The latest inflation figures did little to cheer markets on Wednesday, after UK CPI fell to 9.9% in August, dropping below July’s 40-year record of 10.1%.

The FTSE 100 dropped 1.2% to 7,293.5 during lunchtime trading, dragged down by rising fears of higher interest rates and the aftershocks of Tuesday’s hotter than expected inflation figures of 8.3% for August, failing to meet analyst expectations of 8.1%.

US futures clawed back a slight amount of ground, with the NASDAQ rising 0.4% to 12,165.7, the S&P 500 increasing 0.3% to 3,965.2 and the Dow Jones climbing 0.2% to 31,300 in pre-open trading.

“Despite some of the key factors behind surging inflation easing slightly, many prices continue to go up and markets are not happy,” said AJ Bell investment director Russ Mould.

“With the 8.3% number for August higher than the 8.1% expected by economists, investors took fright and we saw an almighty sell-off on the markets, including a 5% decline in the tech-heavy Nasdaq index.”

Evelyn Partners chief investment strategist Daniel Casali added: “On the one hand, headline CPI inflation came in lower-than-expected, but the underlying core CPI measure remains stubbornly high, increasing the pressure on the Bank of England to raise interest rates by more than the 50bps expected by the Bloomberg consensus of economists when it meets on 22 September.”

EU calls for energy revenues price cap

Meanwhile, utilities stocks circled the bottom of the FTSE 100, after European Commission President Ursula von der Leyen called for a price cap on non-gas energy suppliers across the bloc to assist vulnerable families as the cost of living crisis and surging energy prices threaten to plunge households across the continent into a harsh, cold winter.

The revenues cap is expected to raise £121 billion, with the cap set to impact producers of low-cost power including renewables and nuclear.

“In these times it is wrong to receive extraordinary record revenues and profits benefiting from war and on the back of our consumers. In these times, profits must be shared and channelled to those who need it most,” said von der Leyen in a statement.

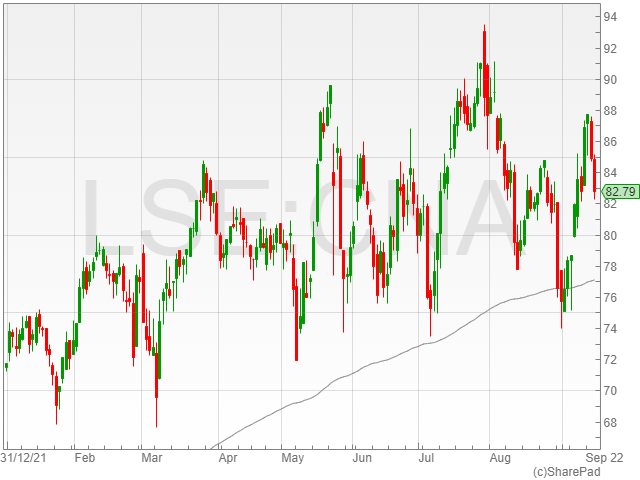

United Utilities shares fell 3.6% to 143.8p, Severn Trent declined 3.6% to 2,684.5p, Centrica dropped 2.4% to 82.8p and National Grid decreased 2.2% to 1,055.7p.

Retail companies rise

However, retail companies gained on the relief of a less extreme cost of living crisis, sparking hopes of increased consumer spending.

Next shares rose 1% to 5,886p, JD Sports Fashion climbed 0.1% to 127.4p and Kingfisher increased 0.1% to 247.5p.

Oil receives boost

Oil companies enjoyed a boost to $93 per barrel in Brent crude after reports of bullish demand from the International Energy Agency (IEA), with the Agency expecting a large-scale switch from gas to oil projected to average 700,000 bpd from October 2022 to March 2023, doubling the rate compared to last year.

The positive news for energy groups follows estimations for growth in international oil demand to rise in 2022 and 2023 by the Organisation of the Petroleum Exporting Companies, which noted major economies were doing better than expected despite problems including spiking inflation.

Shell shares rose 0.1% to 2,331.2p and BP shares gained 0.3% to 463.1p.