The FTSE 100 gained more than 1% on Friday after the market enjoyed a wave of optimism, as reports from REC and KPMG revealed that UK starting salaries rose at their fastest rate in March since records began in the late 1990s.

It was a great day for miners, banking and investment groups, and oil companies, with the stocks swept up in a commodities rally and hopes of a stronger global economy.

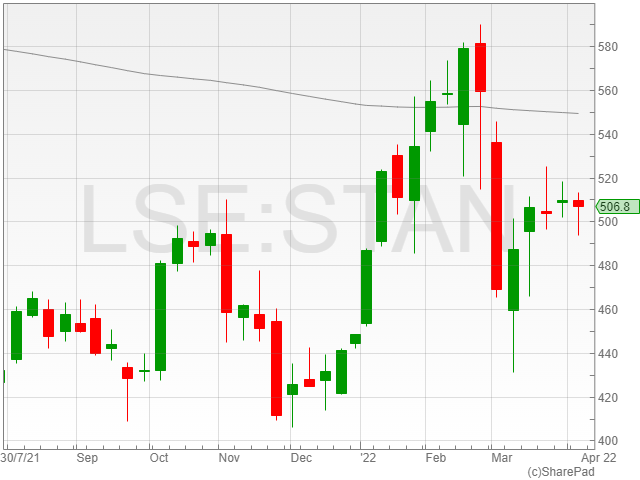

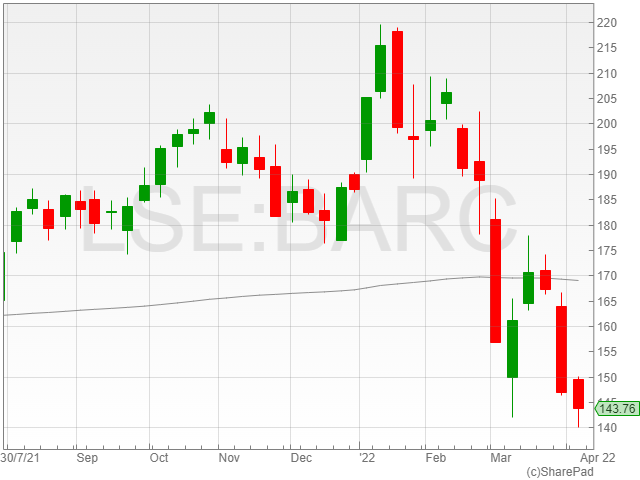

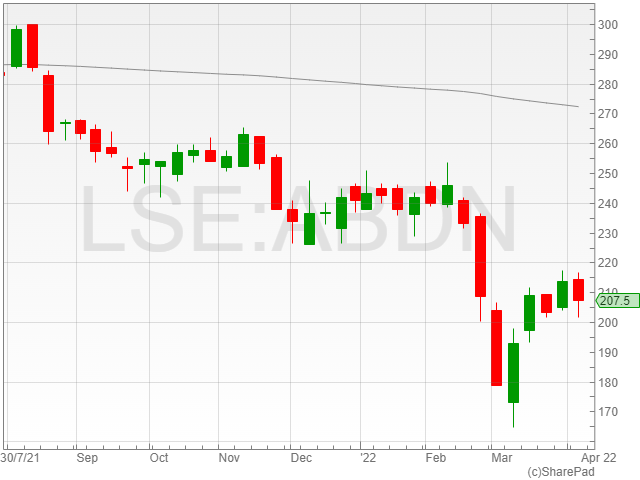

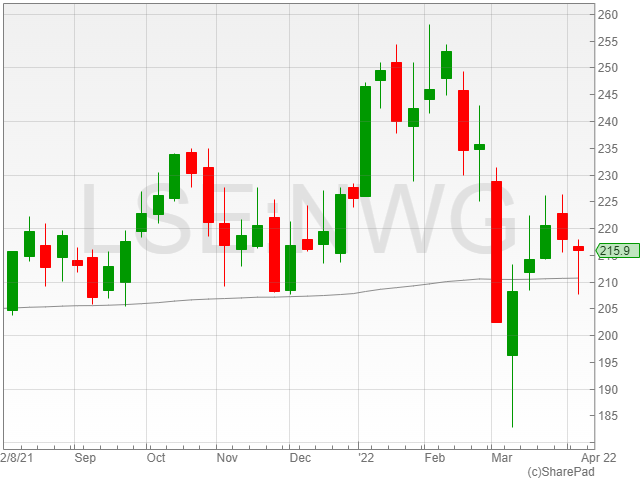

The FTSE 100 was anchored by the financial companies, with Standard Chartered rising 2.8% to 508.6p, Barclays shares increasing 2.7% to 144.5p, abrdn gaining 2.3% to 207.7p and NatWest receiving a 2% boost to 216.6p.

“Commodities firms and financial stocks, the latter boosted by expectations of faster rate hikes, helped lead the charge higher,” said AJ Bell investment director Russ Mould.

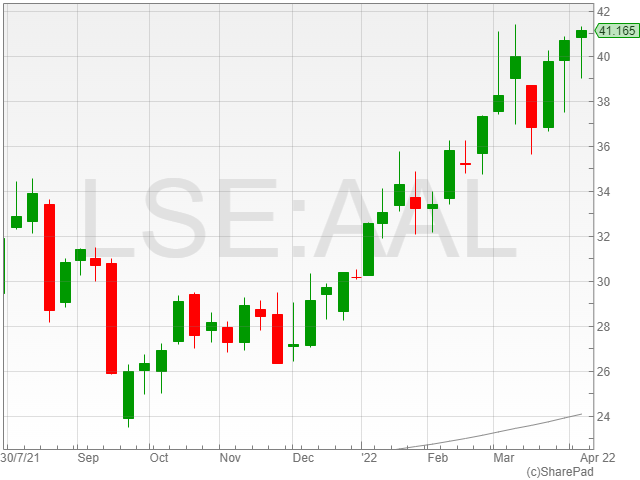

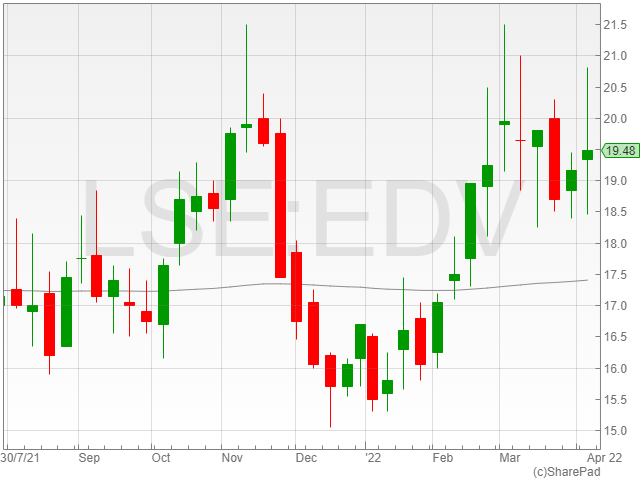

Anglo American shares enjoyed a boost of 3.2% to 41,065p and Endeavor Mining rose 2% to 19,485p.

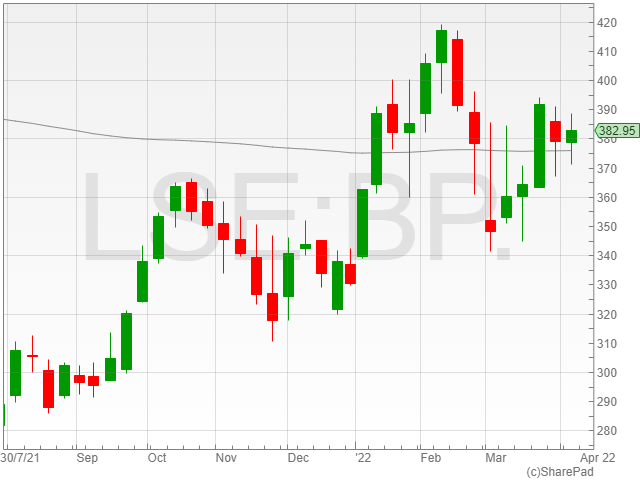

BP shares rose 2% to 385p, following the minor 0.5% upswing in the Brent Crude price to $101 per barrel.

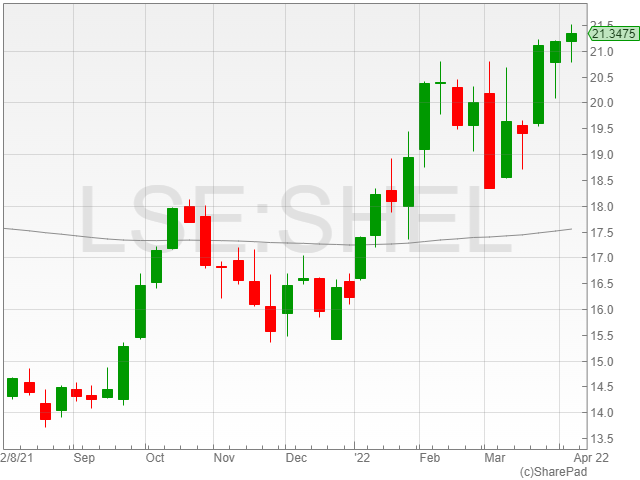

Shell shares increased 2.9% to 21,477p as the company gained back ground after its nasty shock yesterday, following the announcement that its exit from Russia would cost it an estimated $5 billion.

Although investors might be celebrating today, there does remain the risk that the increase in salaries will not work as a counterbalance to the spiking rates of inflation.

“Investors continue to wrestle with the challenges posed by rising interest rates and surging inflation with the latest data on wages in the UK offering an indication of how entrenched inflationary pressures are,” said Russ Mould.

“The risk is even the most generous salaries will see their buying power severely pinched by the rapidly escalating cost of living.”