increasing.”

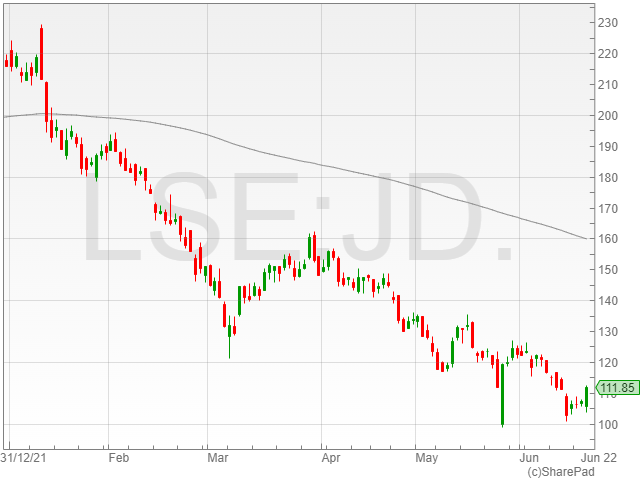

JD Sports Fashion

JD Sports Fashion shares gained 4.9% to 112p on a strong slate on results, including revenues of £8.5 billion and record pre-tax profits before exceptional items of £947.2 million.

However, analysts warned that the company’s good news only accounted for its results before the Ukraine war, and economic volatility combined with the rising cost of living is set to see JD Sports expect no growth in FY 2023.

“While JD Sports has reported a record set of results, it must be noted that this financial period ended before the Ukraine crisis unfolded and inflation surged higher,” said Mould.

“Therefore, it is not representative of the current environment in which consumers are under considerable financial pressure and are losing confidence with regards to the economic outlook, which will curb their ability and willingness to keep spending at levels seen in 2021.”

“This headwind is clear to see in the retailer’s forward earnings guidance. After seeing pre-tax profit more than double in the past financial year, JD now expects no profit growth at all in the current year.”

Natwest shares rise as Oil Price Falls

Natwest shares rose 4.1% to 230.5p after the UK government confirmed it would continue to sell down its stake in the bank for the next year.

The trading plan reported in July 2021 is set to end no later than 11 August 2023 and will continue under the management of Morgan Stanley with unchanged conditions.

Meanwhile, Shell and BP took a hit as the price of oil dipped below $110 per barrel to $109 for benchmark Brent Crude, with shares falling 3.1% to 2,084.2p and 2.7% to 384.6p, respectively.

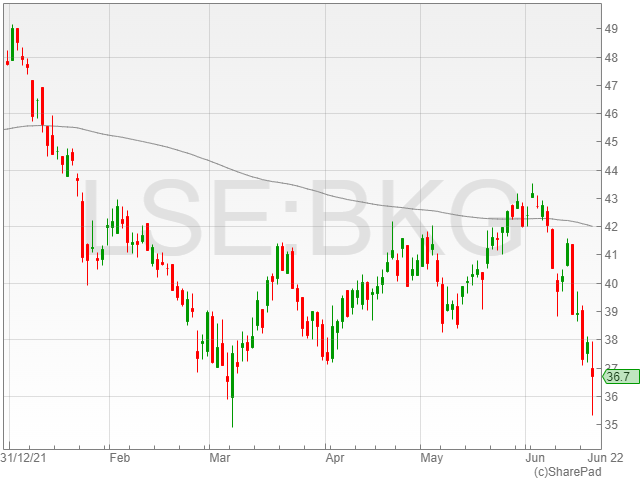

Berkeley Group and Housing Market

Berkeley Group shares fell 3.5% despite a pre-tax profit growth of 6.4% to £551.5 million and a revenue climb of 6.6% to £2.3 billion year-on-year on the back of the strong housing market in FY 2022.

However, with interest rates rising to 1.25% and inflation speeding rapidly towards 11% in October, it appears the cost of living crisis might serve to bring the housing market back to ground level.

The housing giant’s drop in cash from £1 billion to slightly above £250 million might also give investors reason to be nervous over the firm’s prospects in FY 2023.

“Berkeley is known as the cream of the crop when it comes to housebuilders and its latest update suggests it is continuing to deliver on its strategy which involves taking brownfield land and turning it into desirable housing developments,” said Mould.

“It’s worth noting the significant drop in its net cash position from more than £1 billion to a little more than £250 million.”

“While this was used to invest for future growth and Berkeley still enjoys a healthy buffer, there may be some concern among shareholders that the company doesn’t have more cash on hand to help sustain capital returns if there is a pronounced downturn in the housing market.”

Housebuilder shares across the market dropped as the cost of living crisis threatened the gravity-defying industry, with Persimmon sliding 2.5% to 1,802.5p, Barratt shares dipping 0.8% to 456p and Taylor Wimpey shares dropping 1.7% to 115.2p.